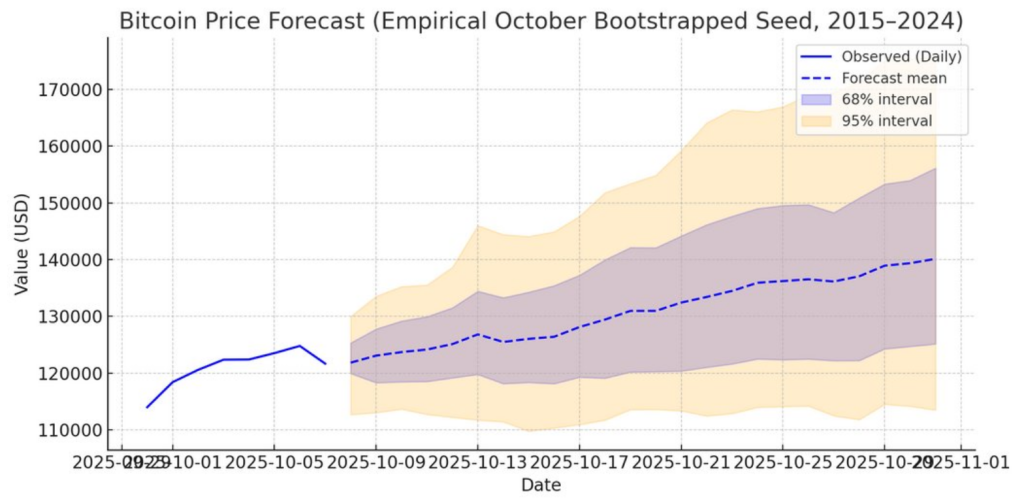

According to economist Timothy Peterson, Bitcoin has 50 % chance of exceeding $ 140,000 before the end of the month. He published this probability on X and supported it by simulation work which uses a decade of price development to map the probable results.

Related reading

Simulation based on historical data

Peterson said the model is running hundreds of simulations using daily Bitcoin prices since 2015. Based on these analyzes, he estimates that the luck that Bitcoin ends the month over $ 140,000 is 50 %.

It also gave a 43 % probability that the price ends the month below $ 136,000. As he spoke, Bitcoin was negotiated at $ 121,200. This means that an increase of approximately 11 % would be necessary to reach $ 140,000 compared to the current level.

Half of the Bitcoin gains in October may have already taken place, according to this Simulation of AI.

Bitcoin ends the month above $ 140,000

But there are 43 % chance that Bitcoin ended below $ 136,000. pic.twitter.com/lphfr0mry9– Timothy Peterson (@Nnsquaredvalue) October 7, 2025

Bitcoin reached a new historic summit of $ 126,200 on Monday, then cooled. The play started the month of October at around $ 116,500, so the month has already generated earnings.

According to data, October has been the second best month on average since 2013, with typical 20 %gains. Reports have revealed that November is the strongest month in history, with average gains of 46 % since 2013.

No human emotion

Peterson described his forecasts as being based on data rather than human emotions. He said that each projection follows the price changes that reflect volatility and past rhythm of Bitcoin.

This approach aims to eliminate biases from short -term feeling. However, there are limits to what historical simulations can show.

Bitcoin has sometimes evolved in a way that did not correspond to past models. Market reactions, political decisions and other forces can bring prices out of the scenarios that history suggests.

The feeling of the market remains bullish

Other analysts on social platforms have called for continuous optimism after the recent summit. An analyst said the market was once again testing the previous heights and could increase.

Another wrote that the pressure increased to get new gains. These views are accompanied by data -based forecasts and are monitored by traders and funds.

Bitcoin is the new limit rate.

If you can’t beat it, you have to buy it.

I explained on @Squawkcnbc This morning, why so many investors do not produce the yields they think. pic.twitter.com/re98rjcdua

-Anthony pumpliano 🌪 (@apompliano) October 7, 2025

Macro notes of a leading investor

Reports also contain comments from Anthony Pompliano, who said on CNBC that the Bitcoin rally can continue if governments and central banks continue to print money.

Justin: Anthony Pompliano said to CNBC Bitcoin will never stop increasing.

“They will never stop printing money.” pic.twitter.com/qewjntsib3

– Bitcoin archives (@btc_archive) October 7, 2025

His point of view connects monetary policy at the request of Bitcoin, and he is widely shared by his supporters who consider the assets as coverage.

Related reading

Verdict star image, tradingview graphic