Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Bitcoin bulls are Try to grow higher From just under $ 97,000, try to confirm its last higher escape to a consolidation beach of several days. After hiding nearly $ 95,000 for more than a week, Bitcoin broke out at $ 97,000 before reverse and form a difference of fair value.

Related reading

This has led to an increase in activity on Bitcoin blockchain, and the next prospect is whether the current The structure is valid for a continuation at $ 100,000 or if this momentum could vacillate in a resistance area.

Bitcoin reaches a 6 -month peak in network activity

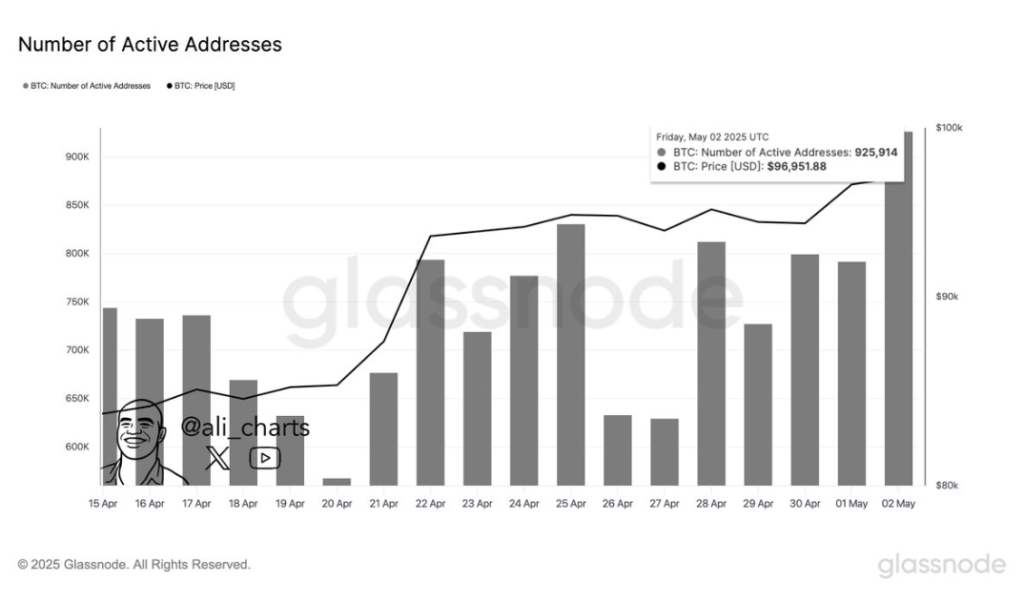

One of the most notable changes in market dynamics came on the side of the chain. According to Crypto Analyst Ali Martinez, Bitcoin I just recorded her greatest number Active addresses in the past six months. As shared in an article on the social media platform X, Martinez noted that 925,914 BTC addresses were active in a single day, which is a Unusually high level of engagement On the Bitcoin blockchain.

The Glassnode graphic which accompanies it reveals how steep this overvoltage was, based on a progressive rise which started the last week of April. Interestingly, the tip of Bitcoin activity coincides with its recent recovery from the price range of $ 95,000.

Image of X: @ali_charts

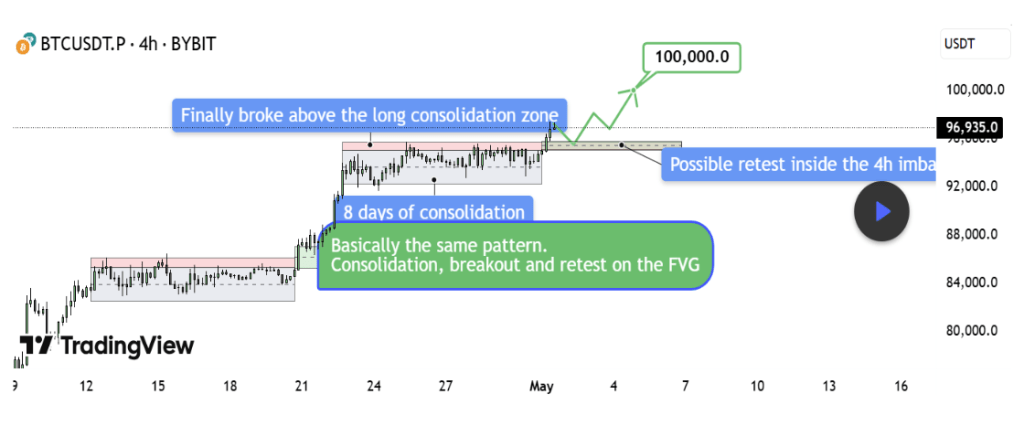

Adding to the bullish case, the cryptographic analyst Tehthomas shared a Technical analysis which underlined an escape Continue to $ 100,000. The interpretation of the 4-hour BTCUSDT period shows a structure almost identical to that observed in mid-April.

At the time, Bitcoin consolidated nearly $ 86,000, exploded, left a gap of fair value (FVG), retested the gap and rallied nearly $ 10,000. A mirror image of this motif Currently takes place. The Bitcoin price supplemented below $ 95,000, broke out by the resistance and created a FVG fresh between $ 94,200 and $ 95,000.

Tehthomas noted that the key was not to chase the break but to wait for a new remediation of the new FVG. If buyers defend this area as they did earlier this month, the road to $ 100,000 is structurally intact. However, even if the structure currently promotes bulls, the situation could become Bison if Bitcoin gives back in the old range of less than $ 94,000.

Chart from TradingView

The downward pocket configuration of the sustainable risks of the risks to come

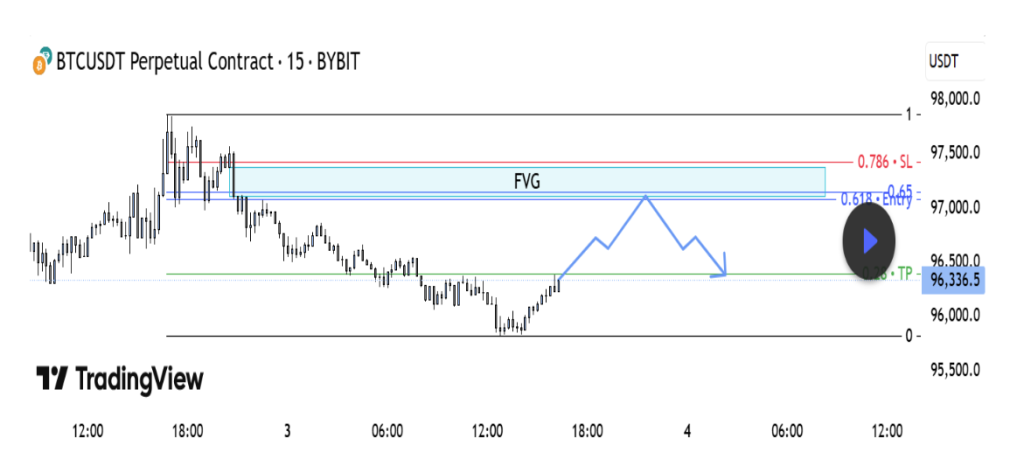

Not all analysts are convinced This Bitcoin will reach $ 100,000 again without a shakeout first. A counter The TradingView platform highlights a possible short-term lower configuration based on the 15-minute BTCUSDT graphic.

According to the analyst, the current retraction seems to be correct rather than impulsive, forming a short classic configuration in a resistance area of fairly strong value. Technical analysis shows that Bitcoin has found itself in a region that aligns with a gap of just lower value and the golden pocket area defined by fibonacci levels from 0.618 to 0.65.

Related reading

As it stands, the gap of fair value is between $ 97,000 and $ 97,450. If the price fails to cross this region of tenders, it could reverse And catch bulls off guard.

Chart from TradingView

At the time of writing this document, Bitcoin was negotiated at $ 96,040.

Felash star image, tradingView graphic