- The Binance exchange has seen strong growth in stablecoin flows, contributing to its market dominance.

- A summary of BSC network activity and BNB price action is also worth highlighting.

Binance’s dominance is becoming more apparent and influential as the market continues to heat up. In fact, recent reports suggest that the crypto exchange has recently noted an increase in stablecoins and therefore liquidity.

According to a recent analysis by CryptoQuant, Binance currently controls approximately 67% of the total stablecoin reserves held across all exchanges. In other words, it is the most liquid exchange. This is therefore what has the greatest impact on flows towards cryptocurrencies.

Binance has reportedly seen over $22 billion in stablecoin inflows so far in 2024. This makes it the main driver of crypto demand this year. Additionally, this technically allowed Binance to secure more transaction activity and should result in more revenue.

Binance Smart Chain Network Activity Summary

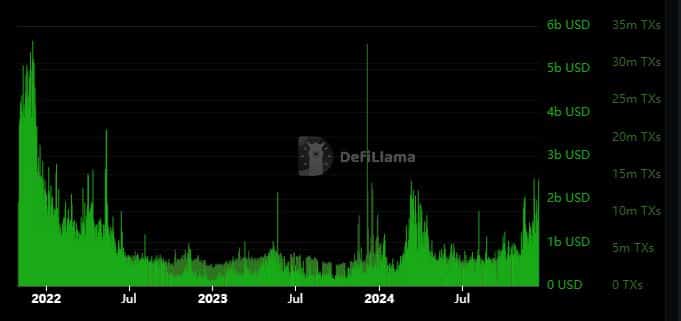

According to DeFiLlama, the stablecoin market cap on the Binance Smart Chain (BSC) increased significantly in 2024. The lowest stablecoin market cap recorded during the year was $32.71 million on January 21.

This is due to a short-lived decline, which quickly climbed back above $4 billion.

Source: DeFiLlama

The BSC stablecoin market capitalization has increased significantly over the past 3 months. It rebounded from around $5.01 billion in early November to $6.60 billion on December 13. However, it should be noted here that this is primarily about the liquidity of the network and not the exchange itself.

BSC volumes have also improved significantly so far in the fourth quarter. Volume peaked at $2.43 billion in the past 24 hours, marking the second time this month it has surpassed the $2 billion mark.

Source: DeFiLlama

Despite the recent increase, volume was far from the all-time high levels seen during the height of the bull market in 2021. Meanwhile, the number of transactions also increased from 3 million daily transactions in September to more than 5 million transactions.

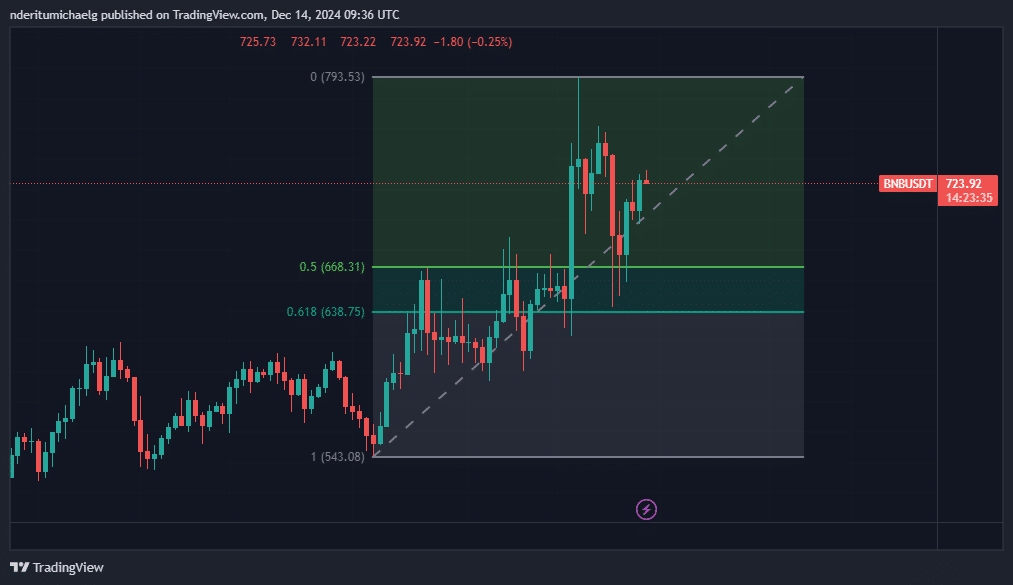

BNB Price Summary

BNB has arguably benefited immensely from 2024 bullish activity, judging by its uptrend. On the shortest time frames, BNB started this week on a bearish trend, characterized by a sharp decline compared to its recent ATH.

The pullback saw the price drop as low as $642. However, this also resulted in a retracement into a key Fibonacci retracement zone and the price has since rebounded above $700. The altcoin was valued at $723.91 at the time of writing.

Source: TradingView

The retracement dashed hopes of a price surpassing $800. However, the altcoin’s recent recovery in the second half suggests that the price could still exceed this target before the end of the month.