- Solana price remained stable above the $180 support level on Thursday as downward volatility in the crypto market intensified.

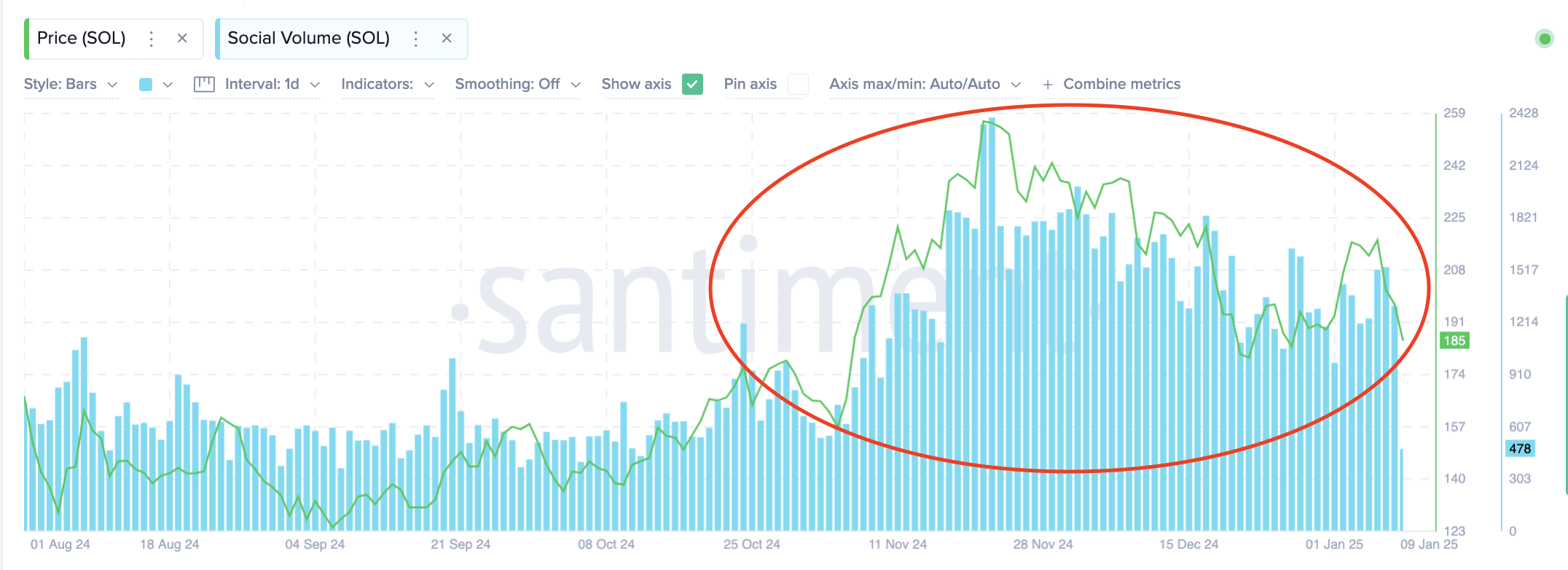

- On-chain data shows that social media discourse around Solana has been increasing since October 2024.

- Technical indicators suggest that a failure to close below $190 could allow bulls to regain control of SOL price momentum in the near term.

Solana’s price narrowly avoided a drop below $185 on Thursday, as the crypto market collapsed under fears of a looming $6.5 billion Bitcoin sale by the US government.

Solana Price Stabilizes at $185 After 15% Losses in 2 Days

Solana’s price saw a sharp 15% decline in two days as the broader cryptocurrency market faced increased volatility. The crash, which wiped $320 billion from the total market capitalization, left investors reeling from global macroeconomic uncertainties and fears of an impending Bitcoin sell-off for the United States government.

The sharp SOL price correction follows widespread expectations that the U.S. Federal Reserve (Fed) will take a hawkish stance in the first quarter of 2025, leading to fears of reduced liquidity in crypto markets.

Solana Price Action | SOLUSDT (Binance)

Solana Price Action | SOLUSDT (Binance)

In addition to bearish sentiment, regulatory concerns have emerged in South Korea, where authorities announced investigations into DeFi platforms linked to Solana following allegations of market manipulation.

Despite the sell-off, Solana price appears to find support at the $185 level, marking a key technical and psychological zone for traders.

Although Solana remains under pressure, if the bulls hold on for a close above $185, it could pave the way for a potential early recovery.

Solana Continues to Dominate Investors’ Minds Amid Market Volatility Trends

After a sharp price drop of 15% over the past two days, Solana continues to attract investors’ attention.

As macroeconomic uncertainties weigh heavily on the broader crypto market, Solana’s measure of growing social dominance on-chain suggests the project is gaining long-term traction among traders and enthusiasts.

Social dominance measures the share of total mentions a cryptocurrency garners on major platforms like Telegram, Reddit, and X (formerly Twitter), compared to the top 50 projects.

Social dominance of Solana | Source: Santiment

Social dominance of Solana | Source: Santiment

According to Santiment data, Solana’s social dominance has continued to trend at unusually high levels, despite the recent price pullback.

The chart reveals a 30% increase in Solana-related social activity since October 2024.

Solana’s growing popularity appears to be driven by the advent of the “Crypto AI Agent” narrative.

Popular AI-focused memecoin projects like Pudgy Penguins and Ai16z have attracted massive investor interest, propelling their valuations to billion-dollar unicorn status within weeks of their launch.

As traders remain cautious amid uncertain macroeconomic backdrop, strengthening social measures strengthen SOL’s position as one of the crypto assets to watch as overall market sentiment improves.

Solana Price Forecast: $200 Breakout Could Return Bulls In Control

Solana’s recent 15% decline has brought the price to a key support zone around $183 to $190 as market sentiment fluctuates.

The formation of a potential double bottom pattern on the daily chart, coupled with rising trading volumes, suggests the possibility of a rebound.

Historically, such trends indicate a reversal, supported by higher volumes, a sign of strong buyer interest.

However, failure to maintain this level could open the door to further bearish momentum.

Solana Price Prediction

Solana Price Prediction

The Bollinger Bands show Solana price approaching the lower boundary, typically an area where prices consolidate or rebound.

If the price manages to close above $190, the mid-band at $196.86 could serve as near-term resistance.

On the contrary, the Squeeze Momentum indicator highlights a decrease in bullish momentum, turning into a bearish squeeze.

This suggests a potential consolidation or continuation of the downtrend unless volumes increase decisively.

In this case, an extended break below $183 would expose Solana to the lower Bollinger band around $173, signaling prolonged selling pressure.

In the short term, strategic Solana traders could watch $190 as a critical pivot point, where a bounce could reestablish bullish dominance.