- Evaluating XRP price predictions as the altcoin rose almost 200% in November.

- Can the upward trend continue in a context of renewed interest in whales?

Ripple (XRP) rose nearly 200% in November, hitting a four-year high of $1.63 in two weeks. Such a rally meant that most holders had huge unrealized profits, which always precede a potential price decline and cooling.

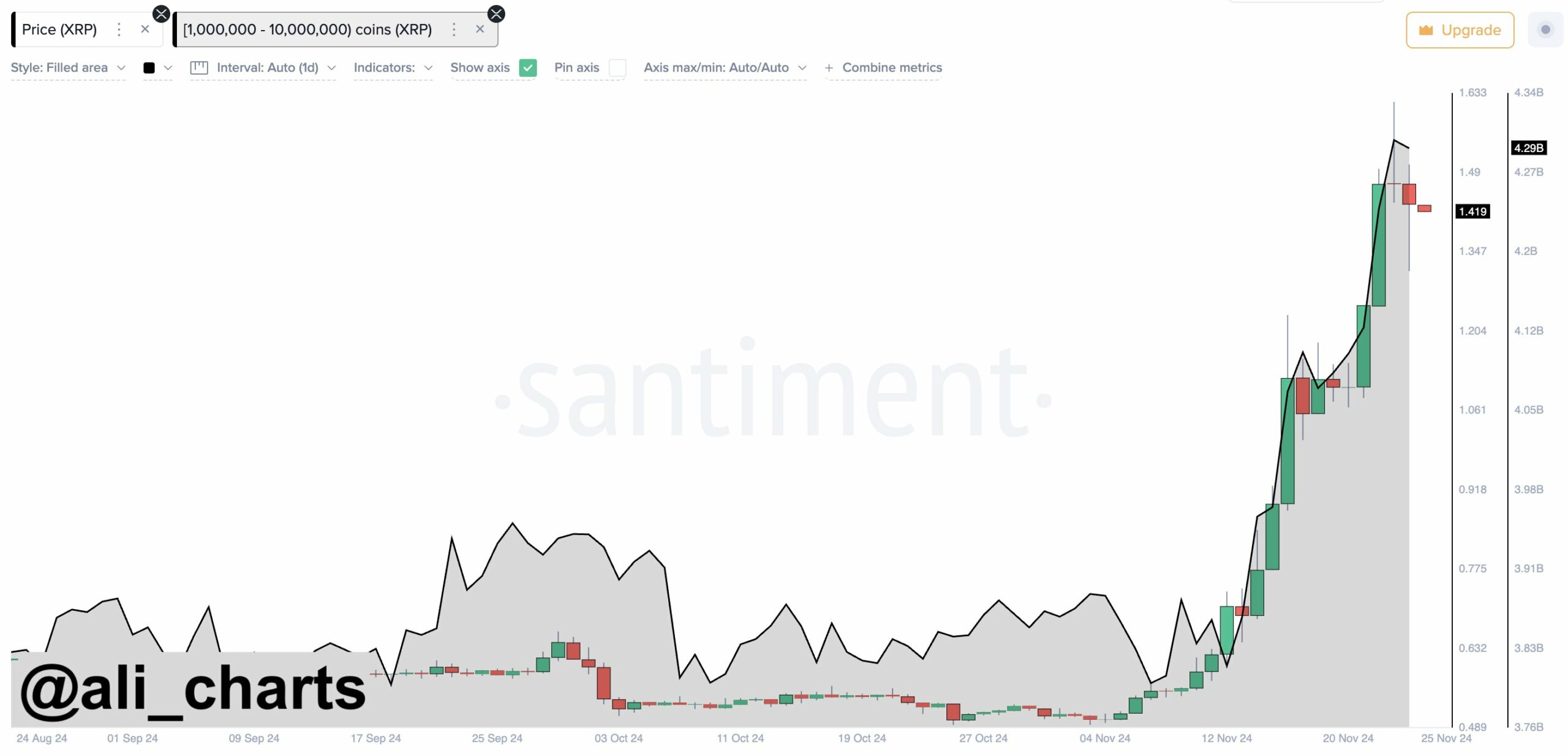

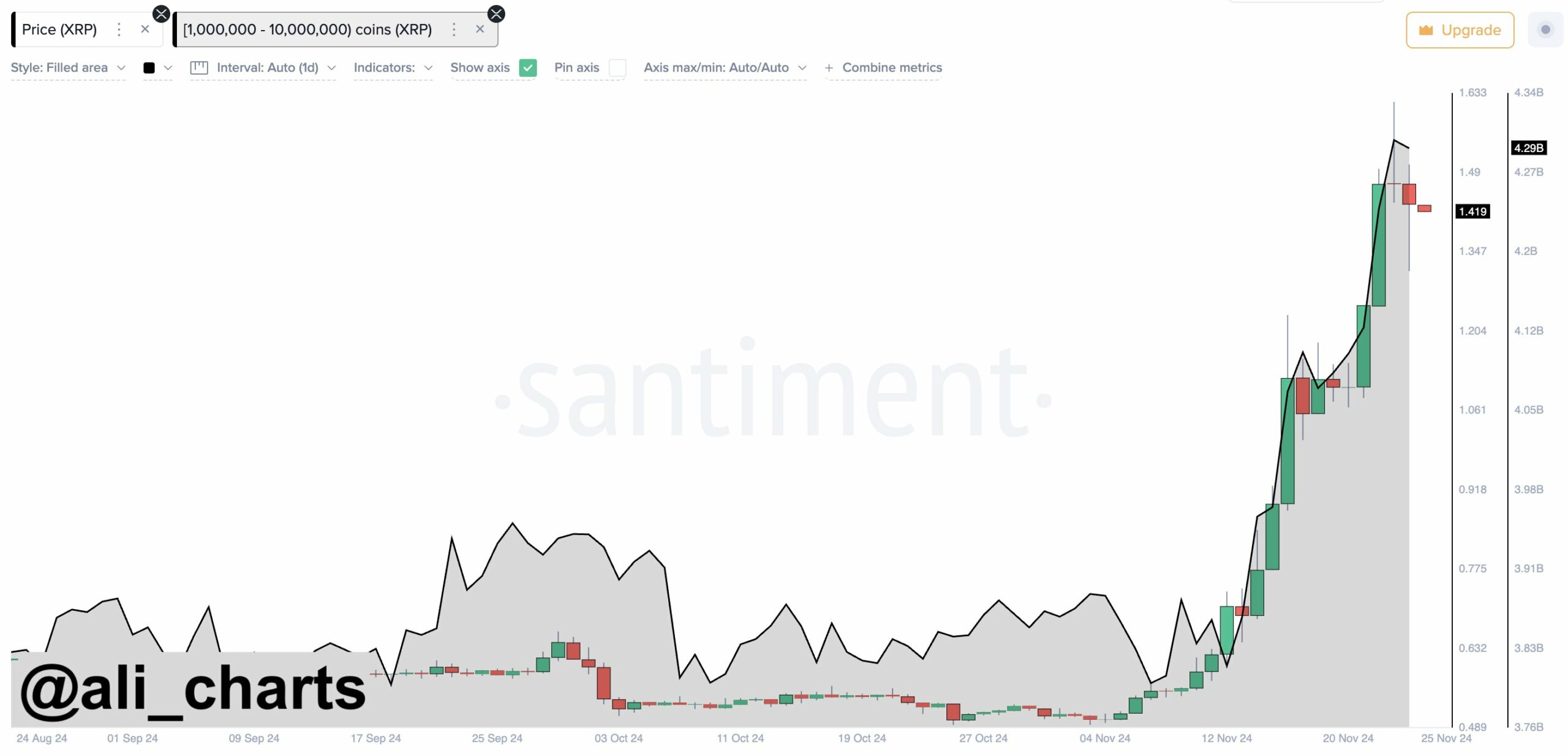

But the whales’ actions suggest otherwise. Crypto market analyst Ali Martinez noted that whales captured over 50 million XRP over the weekend, suggesting that some big players expected the uptrend to continue.

Source: Santiment

XRP Price Prediction

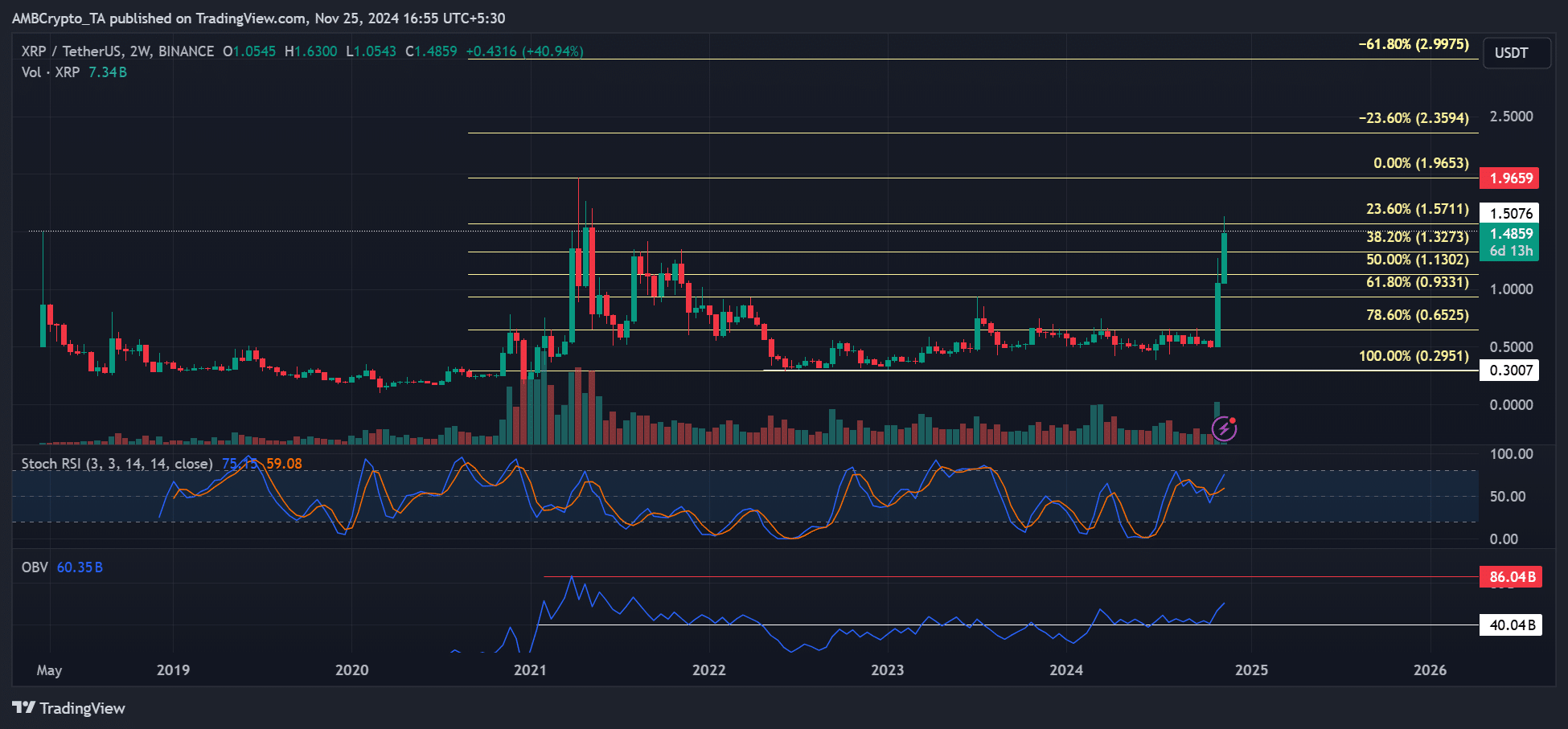

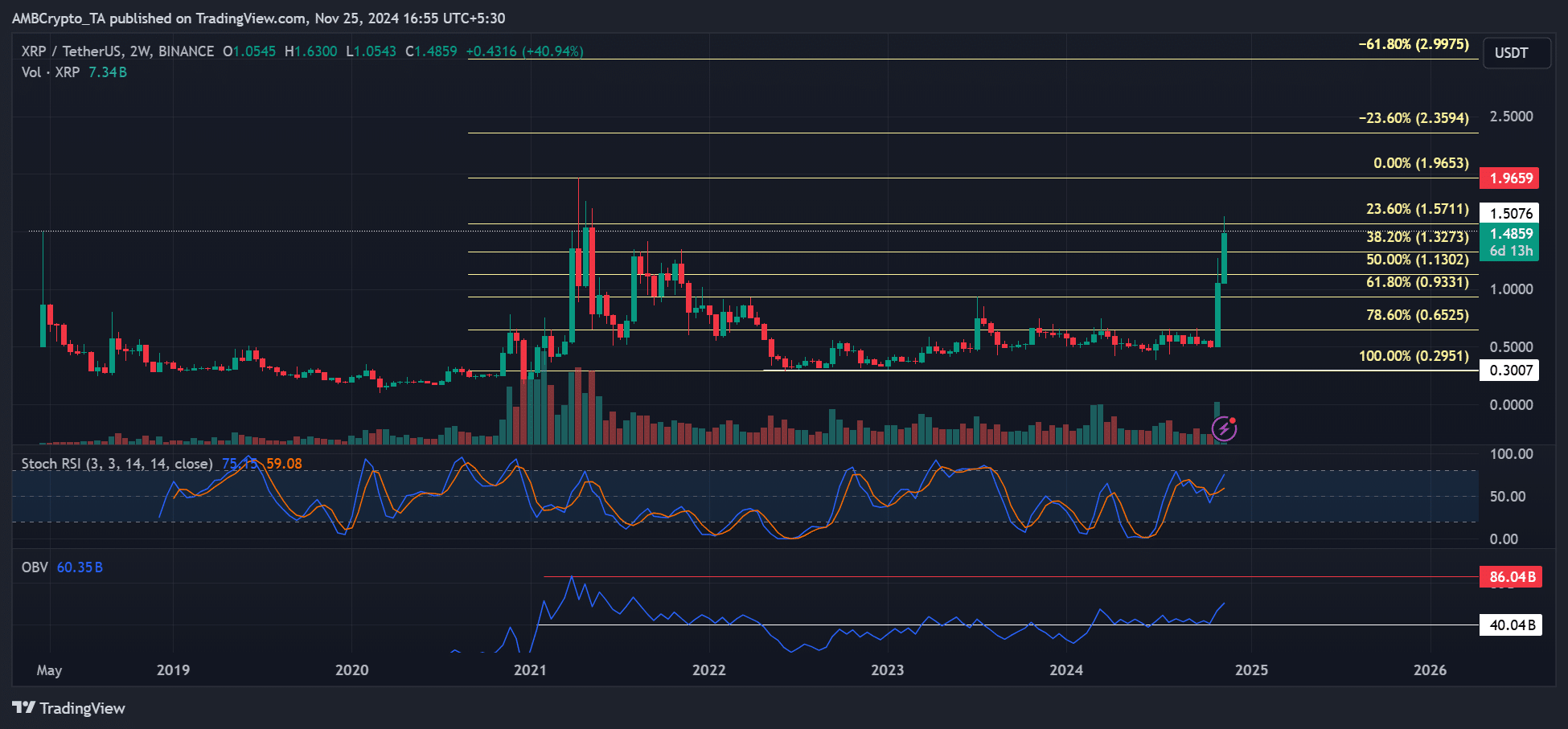

At press time, XRP was valued at $1.5, halfway to its 2018 high above $3 and about 20% below the 2021 cycle high of $2.

Thus, the $2 price target was the immediate upside target for XRP, especially if the uptrend continued.

Strong price momentum, illustrated by the Stochastic RSI and rising OBV (On-Balance Volume), indicates strong buying pressure and the possibility of reaching targets of $2 or more.

Source: XRP/USDT, TradingView

But there was a small caveat for the bulls. Last week’s candlestick closed below $1.5, like the last two days. This meant there was a fight for the $1.5 level, and securing it could shed light on the next price direction.

On the daily chart, the bulls had the upper hand. The price imbalance (FVG-fair value spread) below $1.4 has been a key re-entry point for the bulls.

Strong momentum at this level could allow the uptrend to target higher targets such as $1.96.

Source: XRP/USDT, TradingView

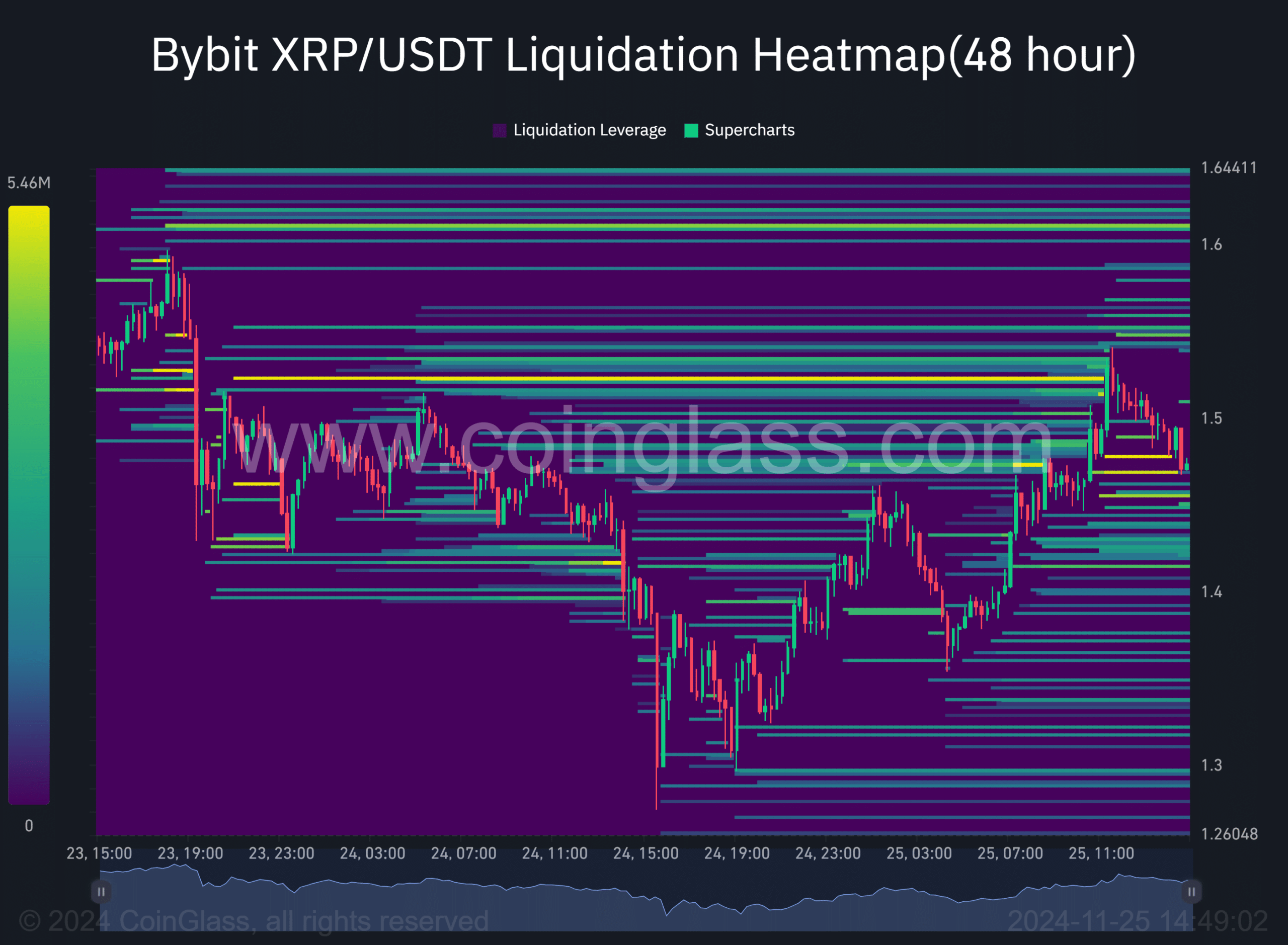

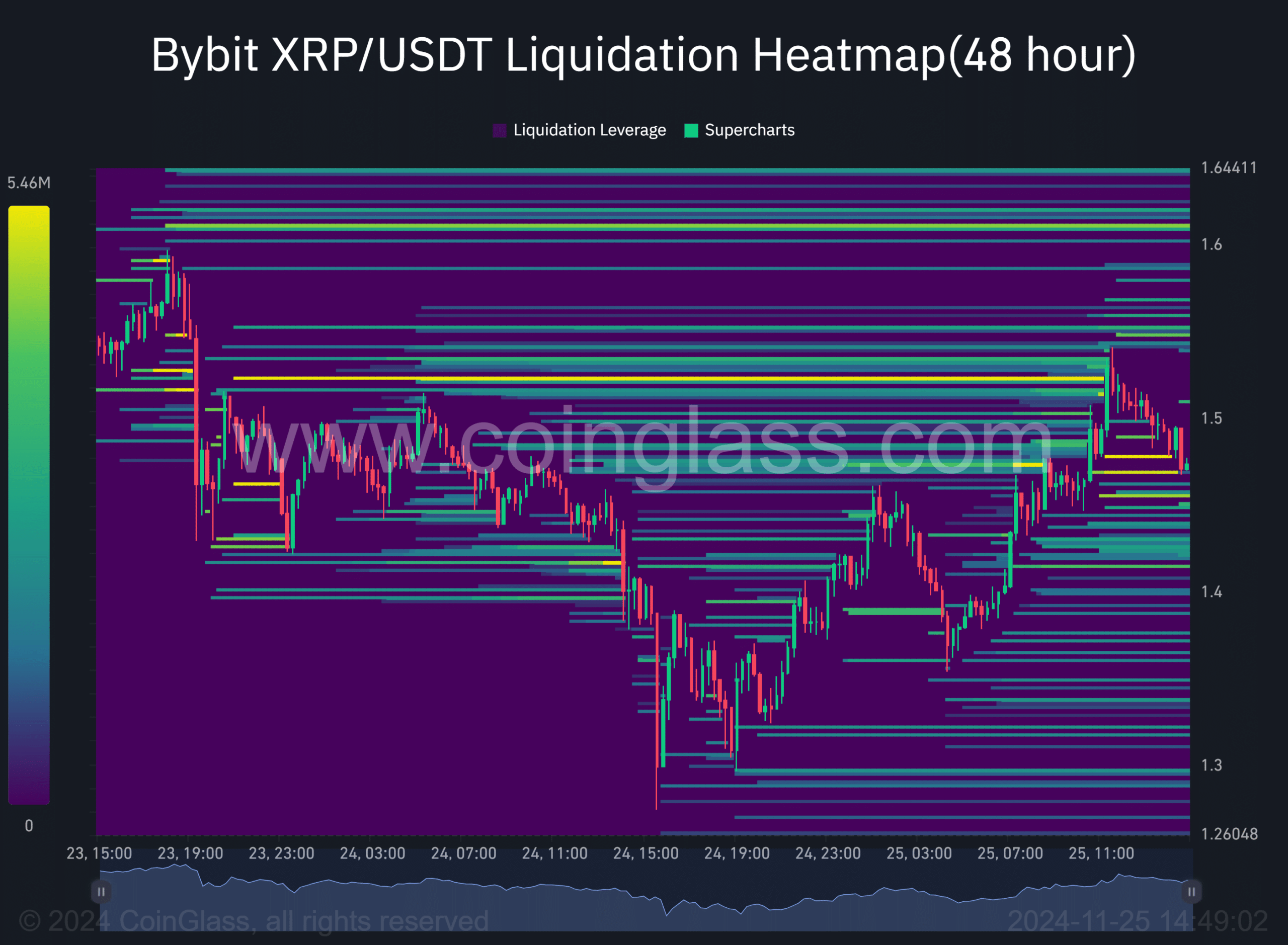

The area below $1.5 also featured a buildup of leveraged long positions (bright orange levels), which market makers could use to seek liquidity.

Read XRP Price Forecast 2024-2025

On the higher side of price action, leveraged short positions were also parked above $1.6. In short, XRP could see a liquidity sweep at or below $1.4 before looking at $1.6 or $1.9.

Source: Coinglass

In conclusion, XRP was poised for further uptrend, at least based on the strong demand for whales. However, this momentum could only be validated if XRP decisively rises above $1.5.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.