- XRP has remained below its neutral line in recent weeks

- ETF Applications Could Cause Increase in Positive Sentiment Once and If Approved

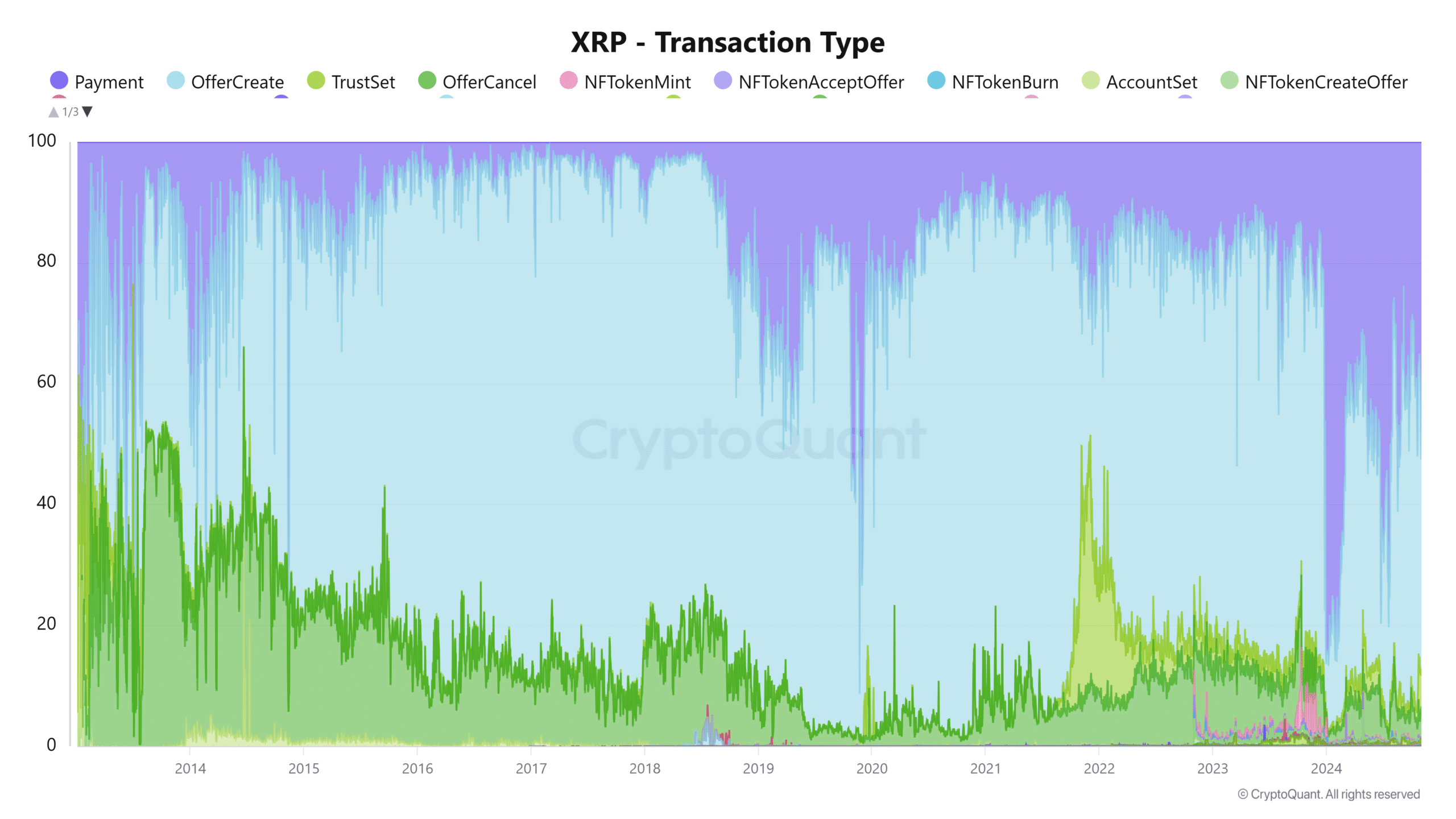

The XRP ledger has undergone a notable transformation in its network usage over the past few months. In fact, rRecent analysis indicated that trading activity has increased significantly – a sign that there has been a shift beyond Bitcoin’s traditional payment functions.

Additionally, submitting another application for a Spot ETF can further enhance the utility of Ripple’s offerings.

An increase in user interest

CryptoQuant data has highlighted a change in user behavior on the Ripple network.

Previously, the platform was mainly used for payment transactions. This represented about 88% of all activity at the start of this year. However, this dominance has since declined, with payment transactions now accounting for around 44% of the total.

At the same time, the new OfferCreate feature has gained traction and is now just as important.

Source: CryptoQuant

Such an increase in OfferCreate transactions can be interpreted to imply a growing interest in trading activities.

This trend also seems to highlight that users are engaging with Ripple to issue new assets and use DEX features. Diversifying use cases beyond payments is promising for Ripple. Especially since it strengthens Ripple’s appeal and boosts user engagement.

XRP attracts more ETF applications

More institutions are showing interest in launching spot XRP ETFs, strengthening the prospects of XRP and, by extension, Ripple.

For example, according to reports, 21Shares submitted its Spot ETF application for XRP on November 1. This application, which included a Form S-1 for Core XRP Trust shares, is expected to be listed and traded on the Cboe BZX exchange.

The filing is just the latest following previous requests from Bitwise and Canary Capital. If these applications receive approval from the United States Securities and Exchange Commission (SEC), more traders could be directly exposed to XRP.

This would bring XRP in line with Bitcoin and Ethereum, both of which have Spot ETFs from various institutions. It should be emphasized, however, that wEven though the Bitcoin ETF has seen considerable success, the Ethereum ETF is still playing catch-up.

The timing for XRP is also good. Especially since recent filings suggest that Ripple’s toughest phase of legal battle with the SEC may be over after the ruling declared that XRP is not a security.

Potential trend for XRP

If XRP gets approval from a Spot ETF, its price could see a significant rise in the charts. Actually, Technical indicators revealed that XRP appeared to be struggling to maintain levels above the 50-day and 200-day moving averages – both around $0.55.

Furthermore, support for the altcoin was hovering around the $0.50 area.

Source: TradingView

ETF approval could trigger a breakout above these moving averages. If this happens, XRP could then test resistance levels near $0.60 or above.

A successful breakout could see XRP target the psychological $0.75 mark and even the $0.85 range, if buying pressure intensifies.

– Realistic or not, here is the market capitalization of XRP in terms of BTC

At the time of writing, the MACD and RSI indicators were quite moderate. However, sentiment could change dramatically if the ETF is approved. Needless to say, this update may precipitate a bullish rally on the XRP charts.