Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

The action of Solana prices in the last 24 hours has been marked by a decisive decision above the level of $ 135, a development which could report An increasing bullish momentum. This escape follows several days of lateral movement, during which the Solana price exchanged itself in a narrow range between $ 124 and $ 135.

Related reading

Although the recent move Above this consolidation area Advice during a potential increase, chain data reveals that significant resistance awaits nearly $ 144, which could be used as a major major test for bulls.

Levels that will define the next waterproof to Solana

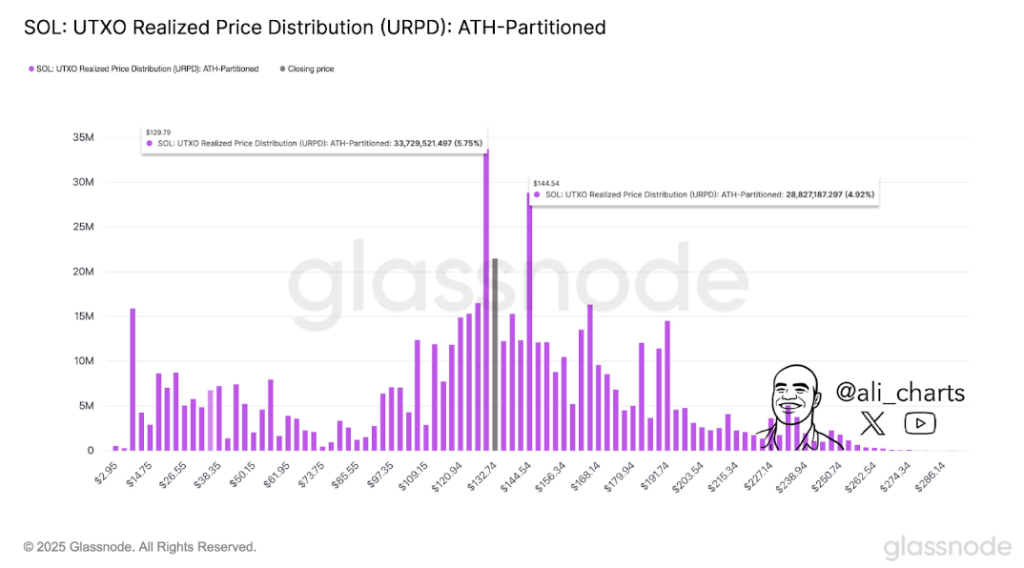

According to to a post on The social media platform X by Crypto analyst Ali Martinez, the current Solana negotiation range between $ 129 and $ 144 is very important for the way it happens from here. In particular, Martinez noted that the most important support for Solana’s price is $ 129, while the key resistance to watch is at $ 144.

This commentary aligns closely with the data indicated in a graph shared by the analyst, coming from the UTXO price model produced UTXO from Glassnode: ATH partition model.

The volume bars indicated in the URPD data below indicate that the Solana price is supervised between dense clusters of purchasing and sale activity. The highest concentration is currently around the region from $ 129 to $ 144.

The graph underlines that around 5.75% of the entire current volume made for soil occurred near the price of $ 129, making this level a solid support area. Interesting fact, its importance was reinforced on April 17 When Solana’s price has rebounded Speed after briefly plunging at this level.

Likewise, the level of $ 144 also has around 5% of the volume, resistance short -term ceiling. This price zone had previously rejected upward attempts in the last week of March, confirming it as a short -term ceiling for an ascending momentum.

Together, these two levels form a closely contested beach, and an escape beyond one or the other border will probably dictate if Solana enters a new updated leg or retracts more.

Picture From X: Ali_charts

The distribution of prices produced UTXO (URPD): ATH shares model

The UTXO has carried out the distribution of prices (URPD): Ath-à latelle is an advanced metric on a chain which approaches the holders of current parts acquired their tokens compared to the top of all time (ATH). When a price level shows a high volume concentration made, this implies that a large number of tokens have been purchased at this level.

These clusters tend to act as a psychological support or resistance, because holders may be more inclined to defend the profitability threshold areas (support) or to go out in the previous loss areas (resistance), depending on the feeling of the market.

Related reading

In terms of market feeling, the current market feeling is gradually becoming bullish for Solana, and the recent break above $ 135 puts the level of development of $ 144, at least in the short term. The price could reach this new week, or a removal of feeling could put the $ 129 to the point as level to hold.

At the time of writing this document, Solana negotiated at $ 139, up 3.6% in the last 24 hours.

Mudrex star image, tradingView graphic