- HYPE is currently trading in a descending channel, with further downside potential depending on how it reacts to its current level.

- Key indicators and Total Value Locked (TVL) remain bearish. However, the RSI is gradually suggesting that the selling pressure may be easing.

Hyperliquid (HYPE) ranks among the top losers in the market, down 16.57% in the last 24 hours. This drop reduced his monthly gains to 64.93%.

How the token performs at its current price level will determine whether it experiences a significant rally or faces further losses as market sentiment weakens.

Will HYPE relate positively to this model?

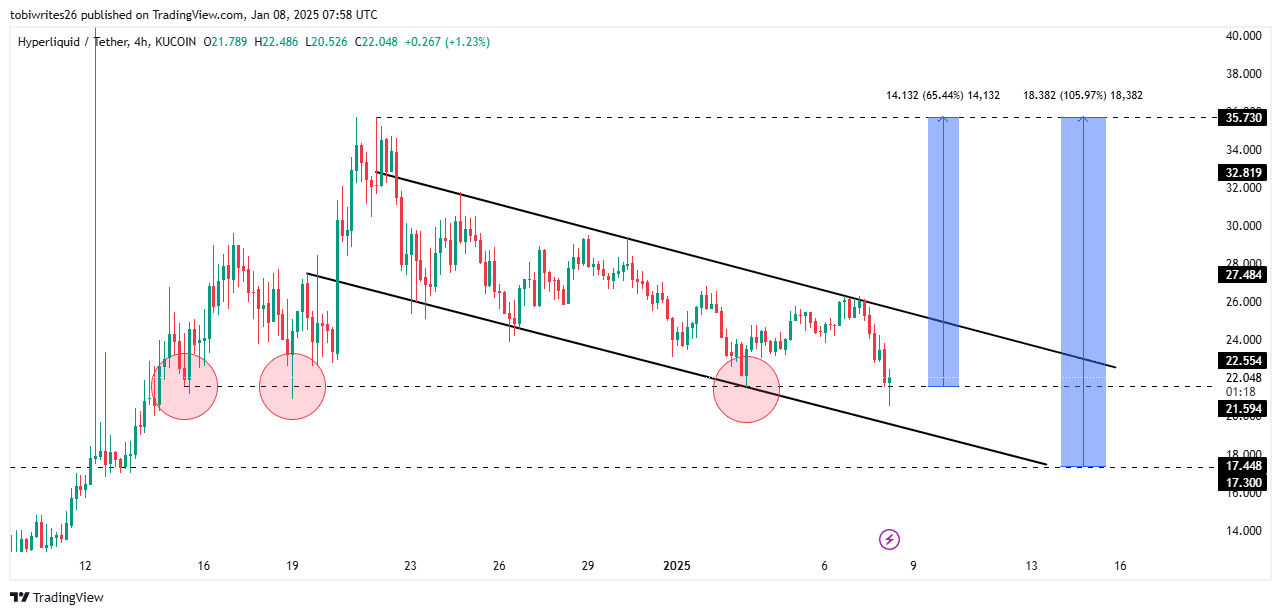

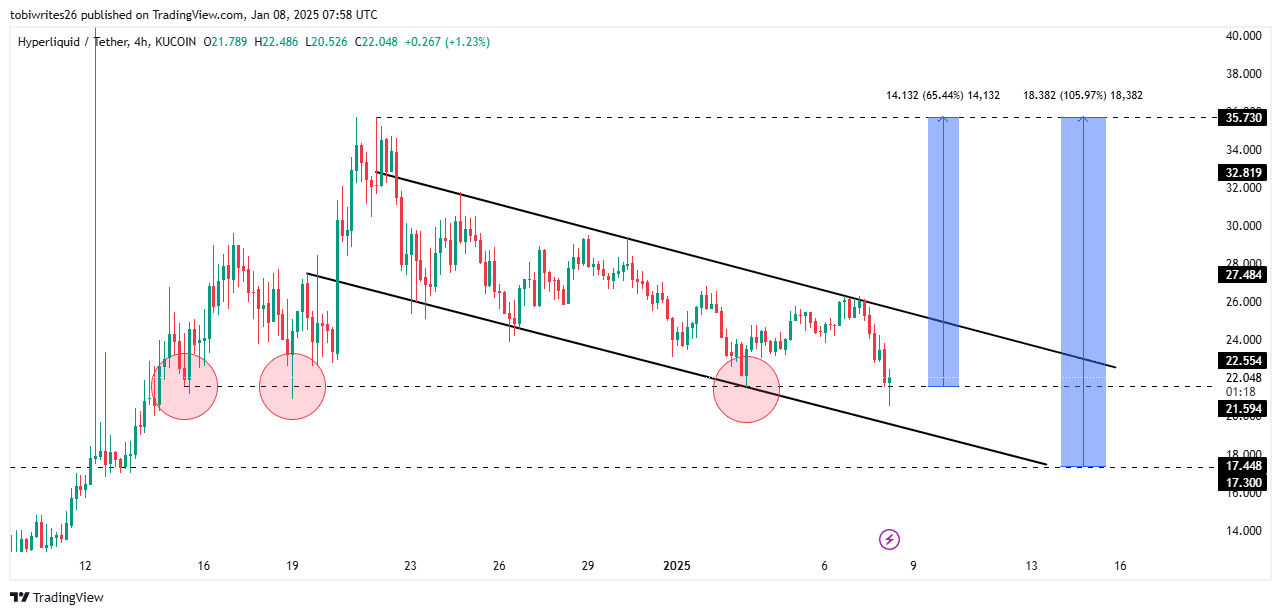

Technical analysis of the 4-hour chart of HYPE reveals that the asset is trading in a descending channel, characterized by lower highs and lower lows. Investors continue to accumulate in anticipation of an upward move.

A bullish breakout of this pattern occurs when price crosses the upper resistance line of the channel, potentially reaching its high of $35.7.

At the time of writing, HYPE is trading within a support zone at $21.59, which has already acted as a bullish catalyst three times. If this support provides the required momentum, HYPE could rebound and gain 65.44%, reaching the mentioned high.

Source: TradingView

However, if the support level at $21.59 is breached, HYPE could fall to the next support at $17.30. This level could act as a catalyst for a final push higher, potentially resulting in a 105.97% gain.

Mixed market signals

Currently, an analysis of technical indicators reveals mixed market sentiment, reflected by trader activity close to the support level.

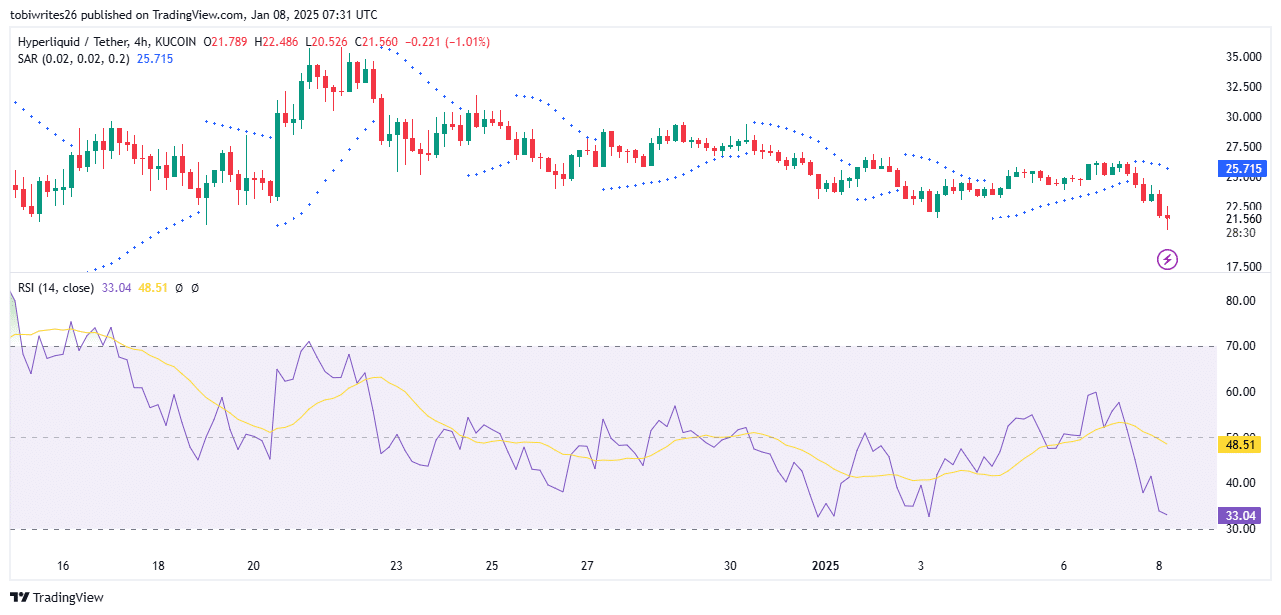

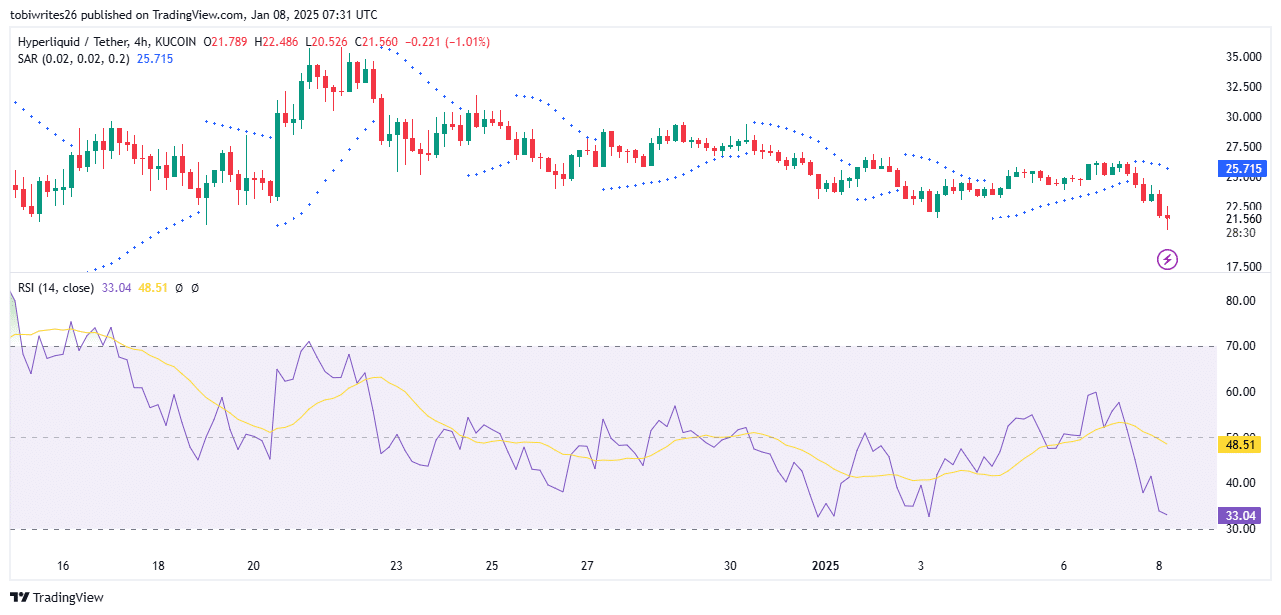

The Parabolic SAR (Stop and Reverse), which identifies trend directions and reversals through points placed above or below price movements, is currently showing points above HYPE.

Points above the price suggest bearish market sentiment for HYPE, indicating that it could fall further from its current zone.

Source: TradingView

Meanwhile, the Relative Strength Index (RSI), another technical indicator, measures the speed and magnitude of price changes to identify overbought or oversold conditions.

At the time of writing, the RSI stood at 33.04, indicating increasing selling pressure as it approaches the oversold region. The RSI was heading towards the oversold region (below 30), suggesting that selling pressure may ease at this level.

If HYPE falls below the 30 mark, it could rebound and begin a recovery. However, HYPE could reverse its trend from the current level without going below 30.

Cash outflow hits HYPE

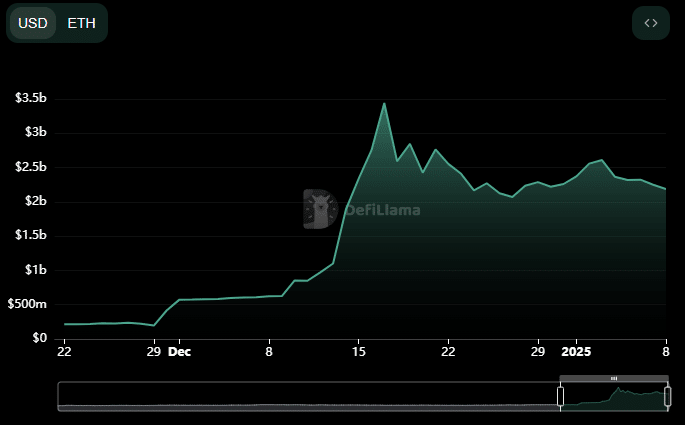

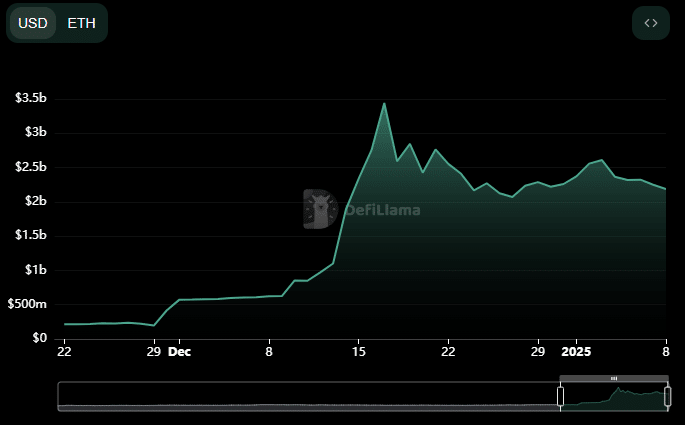

HYPE saw significant cash outflows as its TVL fell to $1.553 billion, a level last seen on December 14. This follows a peak of $2.244 billion on January 2.

Source: DeFiLlama

Read Hyperliquid (HYPE) Price Forecast 2025-2026

Cash outflows in TVL indicate declining interest, which often negatively impacts the price of HYPE and could lead to further declines.

If liquidity outflows persist, HYPE could continue to decline from its current level, or even fall to even lower levels.