Key Notes

- Top banking industry executives are meeting with lawmakers amid ongoing debates over digital asset custody and stablecoin oversight frameworks.

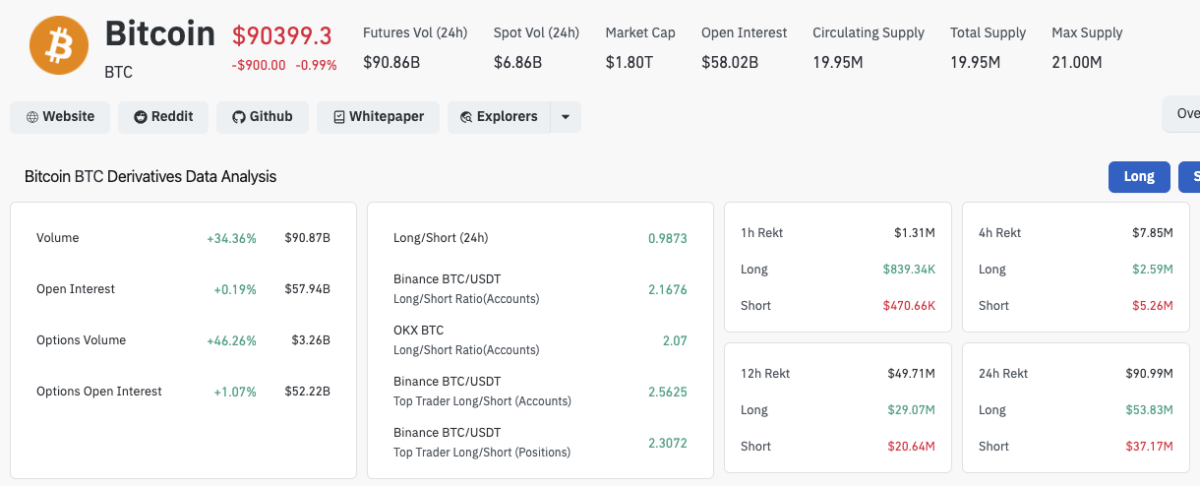

- Bitcoin trading volume jumped 34% while open interest remained stable, signaling cautious positioning ahead of political developments.

Citigroup CEO Jane Fraser, Bank of America CEO Brian Moynihan and Wells Fargo CEO Charlie Scharf are expected to meet with senators on Thursday for a closed-door discussion on crypto market structure legislation.

News: A trio of major bank CEOs will meet with senators this week to discuss crypto market structure legislation. Citigroup CEO Jane Fraser, Bank of America CEO Brian Moynihan and Wells Fargo CEO Charlie Scharf are expected to sit down with senators on Thursday.

PBN texts>>> pic.twitter.com/EzrWeBAKDH

– Brendan Pedersen (@BrendanPedersen) December 8, 2025

Punchbowl News’ Vault team, which tracks financial policy in Washington, released details of the invitation in an X-article on Monday. It described the impending meeting as part of a broader effort for banks, regulators, lawmakers and key stakeholders to deliberate on pending regulatory proposals.

On Sunday, Semafor Congressional Reporter Eleanor Mueller mentioned that the provision for the U.S. government to launch a central bank digital currency (CBDC) was no longer in the draft, while responding to the new comprehensive NDAA agreement published by Politico defense reporter Connor O’Brien.

The lack of a ban on CBDCs adds even more relevance to Thursday’s session, with senators expected to press bank executives on how traditional financial institutions intend to navigate a regulatory landscape that remains volatile.

The United States passed the GENIUS Act in July 2025, creating a framework for the regulation of stablecoins in the country. However, lawmakers continue to debate how banks should handle digital asset custody, oversight of stablecoin reserves, and the role the Federal Reserve should play in tokenized market infrastructure.

Bitcoin Holds $90,000 as Traders Wait for Regulatory Clarity

Bitcoin

BTC

$90,480

24h volatility:

1.1%

Market capitalization:

$1.81 ton

Flight. 24h:

$45.15 billion

remained at nearly $90,000 as the political context evolved. Data from Coinglass shows that futures volumes increased 34.36 percent to $90.87 billion, while open interest increased only 0.19 percent to $57.94 billion. The long/short ratio eased to 0.9873, reflecting a slight trend toward short exposure.

Bitcoin (BTC) Derivatives Market Analysis | Source: Coinglass

The imbalance between the volume spike and the slight increase in open interest indicates that most of the activity came from intraday rotations rather than conviction-driven positioning, suggesting traders prefer to wait for clarity from Washington as the week unfolds before placing larger directional bets.

Crypto Traders on Alert as Maxi Doge Presale Approaches $4.5 Million

Maxi Doge is a meme-based leveraged trading ecosystem that combines social entertainment with aggressive return potential.

The Maxi Doge presale has now surpassed $4.2 million, closing in on its $4.5 million goal. The project offers leverage up to 1,000x with no stop-loss restrictions. Each MAXI token is currently priced at $0.00027, with the next pricing tier expected to unlock within a few hours.

Maxi Doge Presale

Interested buyers can visit the official Maxi Doge presale website to secure early allocation and access exclusive early bird bonuses.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with experience supporting various Web3 startups and financial organizations. He completed his undergraduate degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn