DOT Vs ETH: Polkadot is on the rise, like Ethereum. However, is buying DOT price now a good investment? Find out in Polkadot vs Ethereum.

Competition in crypto is fierce. When Bitcoin first appeared, its code was changed and improved, allowing networks like Litecoin to thrive. Today, in the era of smart contracts, Ethereum faces fierce competition from platforms like Polkadot, Solana, Cardano and the rest of the layer 1 world.

While Ethereum leads in terms of market capitalization and activity, alternatives like Polkadot are more scalable. From a valuation perspective, their relatively low liquidity levels also translate into a higher return on investment (ROI), provided you arrive just in time.

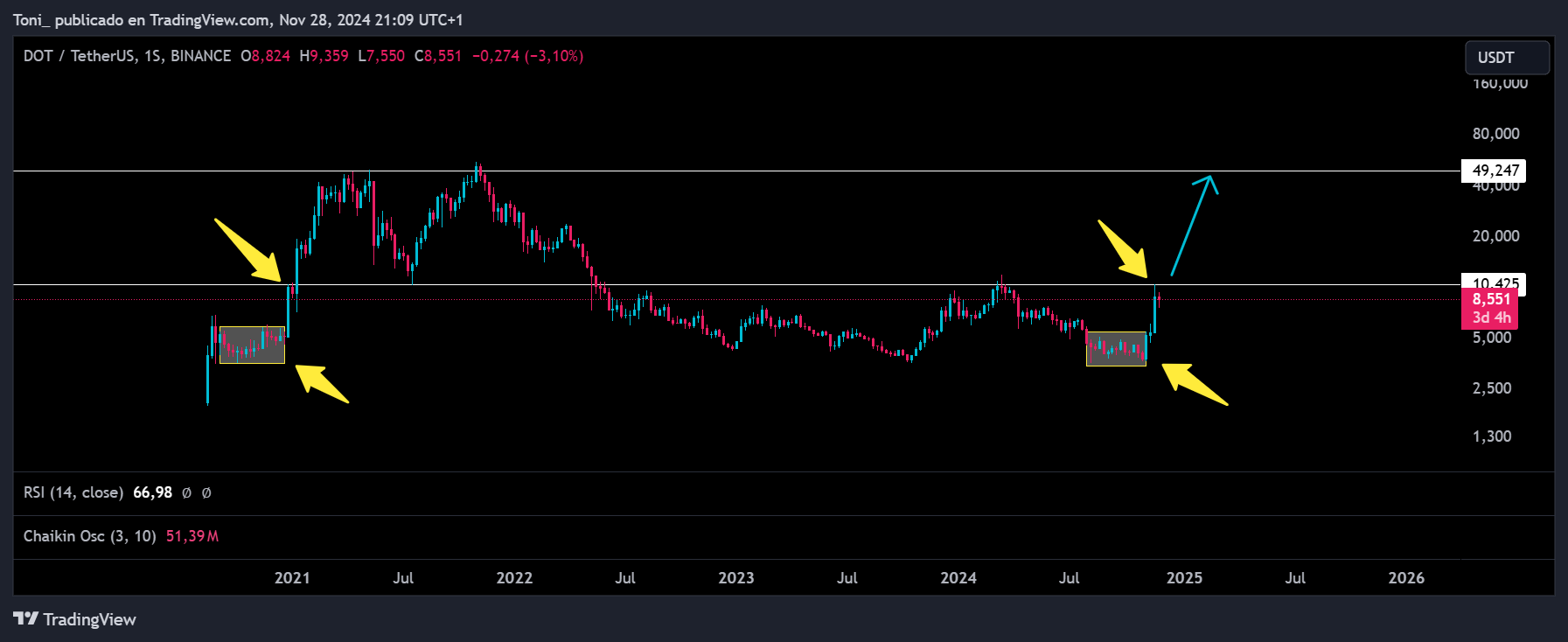

#Peas $POINT seems to be making the same movement as in 2020 – 2021, if it continues like this I would not exclude that the price reaches $50 like in 2021 pic.twitter.com/pWEX00SC1b

— Tony ₿itcoin

(@Toni_Bitcoin) November 28, 2024

Time to Consider Polkadot?

As the race for smart contract dominance heats up, one observer in X believes that buying DOT, Polkadot’s utility currency, can now generate better returns than going all-in on ETH. The second most valuable coin now changes hands at around $3,500.

(Source)

As of press time, both coins have yet to regain their all-time highs recorded in 2021, at around $55 and $4,900, respectively. However, according to the analyst, DOT could outperform ETH in the medium to long term for several reasons.

EXPLORE: Crypto Crash Sends Shockwaves Through Market: Why Is Bitcoin Down and Bull Crushed?

Battle of Layers 1: Polkadot vs. Ethereum

According to him, Polkadot is more interoperable and this functionality is integrated. Blockchains can be integrated through this platform to communicate better in a secure environment.

Additionally, he believes Polkadot has next-generation infrastructure, even with Ethereum 2.0 in place, and is looking to expand the base layer even further in the coming years.

Despite these efforts, Polkadot has a head start. So far the platform is working as it says, it is a more advanced multi-chain framework. As a result, Polkadot can, at present, implement more innovative solutions faster than Ethereum, all without impacting the network.

For scaling, developers can create Parachains (custom, independent chains) secured by the Polkadot Relay Chain. All Parachains are scalable and can be optimized for a specific use case, including very intensive gaming. The introduction of Cores further reduces costs for developers, allowing for faster building.

However, this does not mean that Ethereum is inferior. The developers have actively tried to evolve the existing channel. Thanks to Layer 2 chains, gas fees on the mainnet have decreased as most activities, including DeFi and meme coin minting, have primarily moved to Layer 2s like Base, Arbitrum, and Scroll.

Additionally, Ethereum has a thriving ecosystem of DeFi, meme coins, NFTs, gaming, and other activities that constantly drive demand for ETH.

With institutional interest and the approval of complex products such as spot ETFs and ETPs, the coin has become less volatile and more stable, enduring burst cycles that typically drive down altcoin valuations.

EXPLORE: Is Solana gearing up for a 400% rally? Will SOL price reach $1,000?

Is it time to buy Spot DOT or stick with ETH?

Clearly, Polkadot and Ethereum are quality projects to follow. Both are struggling to gain momentum and are lagging behind Solana and Bitcoin.

As DOT and ETH break out, clearing $6 and $3,500 respectively, there is hope that bulls could push prices higher.

(Source)

A rally to $5,000 is expected, but this will represent a 40% upside from spot rates. If DOT continues its uptrend, any rise to $55 will represent a nearly 500% upside, a higher return on investment for those entering at near or lower spot rates.

EXPLORE: Yield optimization goes viral: Sperax crypto explodes but what is Sperax?

Join the 99Bitcoins News Discord here for the latest market update

The article Is it better to buy Polkadot at $8 than go all-in on Ethereum at $3,500? appeared first on .

(@Toni_Bitcoin)

(@Toni_Bitcoin)