This article is also available in Spanish.

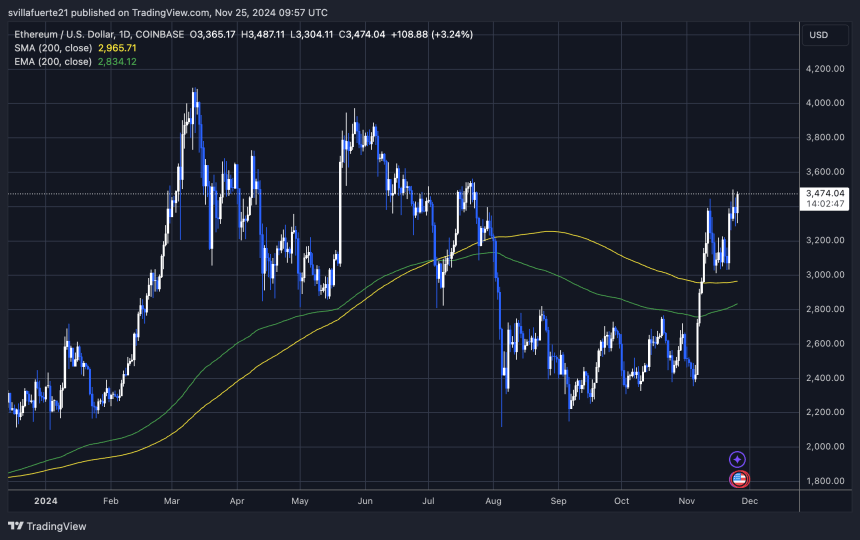

Ethereum is trading at its highest levels since late July, hovering around $3,470. This marks a significant rebound for the second-largest cryptocurrency, which managed to hold above the crucial 200-day moving average (MA) at $2,965. By maintaining this level, Ethereum has confirmed a bullish price structure, setting the stage for continued momentum as it approaches its next milestone: yearly highs near $4,000.

Analyst and investor Carl Runefelt recently shared his technical analysis on X, highlighting that Ethereum’s price action has built a strong foundation for future growth. According to Runefelt, Ethereum is poised for a substantial rally once it breaks key resistance levels, signaling increased confidence from traders and investors.

Related reading

This bullish sentiment is further fueled by Ethereum’s consistent on-chain activity and growing institutional interest, which continue to support its upward trajectory. However, to break above $4,000, Ethereum will need to overcome resistance zones that have historically triggered pullbacks.

As ETH consolidates its gains, market participants are closely watching for signs of an upcoming breakout, which could set the tone for the rest of the year. Ethereum’s recent strength underscores its role as a market leader and barometer of broader cryptocurrency trends.

Ethereum tests crucial supply

Ethereum is testing a crucial supply zone just below the $3,500 level, a key resistance that could propel the cryptocurrency to yearly highs in the coming days. This level has become a focal point for traders and investors, as breaching it would likely be a sign of a continuation of Ethereum’s recent momentum upwards.

Analyst Carl Runefelt recently shared his thoughts on X, highlighting the importance of this resistance. According to his technical analysis, once Ethereum breaks the $3,500 barrier, it could quickly climb up to $3,700, potentially within hours. Market sentiment around Ethereum remains optimistic, with growing demand the catalyst for further price increases.

Ethereum’s strength at this critical level also reignites speculation about a possible Altseason. If ETH continues its upward trajectory and attracts more capital, it could pave the way for other altcoins to follow suit. Historically, Ethereum price action has been a leading indicator of broader market movements, and this time around it seems no different.

Related reading

As ETH approaches this pivotal moment, all eyes are on its ability to maintain upward momentum. A strong push beyond $3,500 would confirm the bullish structure and set the stage for Ethereum to dominate market narratives in the coming weeks.

Key levels to watch

Ethereum is trading at $3,470, hovering below the crucial resistance level of $3,500. This local high has become a key area of interest for traders and analysts, as crossing it could pave the way for a significant rally. If Ethereum manages to forcefully break through this resistance, it could trigger a breakout that propels the price towards $3,900 in a matter of days.

The market, however, remains cautious about the potential risks linked to this pivotal moment. A failed breakout to the $3,500 mark could lead to sideways consolidation as Ethereum seeks stronger buying pressure to regain its bullish momentum. In a more bearish scenario, a substantial correction could occur, taking ETH back to lower levels to establish a stronger base of support.

Related reading

The current price action highlights the importance of this resistance zone. A clear break above $3,500 would likely confirm Ethereum’s bullish structure and build confidence in a continued uptrend.

On the other hand, any hesitation or rejection at this level could signal the need for further consolidation before the next major move. As ETH approaches this critical juncture, the market is closely monitoring its next direction and its potential implications for the broader crypto landscape.

Featured image of Dall-E, chart by TradingView