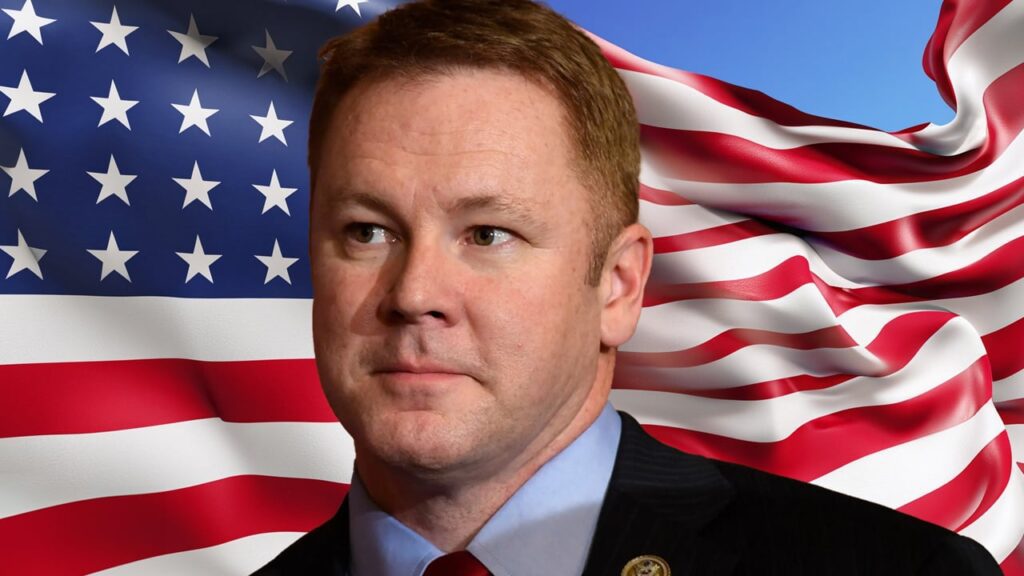

Warren Davidson, the Republican congressman who first introduced the bill in mid-April, introduced the SEC Stabilization Act to remove Gary Gensler, the current chairman of the Securities and Exchange Commission (SEC) from UNITED STATES. Davidson insists the law aims to protect U.S. financial markets “from a tyrannical president.”

Legislation filed to impeach SEC Chairman Gensler in effort to protect U.S. financial markets

Several Republican lawmakers have openly criticized SEC Chairman Gary Gensler for his performance leading the federal securities regulatory division. Among them is Congressman Warren Davidson (R-OH), who recently announced his intention to introduce legislation to remove Gensler from office. Less than two months later, Davidson filed the SEC Stabilization Act and shared the news on Twitter on June 12.

“US financial markets must be protected from a tyrannical president, including the current one,” Davidson said in a statement. “That’s why I’m introducing legislation to address ongoing abuses of power and ensure protection that is in the best interests of the market for years to come.” It’s time for real reform and fire Gary Gensler as SEC Chairman.”

Davidson too announcement that U.S. Congressman Tom Emmer, a Republican from Minnesota, joined him in supporting the bill. “American investors and industry deserve clear and consistent oversight, not political gamesmanship,” Emmer said. “The SEC Stabilization Act will make common-sense changes to ensure that the SEC’s priorities are with the investors it is charged with protecting and not the whims of its reckless chairman.”

Criticism of Gensler’s job performance extends beyond Republican politicians, with Democratic presidential candidate Robert F. Kennedy Jr. also expressing displeasure with the U.S. securities regulator. Kennedy said last month that “the function of the SEC now is not to protect the American people, but to protect the banks.” The presidential candidate also advocated for a crypto-friendly leader at the SEC.

Davidson’s proposal aims to establish a new structure in which responsibility for producing current policy would shift from the SEC chairman to the six SEC commissioners, who would be involved in rulemaking, enforcement and investigations. Patrick McHenry, Chairman of the Financial Services Committee of the United States House of Representatives, also expressed criticism from Gensler lately.

During an oversight hearing on April 18, McHenry asked Gensler a question regarding the classification of Ethereum (ETH) as a security. At the time, Gensler refrained from providing a direct answer as to whether he considered ETH to be a security.

What do you think of the SEC stabilization bill and the ongoing debate surrounding SEC Chairman Gary Gensler’s performance? Share your thoughts and opinions on this topic in the comments section below.