- AAVE price rose 18% in the last 24 hours.

- Selling pressure on the token increased, hinting at a slight price correction.

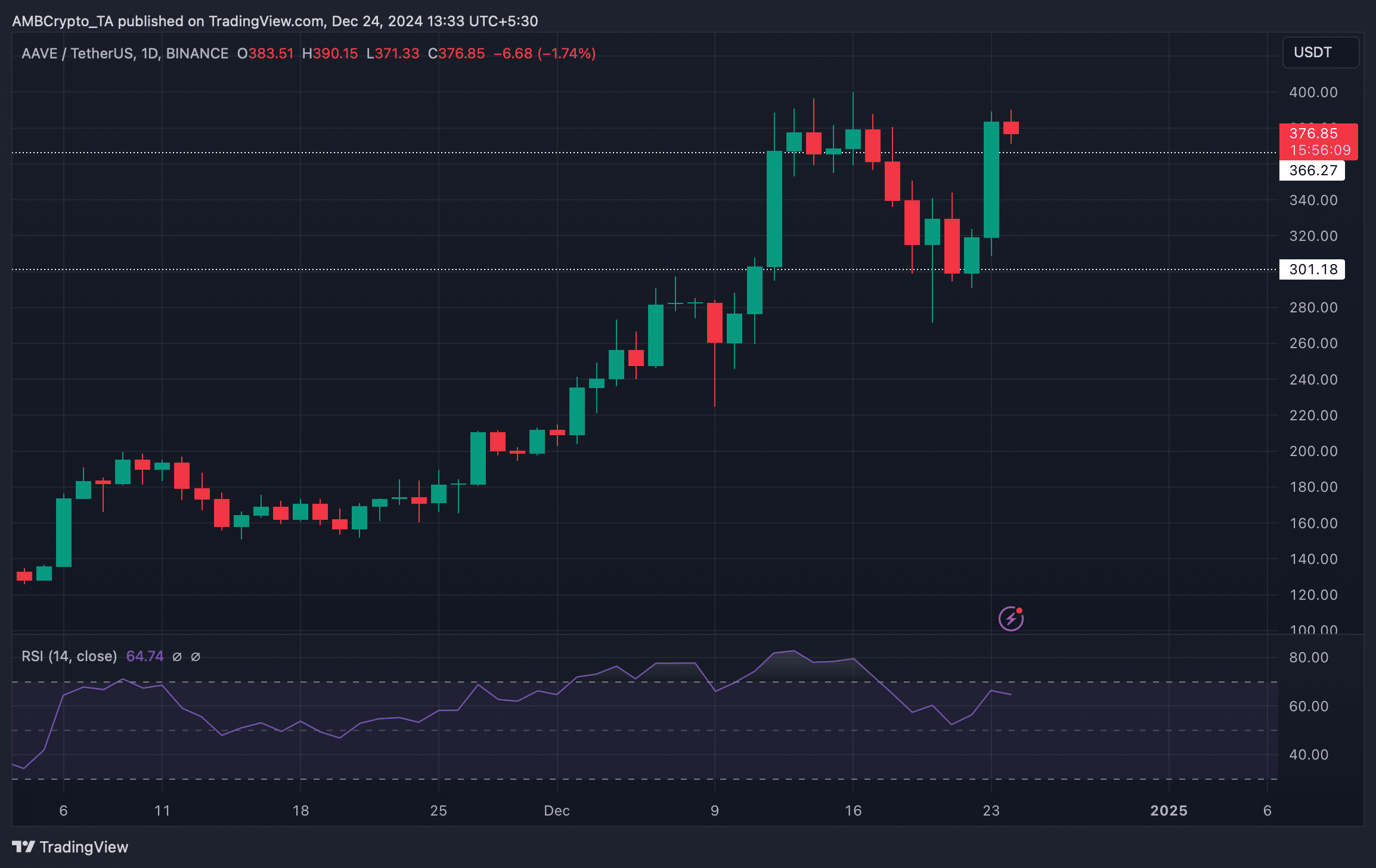

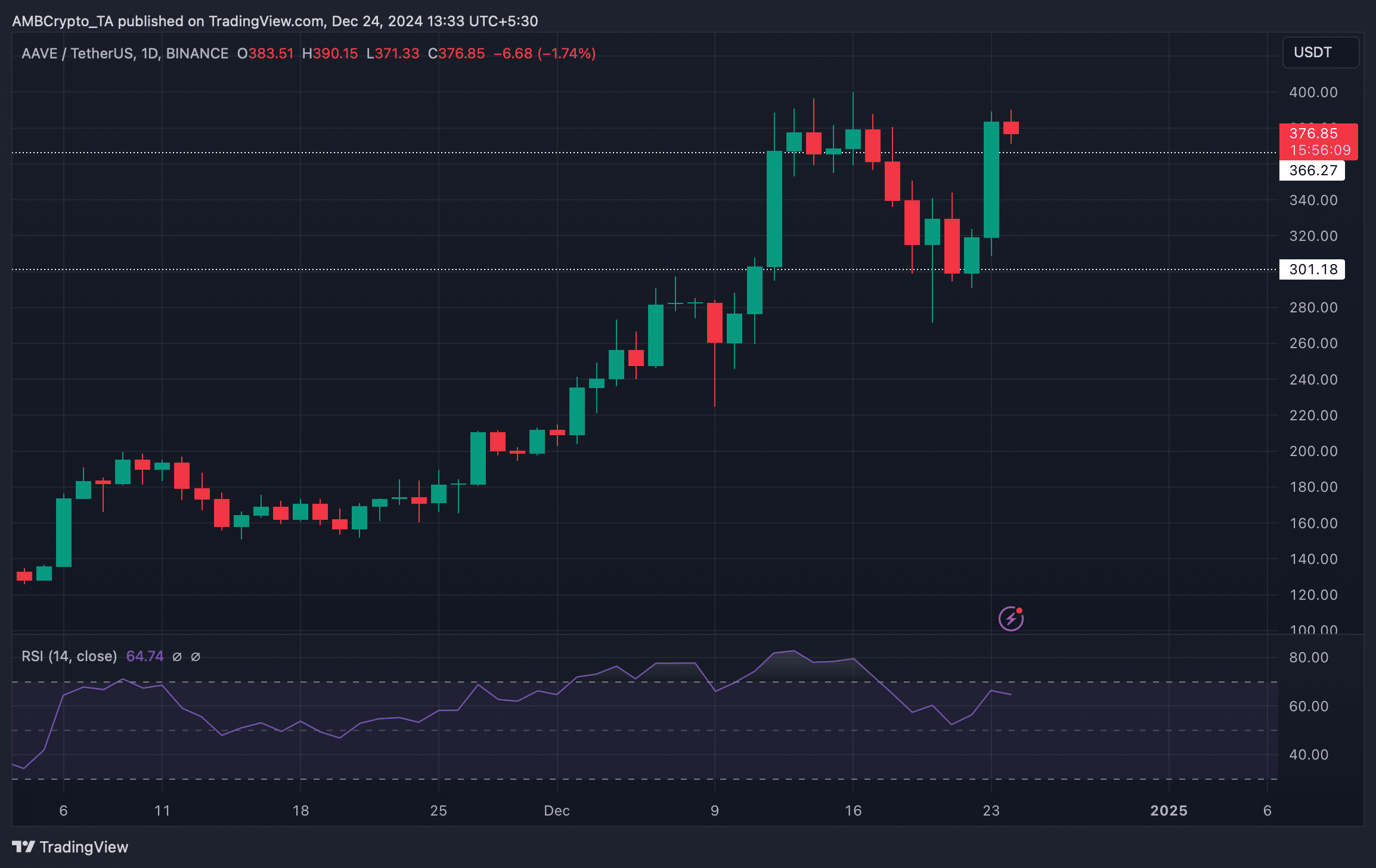

AAVE has shown tremendous performance over the past 24 hours with double-digit price increases. This recent uptrend could push the token above $400, as predicted by a popular analyst.

Therefore, AMBCrypto has evaluated its metrics to find out if the path forward is clear.

AAVE bulls are on the move

AAVE decoupled from major cryptos as it saw an 18% price rise in the last 24 hours alone. At press time, it was trading at $378 with a market cap of over $5.6 billion.

Ali Martinez, a popular crypto analyst, published a tweet this suggested similar growth if a condition was met. According to the tweet, an Adam and Eve pattern was forming on the token’s chart. In case of a successful breakout above the $342 resistance zone, the token could cross $400 soon.

To be specific, Martinez mentioned that a breakout could lead to a 19% price increase. Fortunately, the token managed a breakthrough and at press time was heading towards the $400 mark.

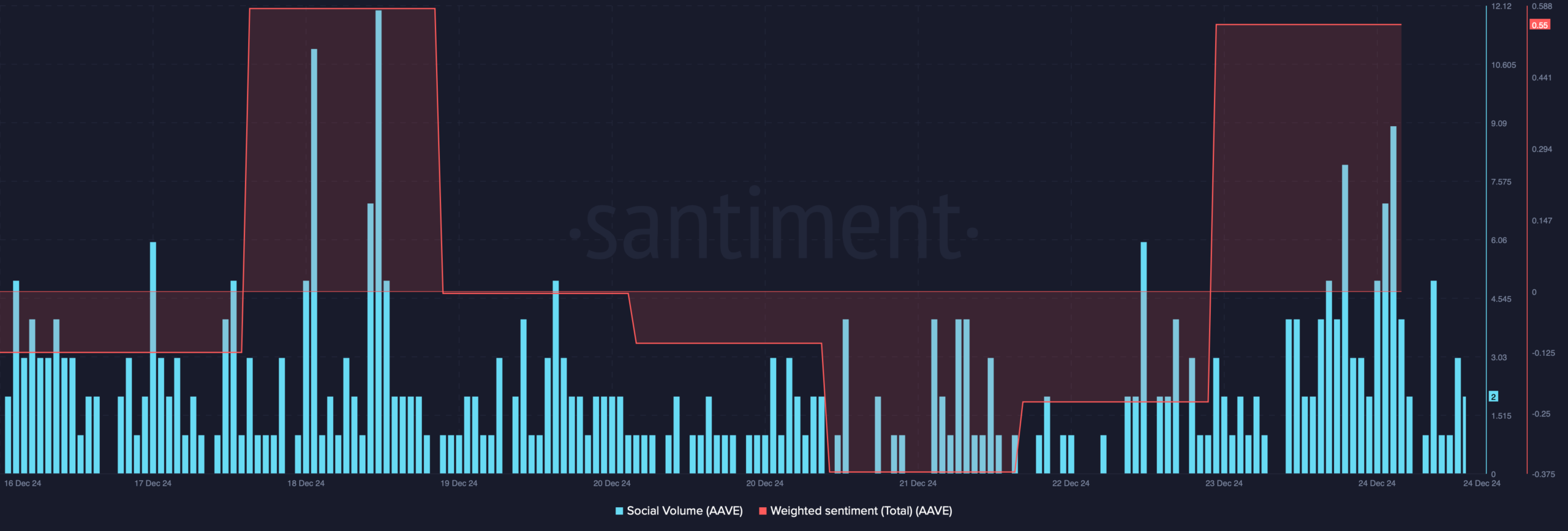

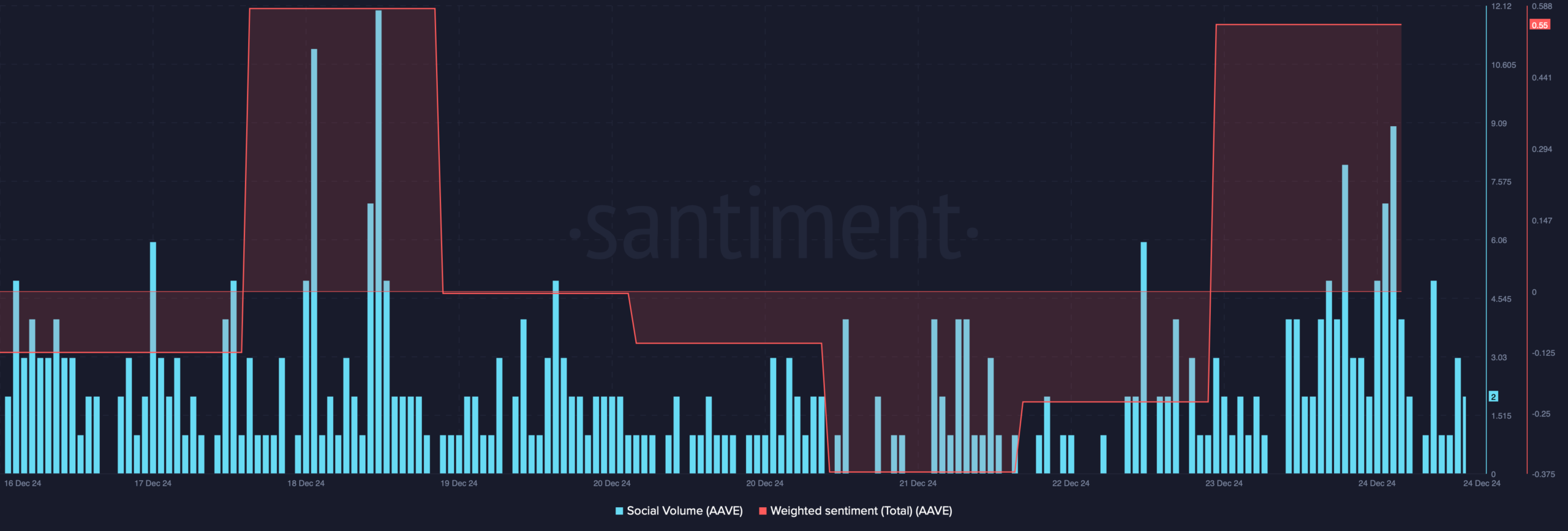

This recent price increase has also had a positive impact on the token’s social metrics. For example, its weighted sentiment entered the positive zone, meaning that the bullish sentiment around AAVE was on the rise.

Its social volume has also increased, a clear sign of the coin’s popularity in the crypto market.

Source: Santiment

Chances AAVE will keep the pump going

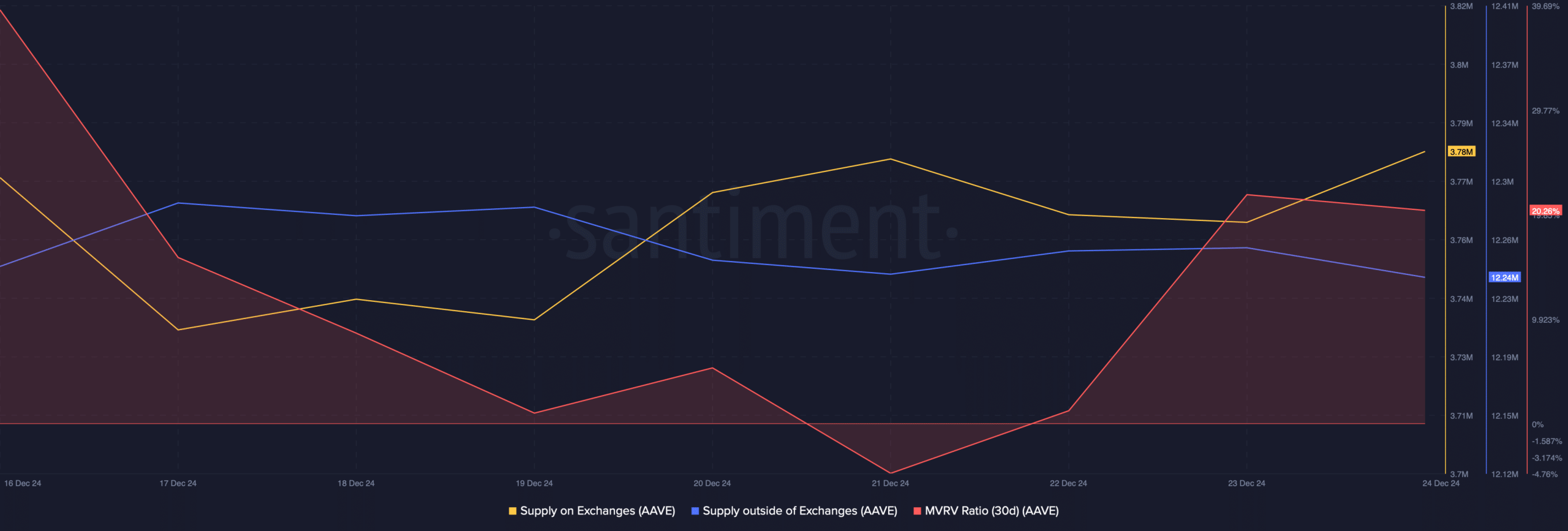

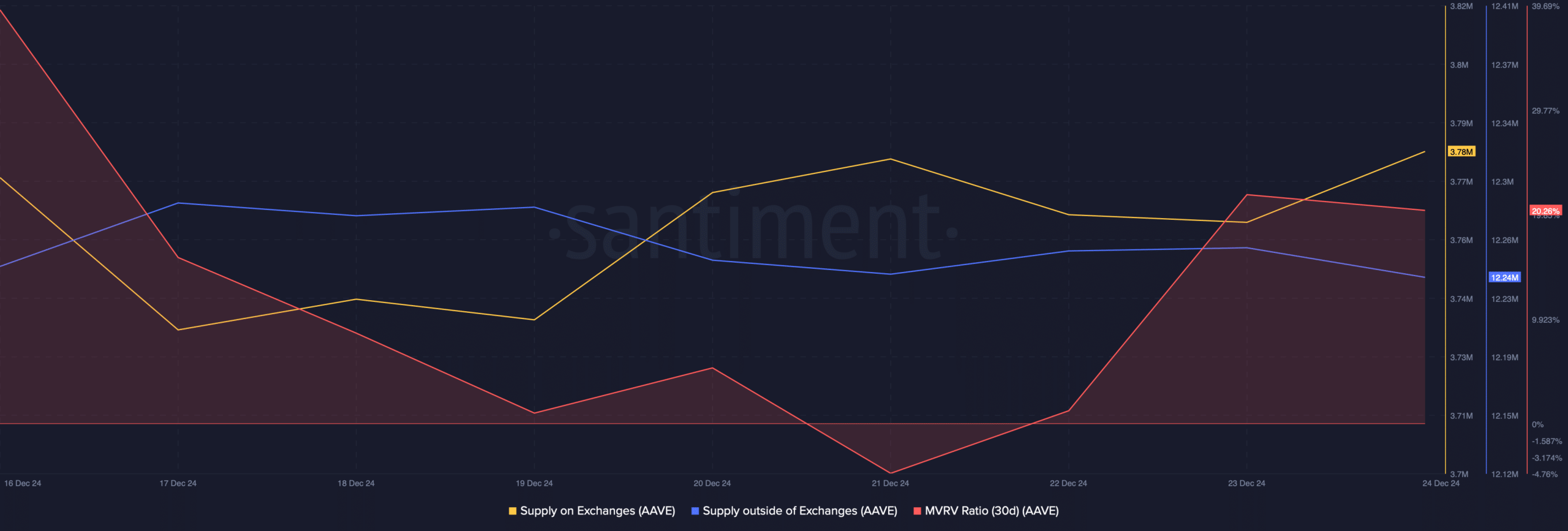

AMBrypto then looked at the token’s on-chain data to see if this uptrend would continue. According to the analysis, selling pressure appears to have increased in the recent past.

AAVE’s supply on exchanges has increased, while its supply outside of exchanges has decreased. Whenever this happens in the middle of a bull rally, it indicates that investors are cashing out for profits, often leading to price corrections.

Another bearish metric was the MVRV ratio, as it fell slightly after posting a promising rise on December 23.

Source: Santiment

Similar to the aforementioned measurements, Coinglass’ data revealed that there are more short positions in the market than long positions as the token’s long/short ratio (4 hours) has decreased over the past 24 hours.

Read Aave (AAVE) Price Prediction 2024-25

If a price correction occurs, then it will be crucial for AAVE to test its support at $366 in order to restart a rally towards $400 in the coming days.

But if the token breaks below the support, its price could drop again to $301.

Source: TradingView