21Shares presented three price outlook scenarios for

In a January 23 research note, 21Shares’ Matt Mena describes 2026 as a “watershed” in which XRP’s valuation becomes “anchored in institutional fundamentals” following the August 2025 settlement that ended the pending SEC issue. The company says the resolution removed a structural constraint that limited XRP’s upside “regardless of underlying utility,” allowing the market to reassess the price to a new all-time high of $3.66 and then consolidate with the old high of $2.00 serving as support.

XRP Price Prediction for 2026

21Shares describes the post-settlement regime as a more difficult environment for the asset: less narrative optionality, more accountability. Once the legal cloud clears, the note asserts that XRP “can no longer rely on court hype or regulatory uncertainty to drive its valuation or excuse its underperformance,” introducing a risk of “selling the news” if usage fails to scale and the market revalues the asset based on realized adoption rather than legal redress.

Related reading

The company’s view is that clarity expands the addressable buyer base and product surface area in the U.S. “U.S.-based institutions. Regulated funds and ETP issuers. Banks and payment companies.” According to 21Shares, these channels were previously limited by the risk of non-compliance, and their reintegration opens a new phase of price discovery.

The second pillar concerns flows. 21Shares claims that US spot XRP ETFs have “fundamentally rewritten” the demand profile of XRP, reaching over $1.3 billion in assets under management in their first month and recording a 55-day streak of consecutive inflows. The note leans heavily on a supply-demand argument, linking ETF absorption to what it calls unusually sticky retail positioning.

“Foreign reserves are at a seven-year low at 1.7 billion XRP. Institutional demand for ETFs is being met by a community that refuses to sell.” This collision, the company claims, is the “primary driver” of potentially non-linear repricing, while also warning that reflexivity is beneficial in both directions if inflows slow.

To support the reflexivity argument, 21Shares cites the first year of U.S. Bitcoin spot ETFs as a model, citing nearly $38 billion in net inflows and price action from around $40,000 to $100,000 in 12 months. The distinction, in his view, lies in liquidity overhead:

Related reading

The third pillar is utility, with 21Shares positioning XRPL as “financial plumbing” for stablecoin tokenization and settlement. The note highlights RLUSD’s growth to over 37,000 holders and a market cap increase of over 1,800%, from $72 million to $1.38 billion in less than a year, while XRPL DeFi TVL grew nearly 100x over two years to over $100 million. It also highlights the Multi-Purpose Tokens standard as a mechanism for institutions to issue RWAs with built-in metadata and compliance rules.

Still, 21Shares flags execution risk: progress is “scalable, not explosive” and XRPL lags behind competitors in developer and user engagement, with competition for RWA feeds cited by Canton, Solana and other ecosystems.

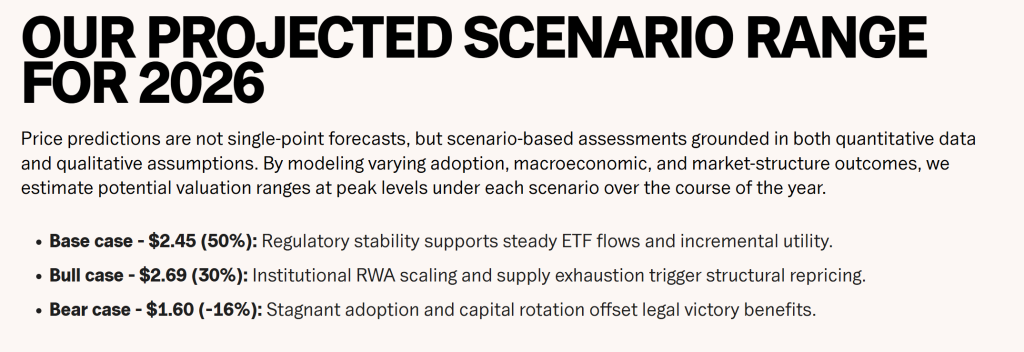

The peak ranges modeled by 21Shares for 2026 place a base case at $2.45 (50% probability), a bull case at $2.69 (30%), and a bear case at $1.60 (implied -16%), with the main driving forces being sustained ETF inflows, significant tokenization volumes, and continued institutional traction. RLUSD.

At press time, XRP was trading at $1.8792.

Featured image created with DALL.E, chart from TradingView.com