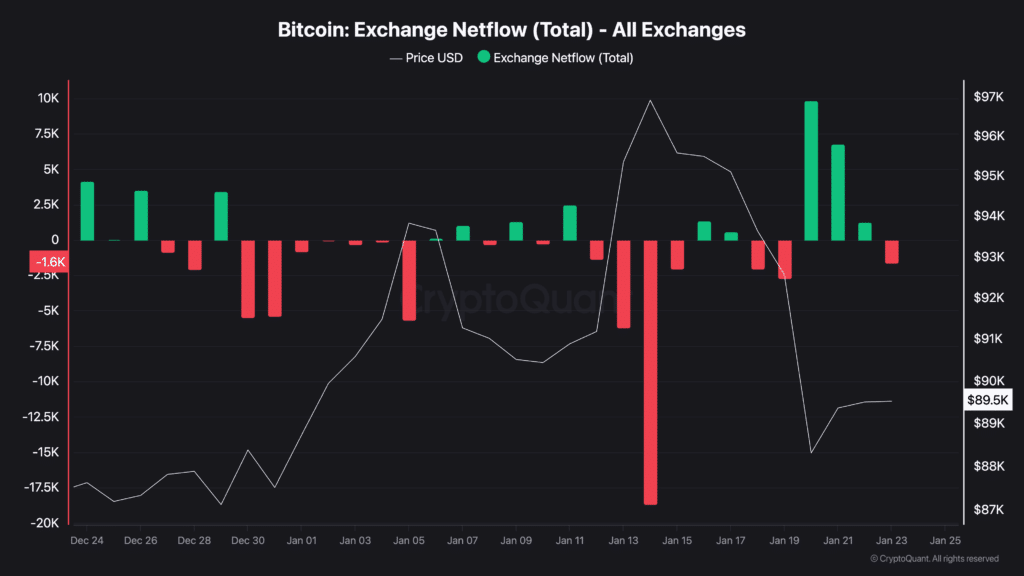

Around 17,000 Bitcoins reportedly moved across crypto exchanges this week, a trend that traders are watching closely for selling pressure. Bitcoin slipped as the influx emerged, struggling to hold recent highs as short-term sellers woke up. The move lands in a market shaped by massive demand for Bitcoin ETFs and a growing tug of war between long-term holders and fast money.

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

Why are Bitcoin exchange flows important?

When Bitcoin enters exchanges, it often signals an intention to sell. Think of it like withdrawing money from a savings account and placing it on the counter. You could spend it. Maybe not. But the opportunity blows.

(Source: Last week, netflow/Cryptoquant Bitcoin exchanges)

On-chain trackers spotted around 17,000 BTC on exchanges in a short window. For beginners, this is important because strong capital inflows often precede pullbacks, especially when prices are already near recent highs.

This behavior is notable because long-term holders have recently slowed their sales and even resumed accumulation, according to Glassnode. This distribution tells us that short-term traders are active, while patient investors are still showing confidence.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

ETF Demand Changes Bitcoin Market Structure

Bitcoin ETFs now play an important role in price action. In 2025 alone, spot Bitcoin ETFs absorbed over 617,800 BTC, removing supply from the open market and tightening liquidity.

(Source: Latest Bitcoin ETF / CMC flow data)

This demand explains why massive sales seem more brutal but shorter. When Bitcoin falls, ETF buyers often step in. According to Cointelegraph, ETF flows now act as a sentiment driver, amplifying both fear and confidence.

So while currency flows may raise eyebrows, they no longer guarantee a prolonged crash. The market has a new class of buyers with deep pockets and longer time horizons.

What does this mean for regular Bitcoin holders?

If you are new to Bitcoin, this data is not a sell signal in itself. This is a volatility warning. When most holders are taking profits, selling pressure increases because people feel comfortable locking in their gains.

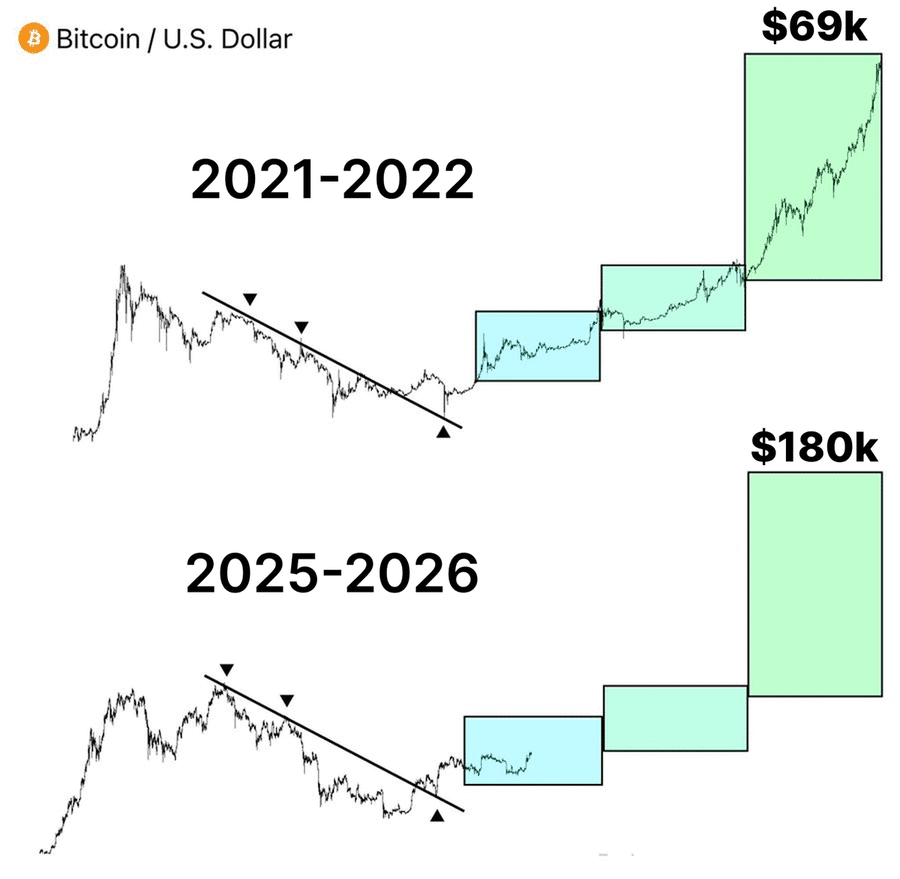

In previous rebounds, on-chain profitability has climbed above 95%, an area where pullbacks become common. This does not kill the uptrend. This resets it.

For beginners, the smart move is simple. Avoid chasing green candles. Spread buys over time. Never use money you need for rent, food, or emergencies.

(Source: Possible scenario for Bitcoin / TradingView)

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The post 17,000 Bitcoin Trades Hit – Is a Deeper BTC Pullback to $80,000 Coming? appeared first on 99Bitcoins.