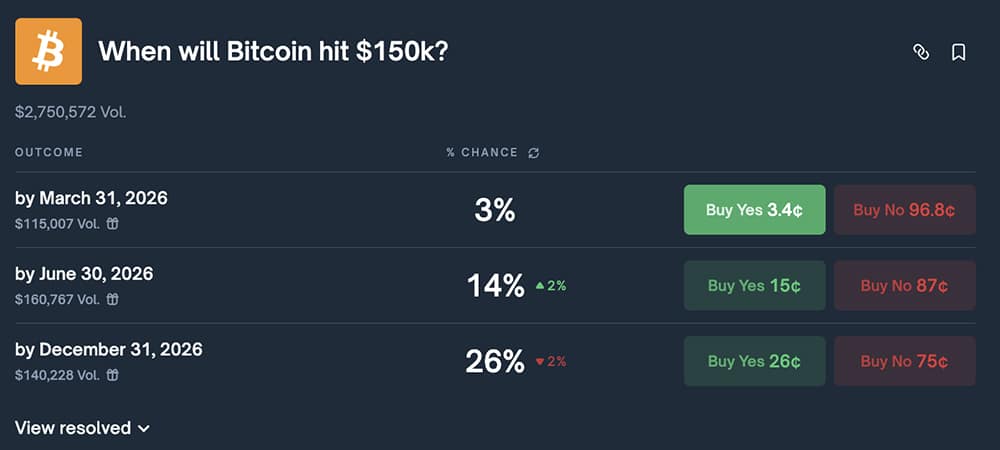

Punters on one prediction market, Polymarket, currently give Bitcoin just a 26% chance of trading above $150,000 at any time in 2026. Other related markets are more bullish on lower milestones, with almost 80% chances of Bitcoin hitting $100,000 before 2027.

As we know, prediction markets are going mainstream just as everyone is fighting over what the next Bitcoin cycle will look like.

(source – Polymarket)

What are Polymarket punters really saying about Bitcoin next?

A prediction market is an exchange for betting on real-world events. Instead of betting on a sports game, you buy “yes” or “no” stocks on outcomes like “Bitcoin hits $150,000 in 2026.” The price of each action reflects the crowd’s estimated probability, so a 26 cent “yes” action equates to a probability of 26%.

Polymarket recently reopened its doors to US users in a regulated manner after acquiring QCEX and getting the green light from the US Commodity Futures Trading Commission (CFTC). This brings Polymarket closer to the traditional financial system, and no longer just a niche of crypto players. At the same time, competitors like Kalshi and Truth Predict, a Truth Social platform linked to Donald Trump, are pushing their own event marketplaces.

We are excited to announce that we have received CFTC approval for intermediation, paving the way for seamless access to polymarkets through registered broker-dealers and financial institutions.

Coming soon to a trading platform near you. pic.twitter.com/2m72ZwCdtA

– Polymarket (@Polymarket) November 25, 2025

So, what are users actually saying? They see a strong chance of seeing higher prices, but they view calls from mega-bulls like Bitcoin at $150,000 in 2026 as far from guaranteed.

A related market puts the chance of Bitcoin reaching $100,000 before 2027 at around 80%, but the move from $100,000 to $150,000 is where confidence drops.

(source – Polymarket)

For us, this constitutes a test of consistency against the outlandish price targets on social networks. Instead of only listening to loud influencers, you can see how people risking real money evaluate different Bitcoin scenarios.

DISCOVER: 16+ New and Coming Binance Announcements in 2026

What does the chance to get $150,000 worth of Bitcoin mean to us?

A probability of 21% does not mean that “Bitcoin will not increase”. This means that the crowd believes there is about a one in five chance of hitting this specific outcome, reaching $150,000 in 2026, which is already a huge improvement from current levels. We basically pack sunscreen if there’s a 70% chance of sun, but you don’t ignore the predicted 26% chance of storms.

This is important to us because it pushes us to plan for multiple outcomes, not just our dream scenario. Some analysts are calling Bitcoin the “king of the decade” and expect it to outperform gold and silver over time, as noted in our Bitcoin analysis. But Polymarket’s pricing tells you that even committed crypto traders treat aggressive targets with caution.

It also fits into the larger 2026 playbook. Our broader crypto forecast for 2026 explores how interest rates, ETF flows, and stablecoins could push or cap Bitcoin’s upside. When you combine this macro picture with predictive market odds, you get a more grounded range of expectations instead of a magic number.

Another point is that prediction markets are now appearing in mainstream tools like Google and Yahoo Finance. This means that more casual investors will start treating these probabilities as another data point, right next to price charts and ETF flows.

DISCOVER: 10+ Next Cryptos to 100X in 2026

How should you use prediction market odds without getting destroyed?

First, treat Polymarket as a solid weather forecast for prices, not a promise. Bettors who buy these contracts may be wrong, overconfident, or focused on the short term. A 26% probability can increase to 40% after a large ETF inflow, a rate cut, or a surprise regulatory victory.

Second, never invest based solely on the odds of a single market. Instead, combine them with long-term research, a half-cycle history, and your own risk tolerance.

Third, don’t forget about position sizes. High upside scenarios like Bitcoin at $150,000 are inherently high risk. If you choose to speculate, treat it like a small side bet, not like rent money or emergency savings. This way, failure hurts your ego, not your ability to pay your bills.

As prediction markets mature and regulators remain involved, their odds will likely become a standard part of Bitcoin discussions. Use them as an extra flashlight in the dark, not the only one, and you’ll navigate the next cycle with more confidence and less stress.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

Follow 99Bitcoins on X For the latest market updates and subscribe on YouTube for daily market analysis from experts.

The post Bitcoin Bet “$150,000 by 2026” Gets Only 26% Odds on Polymarket appeared first on 99Bitcoins.