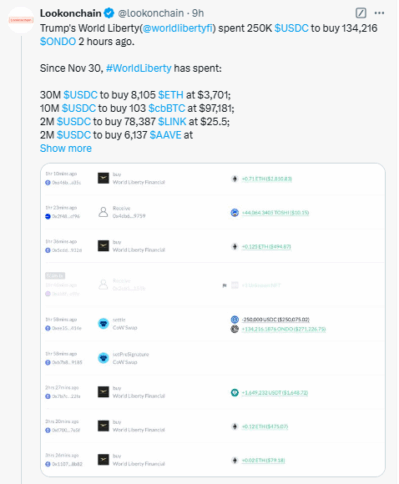

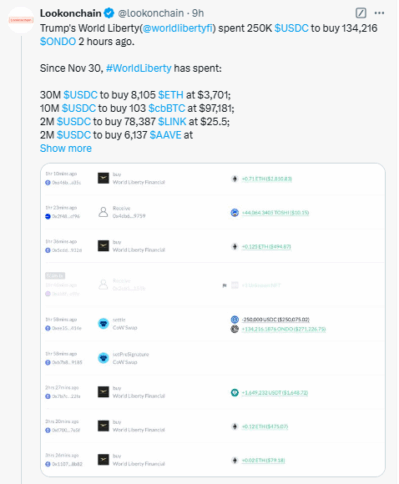

World Liberty Financial, the crypto project backed by Donald Trump and his family, saw a major buying spree in December. The project has spent almost $45 million on various cryptocurrencies including Ether (ETH), Coinbase Wrapped Bitcoin (cbBTC), Chainlink (LINK) and others.

The latest purchase, made on December 15, saw World Liberty purchase $250,000 worth of Ondo (ONDO), a token connected to decentralized finance (DeFi). This followed a $500,000 purchase of Ethena (ENA) a day earlier.

Breakdown of project purchasing activity

- $30 million in Ether (ETH)

- $10 million in Bitcoin wrapped in Coinbase (cbBTC)

- $2 million in Chainlink (LINK)

- $2 million in Aave (AAVE)

- $500,000 in Ethena (ENA)

- $250,000 in Ondo (ONDO)

This brings their total spending for December to $44.75 million.

What is World Liberty Financial?

World Liberty’s token sales didn’t go exactly as planned. The project has struggled to sell its $300 million World Liberty Financial (WLFI) token, selling less than 25% so far. However, things changed when Justin Sun, the founder of the Tron blockchain, purchased $30 million worth of WLFI tokens, becoming the project’s largest investor and advisor.

AaveDAO Collaboration

In addition to its token purchases, World Liberty made headlines in the DeFi community on December 13, when the autonomous group behind the Aave protocol, AaveDAO, approved a proposal from World Liberty.

The proposal allows World Liberty to launch its version of the Aave protocol to lend and borrow digital assets like Ether, Wrapped Bitcoin, and stablecoins like USDC and USDT.

Why this buying frenzy?

According to Nansen researcher Nicolai Søndergaard, World Liberty’s buying spree could be a strategy to gain credibility in the crypto world. By investing heavily in well-known assets like Ether and Aave, the project could seek to build confidence and attract more investors as the market responds to the rising value of these assets.

Growing Popularity of Cow Protocol

In addition to the buying frenzy, World Liberty’s purchases through the Cow Protocol also influenced the market.

Cow Protocol’s token price surged nearly 50%, currently valued at $0.9373, following the Trump family’s purchases, growing to $270 million in market cap and 24-hour trading volume amounting to $467.48 million, a staggering 745% increase.

Also read: Donald Trump plans to ‘do something big with crypto’