Channel data show that Ethereum Exchange Netflow remained negative during last week, a sign that could be optimistic for ETH.

Ethereum Exchange Netflow suggests a trend of withdrawals

In a new post on X, the supplier of Sentora Institutional DEFI solutions (formerly intotheblock) spoke of the latest trend in Ethereum Netflow exchange. The “Exchange Netflow” here refers to a metric on a chain which maintains the trace of the net quantity of the cryptocurrency moving in or out of the wallets associated with the centralized platforms.

When the value of this metric is positive, this means that investors exceed a net number of tokens on these platforms. As one of the main reasons why transfer to exchanges are for purposes linked to sale, this type of trend can have a lower impact on the price of the ETH.

On the other hand, the indicator being under zero suggests that the outputs prevail over the inputs. Generally, investors keep their pieces away from the custody of exchanges to hold in the long term, so that this type of trend can be optimistic for the assets.

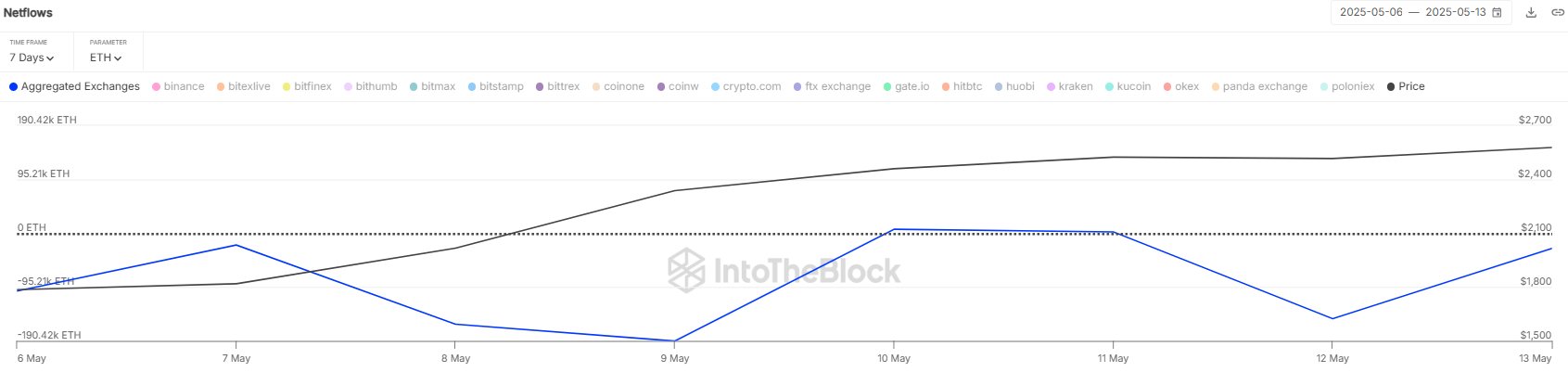

Now here is the graph shared by the analysis firm that shows the trend of Ethereum Exchange Netflow during last week:

The value of the metric appears to have been negative in recent days | Source: Sentora on X

As displayed in the above graph, the Ethereum Exchange Netflow was mainly negative inside this window, which implies that the carriers have removed the supply from centralized exchanges.

In total, investors made withdrawals worth $ 1.2 billion with this output wave. “This sustained trend in net outings, intensifying since the beginning of May, indicates a continuous accumulation and reduces the pressure of the sale,” notes Sentora.

While ETH has seen this Haussier development recently, cryptocurrency may not offer a good opportunity to enter right now, as the Santiment analysis company explained it in an article on Insight.

The data for the 30-day and 365-day MVRV Ratios of ETH | Source: Santiment

The indicator shared by the analytical company is the “market value ratio on the value achieved (MVRV)”, which essentially provides a measure of the situation for Bitcoin investors.

In the graph, Santiment included two versions of the indicator: 30 days and 365 days. The first tells us about the profitability of investors who bought in the last 30 days and the second of buyers from last year.

As it is visible in the graph, the 30 -day MVRV ratio for Ethereum has a significant positive value at the moment, which implies that recent buyers are in significant benefit. More specifically, metrics is 32.5%, which is much higher than the danger area of 15% for altcoins that the analysis company recommends as a play rule.

“This may not mean that prices are about to drop, but it suggests that the rally will slow down or stop until the 30 -day MVRV returns to something more reasonable,” said Santiment.

Ethn price

At the time of writing this document, Ethereum is negotiated about $ 2,600, up more than 43% last week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

Dall-e star image, Santiment.net, intotheblock.com, chart de tradingView.com

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.