- PEPE bulls have not performed to their full potential, but that may soon change.

- Demand for spot and derivatives is up slightly, which could lead to new highs.

Pepe (PEPE) has performed quite well so far in November, but it has underperformed compared to Dogecoin (DOGE). However, this could indicate that there could be better days ahead for the frog-themed memecoin.

PEPE is one of the best performing memecoins of 2024, but its second half performance has been disappointing.

For starters, PEPE failed to reach new highs in 2024, unlike DOGE, which appears to have defied gravity. The latter managed a 206% rise from its November low to its recent peak, while the former rose 92%.

The PEPE could benefit if…

Best-in-class coins have seen robust gains, and that goes for both Dogecoin and Bitcoin (BTC).

However, cash turnover could begin soon, paving the way for companies like PEPE to benefit from large cash inflows.

PEPE may already be on track to see more upside and reach a potential new high before the end of 2024. Its open interest has soared to $214.89 million in the last 24 hours, representing its highest historical level.

Source: Coinglass

This rise suggests that memecoin is currently the most attractive it has ever been in the derivatives segment. But what about demand in the spot segment?

Transaction data from IntoTheBlock revealed that PEPE recorded just over 12,100 transactions in the last 24 hours. The number of memecoin transactions increased this month and was at a 3-month high at the time of writing.

Source: In the block

The correlation with price suggests that the increase in trading was primarily buying pressure rather than selling pressure.

This observation also confirmed that memecoin has gained market traction this month, a result that could potentially lead to a strong bullish result.

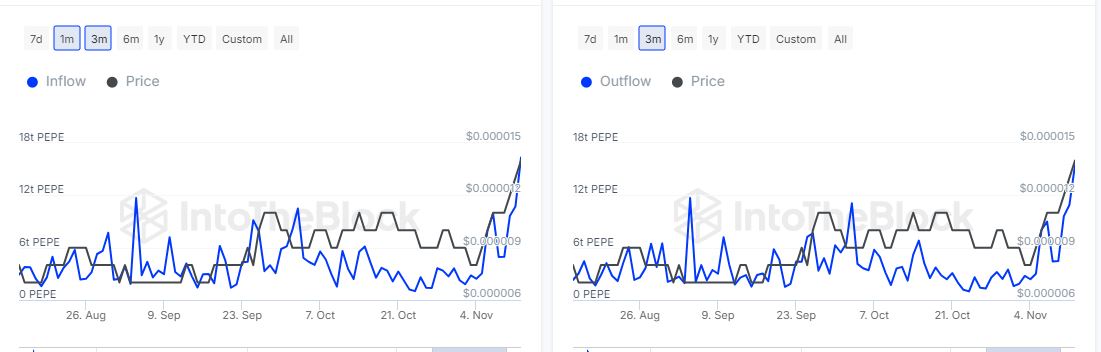

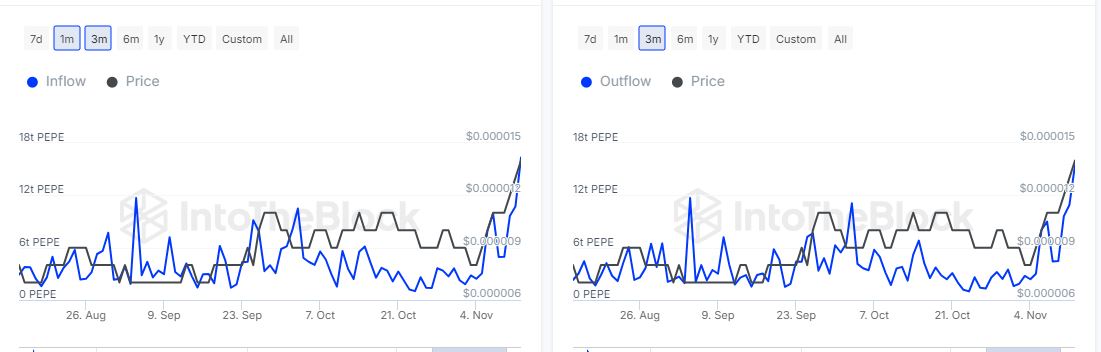

On-chain data also revealed that whale activity has been increasing since early November.

This was demonstrated by the increase in large holder inflows from 1.81 trillion PEPE on November 2 to 16.33 trillion PEPE at press time.

Source: In the block

Although large holders have accumulated, the same category also appears to be preventing PEPE from making more gains.

Read Pepe (PEPE) Price Prediction 2024-2025

Exits from large holders also saw significant outflows, increasing from 1.6 trillion tokens on November 1 to 15.46 trillion tokens as of November 12.

The balance between entries and exits from large holders was still in favor of the bulls at the time of writing. However, this could change soon, depending on prevailing market sentiment.