In three months, after two flash crashes in early August and September, Bitcoin increased by almost 90%.

The drop on August 5, 2024 forced the coin to fall to $49,000, but since then, Bitcoin has almost doubled, lifting the crypto market with it.

It should be noted that the leg was perpendicular. As traders searched for balance after $74,000 disappeared in early November, prices rose rapidly following Donald Trump’s victory in the hotly contested U.S. presidential election.

The breakout above March 2024 could have led to a short squeeze, given all the dumping and expectations of additional losses from short sellers after the uneventful price action at the start of Q3 2024.

Bitcoin rally and decline

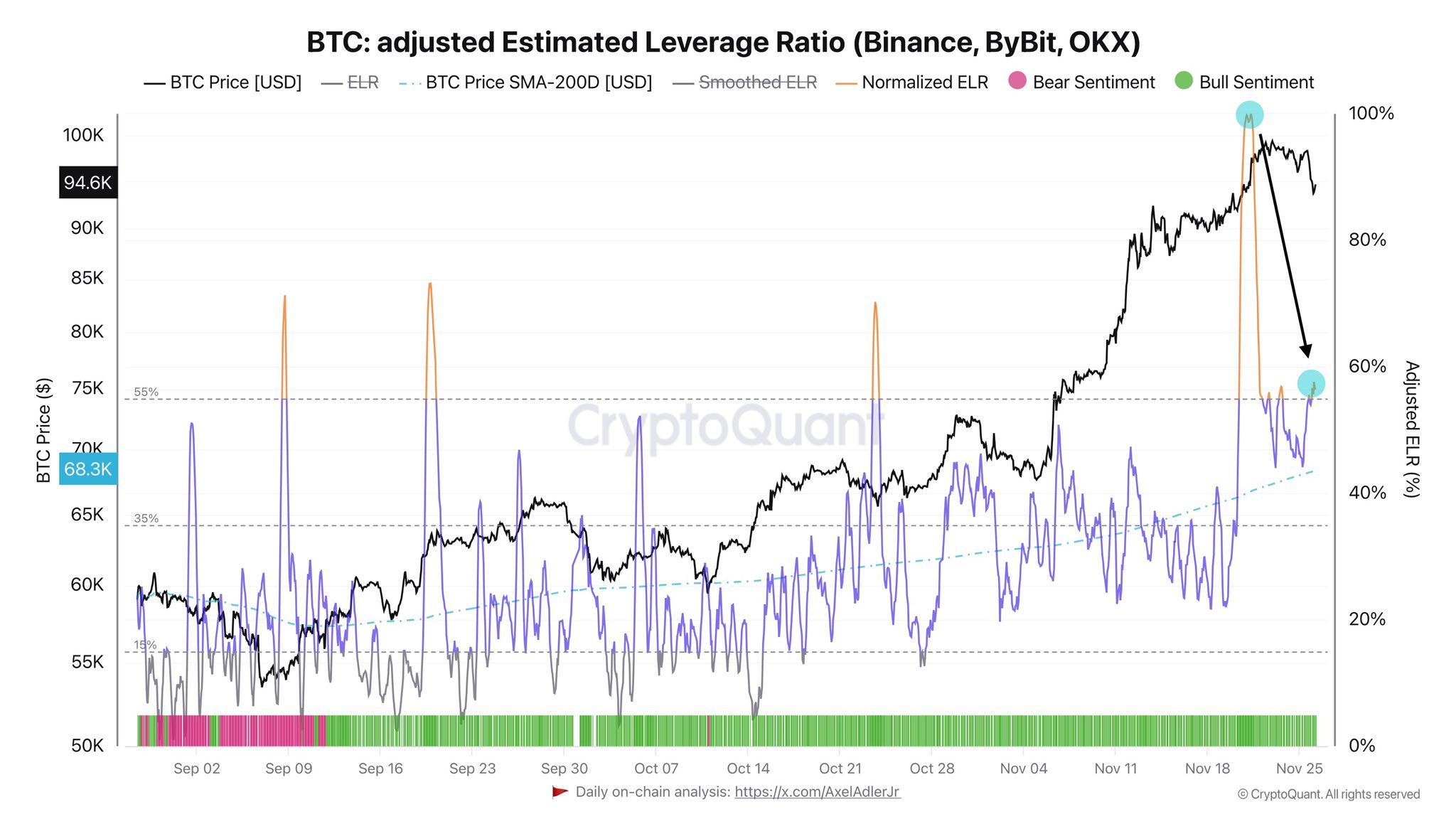

According to the daily chart, the rise from $74,000 to $85,000 was rapid and “violent”. Holders did nothing but saw their gains increase rapidly. Speculators, on the other hand, increased their leverage, maximizing price swings and volatility.

After the “fun”, it seems that Bitcoin is now taking a welcome break. The high-octane rally and frenzy subsides and normalcy returns.

Yesterday, November 25, Bitcoin corrected after stagnation, at one point falling to $92,600.

Although such corrections can usually cause concern, one analyst, referring to X, believes that this pullback is just one of many expected health phases in the coin’s long-term growth cycle.

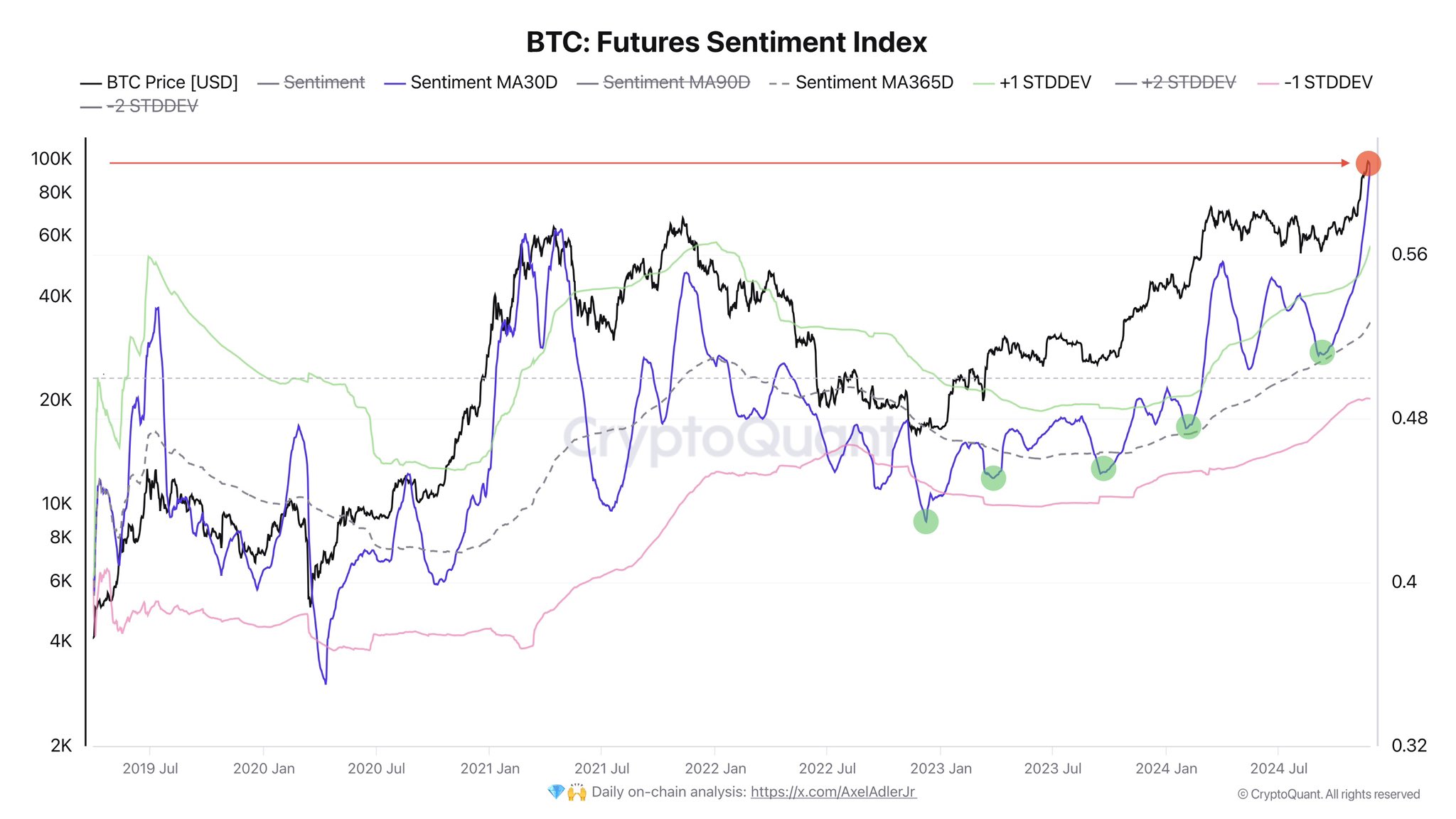

Citing market data from CryptoQuant, the analyst said the correction could even provide a basis for larger gains in the future.

Understanding the Drop!

Bitcoin is cooling off, printing a bearish double-bar formation on the daily chart, completely erasing minor gains recorded over the weekend.

However, this is to be expected.

This occurs when the futures market, the analyst explains, is highly leveraged.

As it stands, the spot market is the main driver of prices, while the futures market is tight due to high leverage. This state of price action proves that the bulls still have what it takes to push higher despite the recent decline.

Leverage remains at multi-month highs and the market appears poised for a deleveraging event.

This evacuation could trigger a cascade of liquidations.

Why is the decline not a concern?

Although Bitcoin may see more losses today and even this week, there should be no reason to worry.

Market data shows that Bitcoin remains on solid ground.

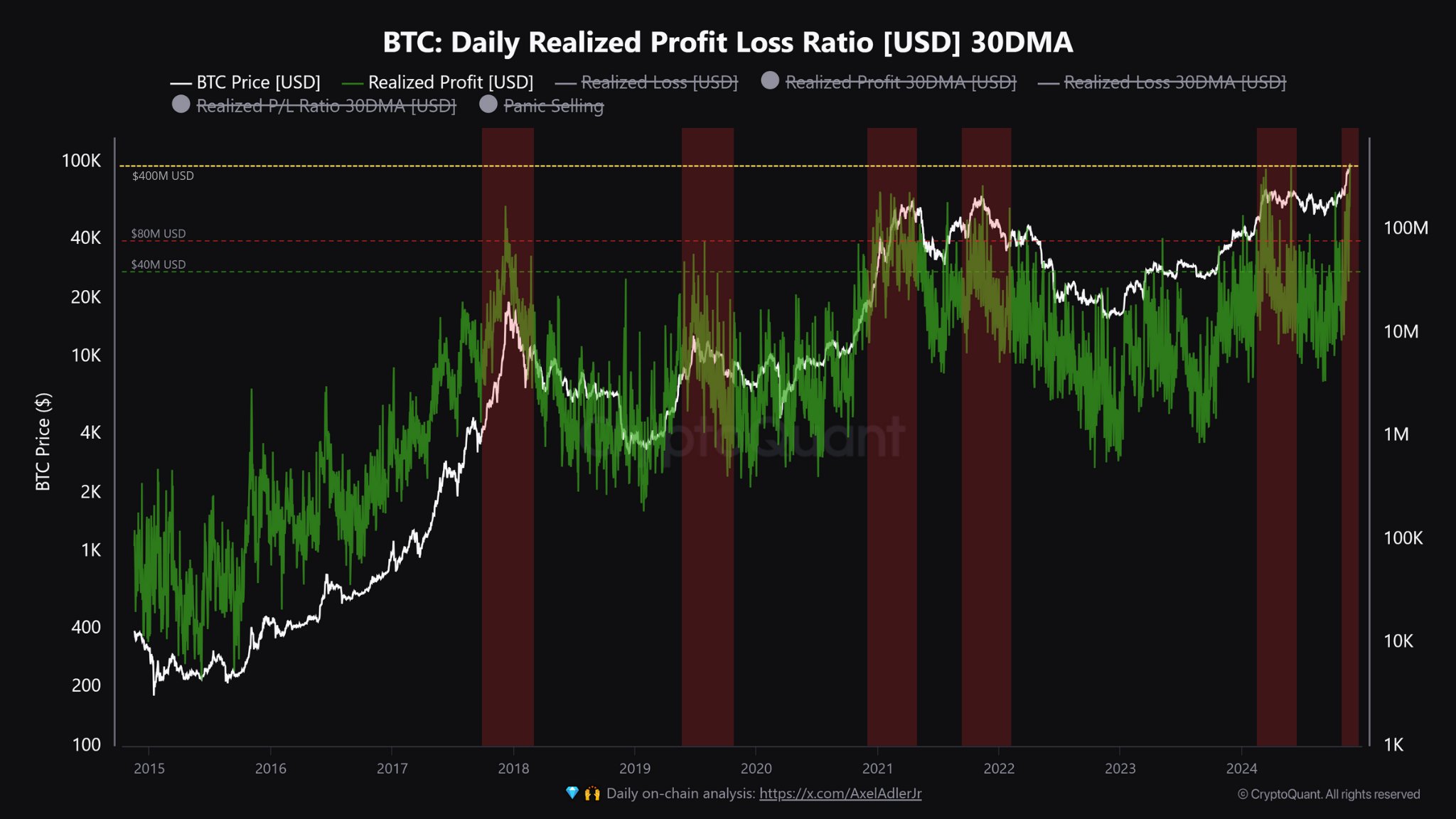

For now, the realized profit/loss ratio is high, suggesting that expected profit-taking could worsen the short-term sell-off. Usually, the realized profit/loss ratio reaches current highs when prices peak. Therefore, looking at history, cooling is part of the ebb and flow of Bitcoin.

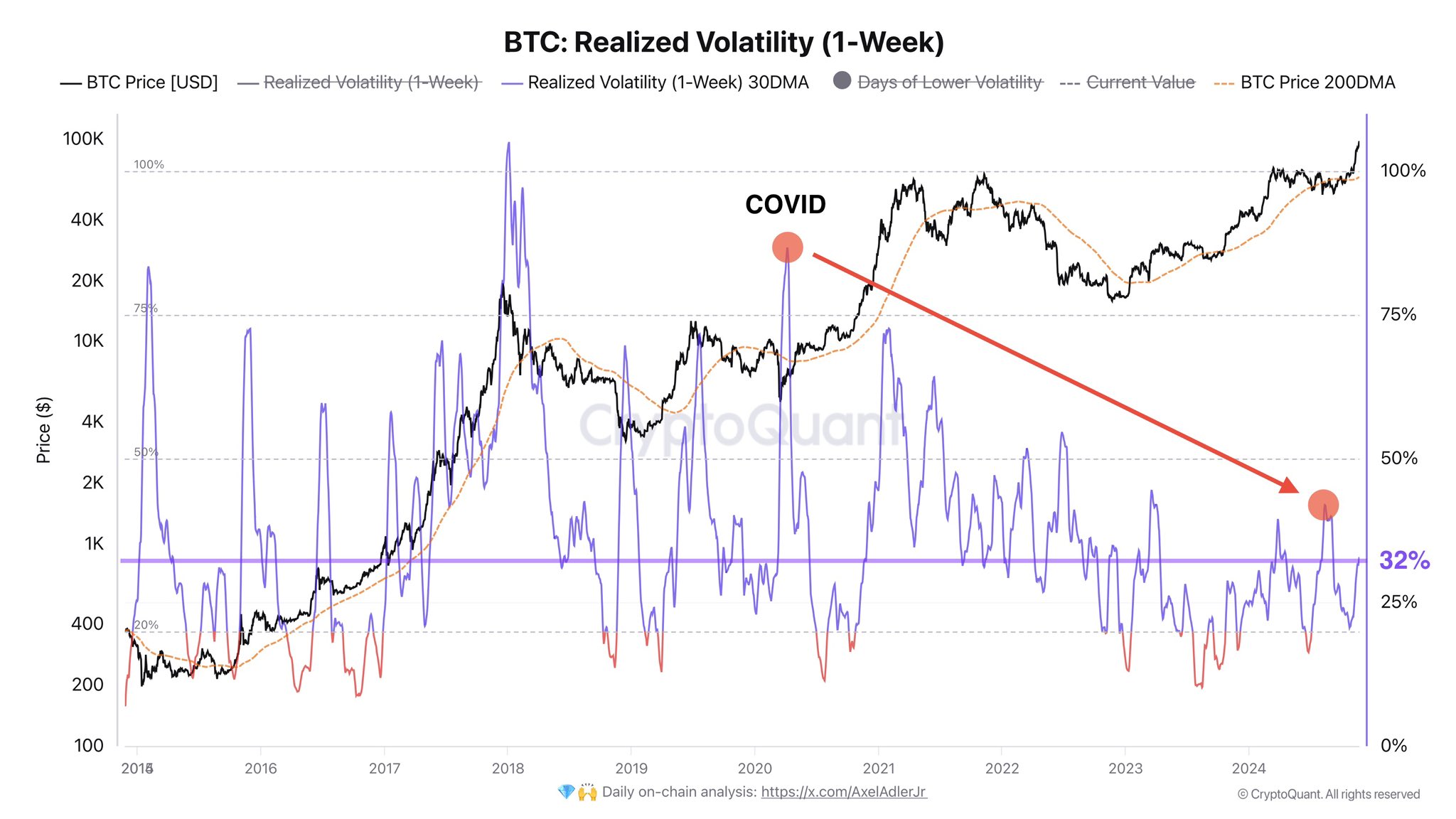

Additionally, the coin’s realized volatility is low, down from COVID-19 levels. Big names, including institutions and governments, could consider gaining exposure to this asset.

Although low volatility could keep speculators away (which is a good thing), the involvement of agencies and large companies could stabilize prices in the long term.

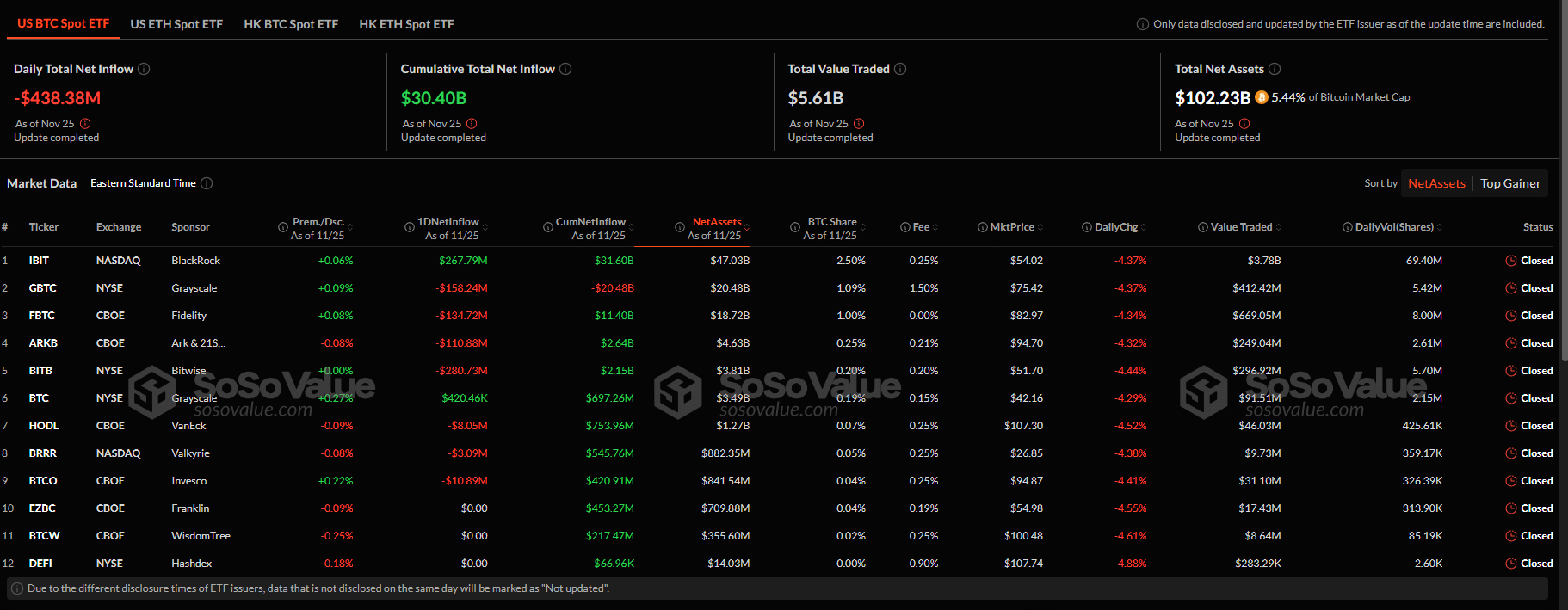

SosoValue data shows that institutions are buying and reviewing entries to spot Bitcoin ETFs. As of November 25, all issuers managed more than $102 billion in Bitcoin-backed equities.

Despite this, taking into account yesterday’s price drop, more than $438 million worth of BTC-backed shares were repurchased.

What’s next for Bitcoin?

Bitcoin may be correcting, but market data shows the decline will not be prolonged.

Smart institutions and companies like MicroStrategy are taking advantage of low prices to buy.

Meanwhile, analysts expect Bitcoin to surpass $100,000, even reaching $120,000 and $150,000 in the coming months.

EXPLORE: 20 new crypto coins to invest in 2024

Join the 99Bitcoins News Discord here for the latest market updates

The article Bitcoin Corrects and Falls to $92,600: Here’s Why This Drop Won’t Hurt the Market appeared first on .