Bitcoin mining giants Marathon Digital Holdings and Hut 8 have capitalized on Bitcoin’s recent correction by investing several billion dollars in the flagship cryptocurrency.

On December 19, the companies announced purchases totaling more than 16,000 BTC for $1.6 billion, equivalent to 37 days of Bitcoin issuance.

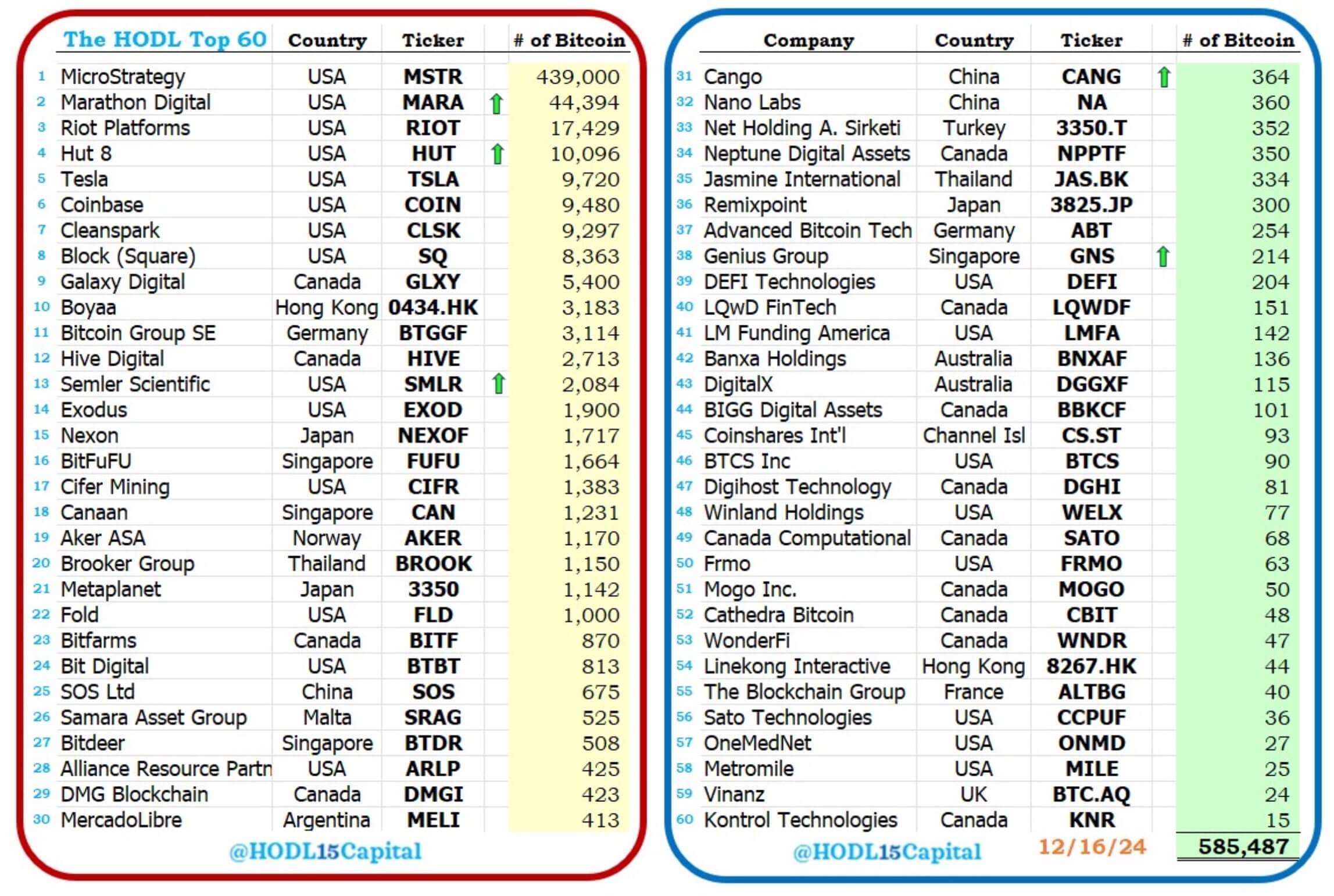

Marathon led the way by purchasing 15,574 BTC at an average price of $98,529 per coin, investing approximately $1.53 billion. This addition brought the company’s Bitcoin holdings to 44,394 BTC, worth $4.45 billion at the current spot price of $100,151.

Marathon is the second largest publicly traded Bitcoin holder, behind MicroStrategy, which holds 439,000 BTC.

Meanwhile, Hut 8 acquired 990 BTC for $100 million, paying an average of $101,710 per Bitcoin. This transaction brought Hut 8’s total Bitcoin reserves to 10,096 BTC. The company now holds more Bitcoin than Tesla and is the fourth public company to hold more than 10,000 Bitcoin on its balance sheet.

These investments followed a sharp market decline caused by a rate adjustment by the US Federal Reserve. Bitcoin’s value fell more than 5%, hitting a low of $96,781 before recovering to $98,750, according to CryptoSlate data.