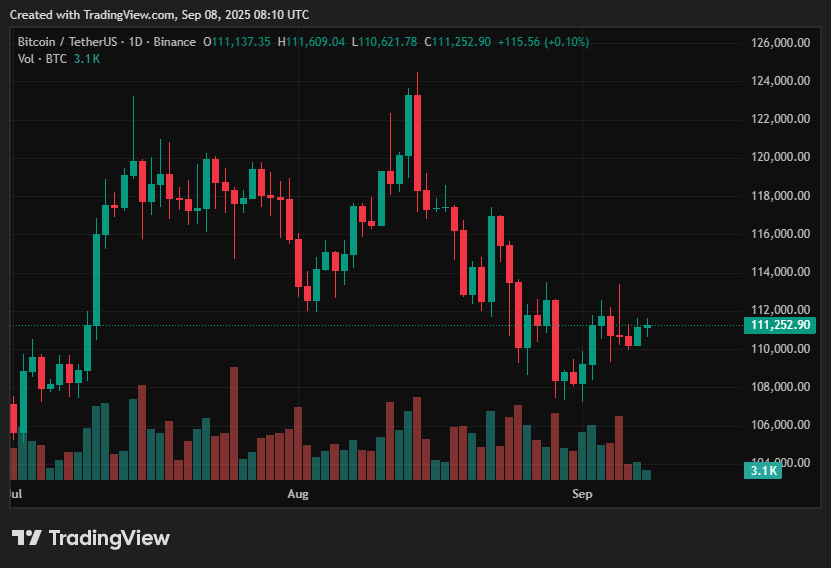

While traders keep an eye on a possible model of head and shoulder emerging on the daily graphic, Bitcoin consolidates about $ 111,000.

Depending on whether the cleavage support holds or fails, the configuration suggests that a price swing of $ 10,000 could be on the horizon.

Summary

- Bitcoin (BTC) consolidates about $ 111,000, forming a possible model of head and shoulders in this price of Bitcoin price.

- FNB entries and institutional demand add support to the brought case.

- The historical volatility of September and macro uncertainty increase the risks of decline.

- A break over $ 112,000 could lead BTC to $ 116,000 to $ 122,000.

- The failure of less than $ 108,000 can trigger a drop to $ 100,000 to $ 101,000.

The market is now delicately balanced between a downward rupture and an upward continuation, because investors consider robust FNB entries against the historical volatility of September. This Bitcoin prices forecast highlights the scenarios upwards and down as the consolidation continues.

Current BTC price scenario

After the volatility of the previous week, Bitcoin is currently negotiating at around $ 111,356, presenting a relatively stable intraday movement. With resistance at $ 112,000 and a support developing around $ 108,000, the price was stable around the $ 111,000 mark.

According to recent reports, Bitcoin is trapped in this narrow range while institutional accumulation and FNB entries are conflict with the desire of long -term holders to make profits. Merchants look closely at this level to refine their BTC price forecasts for the next few weeks.

Upward outlook

Bitcoin (BTC) always has a clear positive path if it can find the range from $ 112,000 to $ 113,000 with a high purchase volume, even with the current correction.

The head and shoulder model would be made worthless by a clear break above this level, with $ 116,000 at $ 118,000 as a target. Beyond there, an increase greater than $ 118,000 could make a bullish turnaround by accelerating gains around $ 121,000 to $ 122,000.

Some analysts even emphasize a twin -in -law head and reverse shoulder diagram which, if resistance to the neckline is broken and institutional adoption supports momentum, could approach $ 150,000 in a larger supercycle. Peter Brandt, a experienced merchant, warns that the slope of the current neckline reduces the reliability of the configuration and advises merchants not to count on a defined increase. This adds a cautious layer to the more disturbed Bitcoin prospects.

Downward risks

However, if the support level of $ 108,000 is broken, there is a considerable risk for the disadvantage of the Bitcoin table. A verified ventilation would support the neckline of the head and shoulders and would indicate a measured movement of $ 10,000 below, with the range of $ 100,000 to $ 101,000 as a goal.

Bitcoin has historically performed in September, and the risk of volatility is increased by mixing seasonal opposite winds, macroeconomic uncertainty and strong derivative positions. This scenario alignments with lower -lower -lower retacements for a deeper short -term retirement.

BTC price prediction based on current levels

Overall, traders are waiting for a clear decision because Bitcoin remains stuck in a neutral range between $ 108,000 and $ 112,000 at $ 113,000. If FNB entries continue at their current rate, an escape from the resistance would validate the optimistic continuation in the range of $ 116,000 to $ 122,000 and perhaps beyond.

On the other hand, a violation below the support would position the market for a lower swing in the range of $ 101,000 to $ 100,000, which is the measured objective of the formation of the head and shoulders.

Until the price movement breaks this consolidation zone, the image is always carefully balanced due to the inputs of robust FNB and macro mounting uncertainties. And suggest a measured movement of $ 10,000 lower, targeting the range of $ 100,000 to $ 101,000.

Bitcoin has historically performed in September, and the risk of volatility is increased by mixing seasonal opposite winds, macroeconomic uncertainty and strong derivative positions.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.