Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum is negotiated just below the $ 2,000 mark, standing at critical levels while the wider market shows signs of recovery. After weeks of jerky price action and sales pressure, the bulls gradually regain control, pushing the ETH in a more optimistic short -term structure. The momentum is built as Ethereum stabilizes above the level of $ 1,800, and the technical indicators suggest that an escape can form.

Related reading

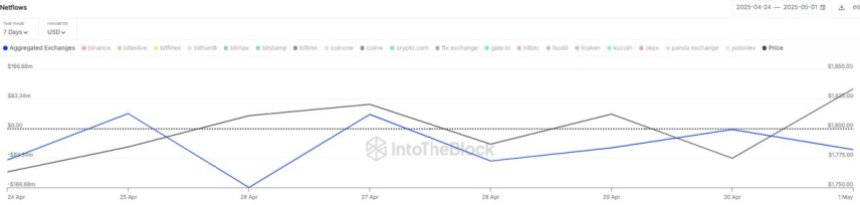

Adding to increasing optimism, data on the chain of intotheblocs show a coherent flow of ETH from centralized exchanges – an indicator often associated with accumulation and reduced sales pressure. During the last week only, net outings exceeded $ 380 million from Ethereum, strengthening the opinion that investors are preparing for a higher movement.

However, the key resistance at $ 2,000 remains a psychological and technical barrier. A push confirmed above this level could trigger a wider Altcoin rally and report the start of the next stage of Ethereum. Until then, the market remains cautiously optimistic because the bulls test the upper limits of this consolidation zone, in search of the momentum necessary to escape it.

Ethereum faces a critical test in the middle of the accumulation trend

Ethereum continues to face opposite winds because it is negotiated more than 55% below its summits of December, oscillating under the resistance zone of $ 2,000. While the wider market of cryptography shows signs of Renaissance, ETH remains locked in a critical battle between the general costs of the offer and the renewal of the purchase interest. The recent price structure shows bullish development within the lower deadlines, while buyers are trying to take momentum. However, high levels of resistance are still looming, and the non-permeation of drilling could trigger a new movement in lower demand zones around $ 1,700, or even $ 1,500.

Despite these technical challenges, chain data depicts a more encouraging image. According to Intotheblock, centralized exchanges have seen net Ethereum outings of around $ 380 million in the last seven days. This regular reduction in the ETH held on the stock market suggests a growing tendency of accumulation, often interpreted as investors transferring coins to the storage of cold rather than preparing to sell. This behavior generally reduces the pressure on the sale side and can lay the basics of gatherings more durable.

The feeling of the market remains mixed. Some analysts argue that Ethereum is preparing for a break, with a movement changing the thrust to an imminent thrust. Others remain cautious, warning that macroeconomic uncertainty and the confidence of fragile investors could always attract ETH to a deeper correction. The next few days will be crucial to define the trajectory of Ethereum.

Related reading

ETH price analysis: testing the keys

Ethereum (ETH) is currently negotiated at $ 1,837 after several days of consolidation just below the level of $ 1,850. As we can see in the daily graphic, ETH tried to form a short -term bullish structure after having bounced back from April nearly $ 1,550. The price has regularly climbed but is now faced with significant resistance almost $ 1,850 – a level that acted both as support and resistance in previous months.

The volume was relatively stable but not convincingly, which indicates that the bulls take control but lack strong momentum to unravel. The simple 200 -day mobile average (SMA) at $ 2,271 and the 200 -day exponential mobile average (EMA) at $ 2,456 remain distant general costs. These levels represent key resistance in the longer term, and recovering them would be a major upper signal.

Related reading

For the moment, the ETH must close decisively to $ 1,850 to validate this short -term trend reversal. Not doing it can lead to another support detect of around $ 1,700 or even lower, especially if changes in broader market. However, the price holding above recent swing hollows and the highest stockings reports that the upward pressure is gradually built. An escape greater than $ 1,850 would open the door to a movement to the area from $ 2,000 to $ 2,200.

Dall-e star image, tradingview graphic

(Tagstotranslate) ETH (T) Ethereum (T) Ethereum Accumulation (T) Ethereum Analysis (T) Ethereum Exchange Outflows (T) Ethereum New

Source link