- ai16z was unable to reclaim the $1.8 area as support

- A rejection from $1.72 would likely take the price to $1.18 and likely below $1 as well.

ai16z (AI16Z) is one of the largest artificial intelligence (AI) agent tokens on the market today. However, lately the sector has also been one of the hardest hit by Bitcoin’s recent losses, which forced the rest of the crypto market to fall.

Sentiment behind AI16Z in the short term appeared firmly bearish at press time. A decline below the $1 support also seems likely.

Price action highlights bearish intent

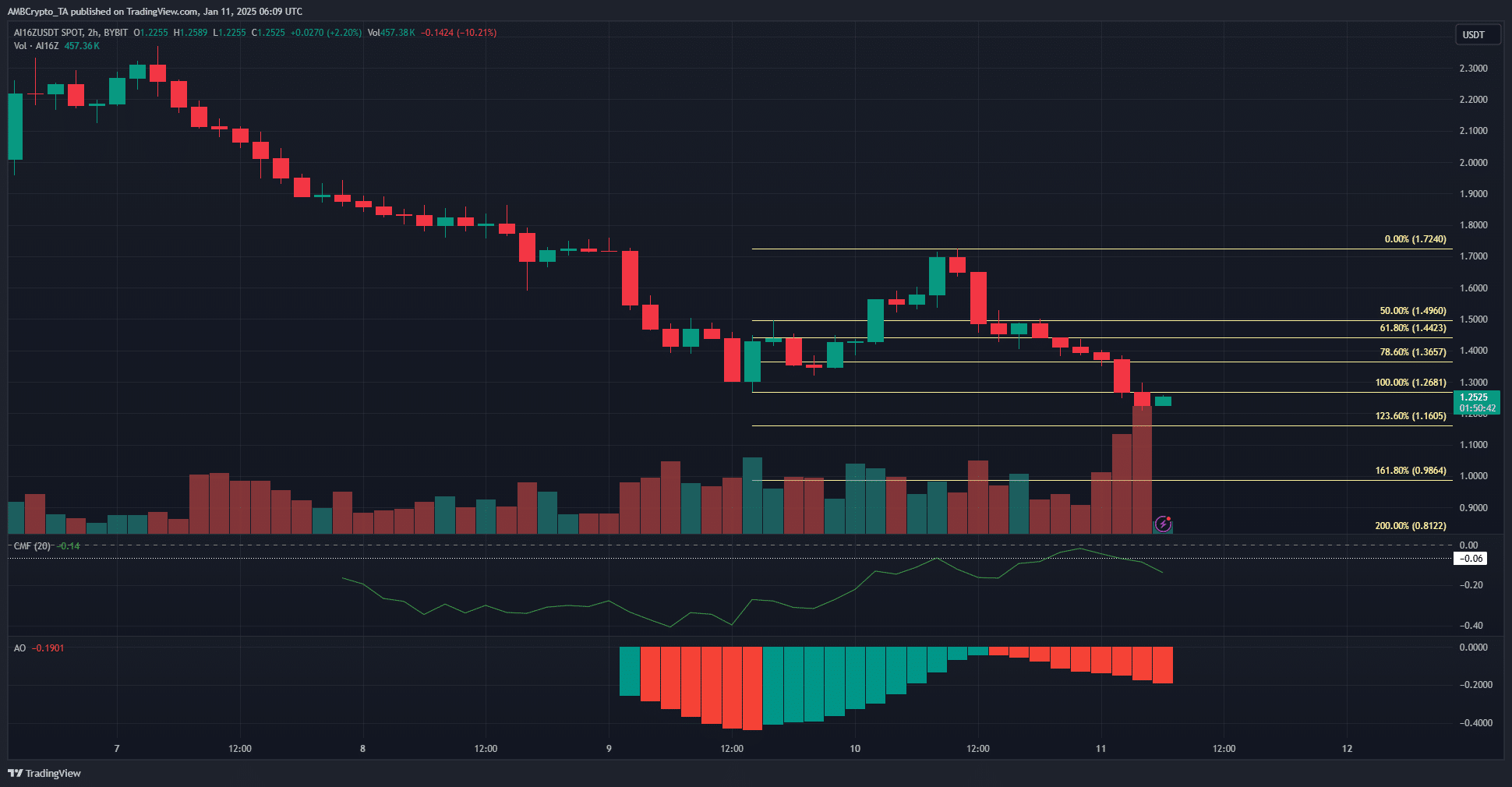

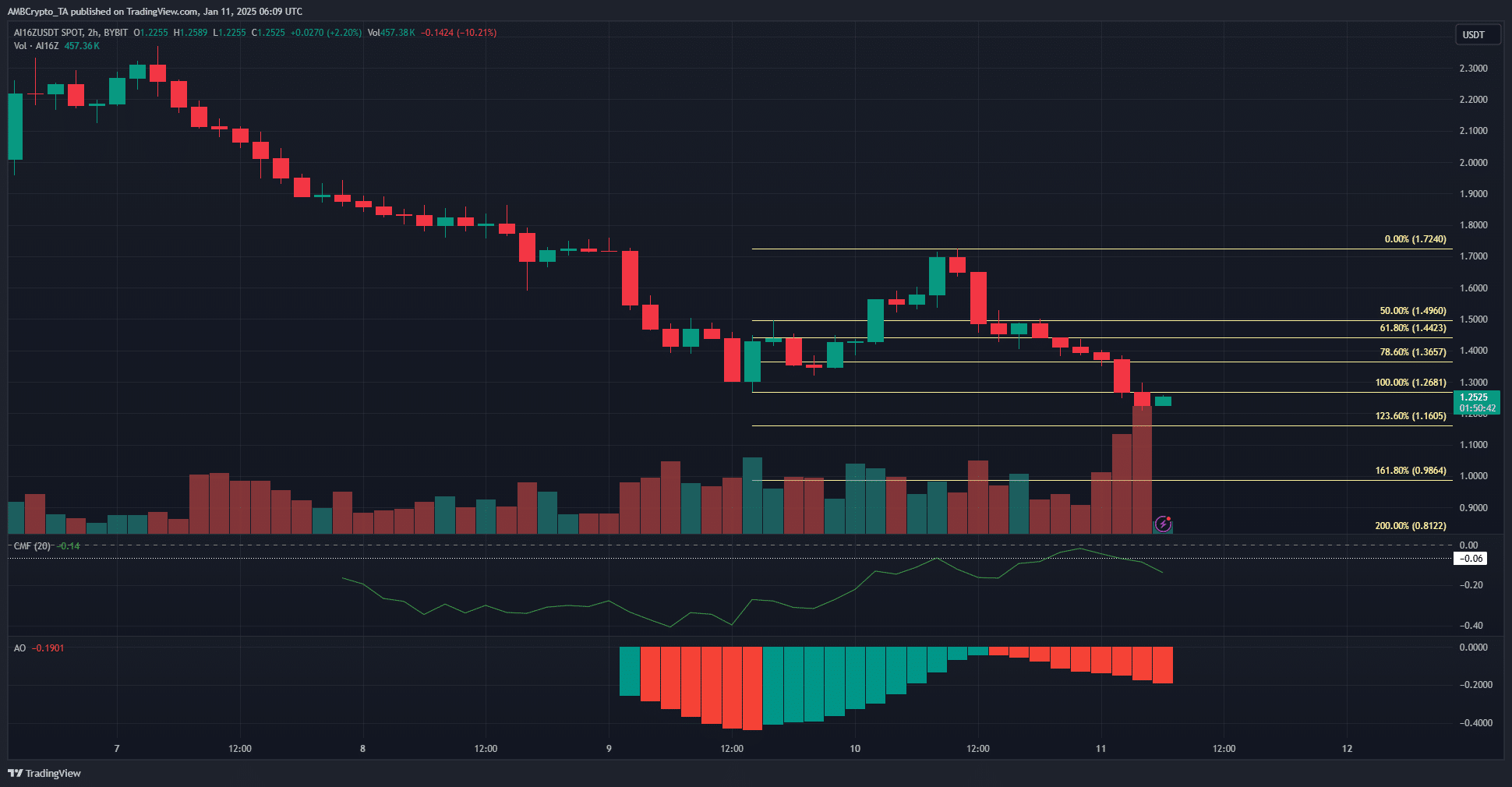

Source: AI16Z/USDT on TradingView

The 2-hour mark for the AI token showed a strong short-term bearish bias. The market structure over the chosen period was bearish. Additionally, the price action reached a new low below $1.26, reinforcing the dominance of sellers.

Before the new low was reached, a rebound to $1.72 was seen earlier this month. Using this bounce, a set of Fibonacci levels and extensions were plotted. They revealed that to the south, the next targets are $1.16 and $0.98.

The CMF has remained below -0.05 for most of the past three days, indicating strong selling pressure and a significant flow of capital out of the market. The Awesome Oscillator was also below zero, signaling intense selling pressure.

Liquidation Heatmap Indicates Rebound Potential

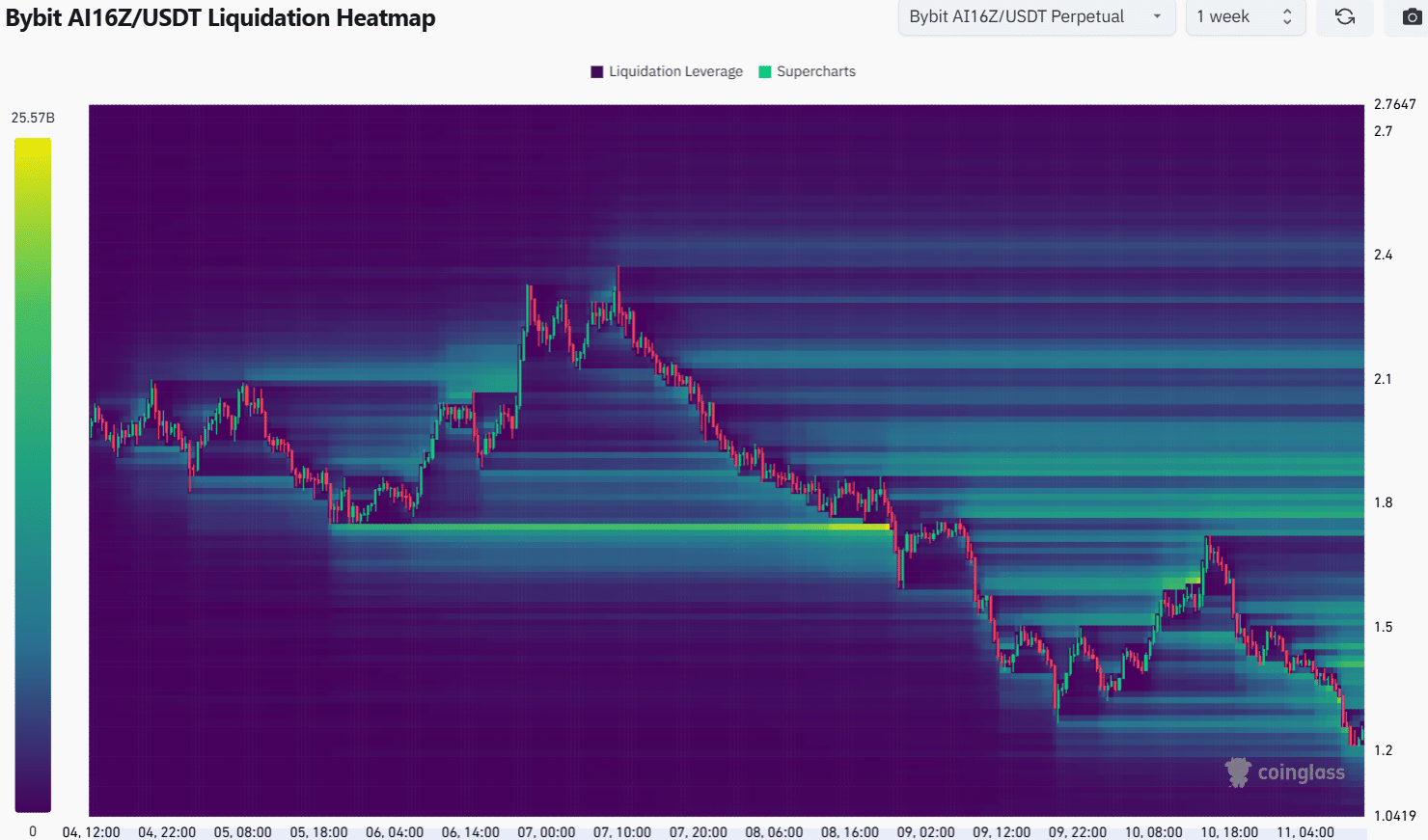

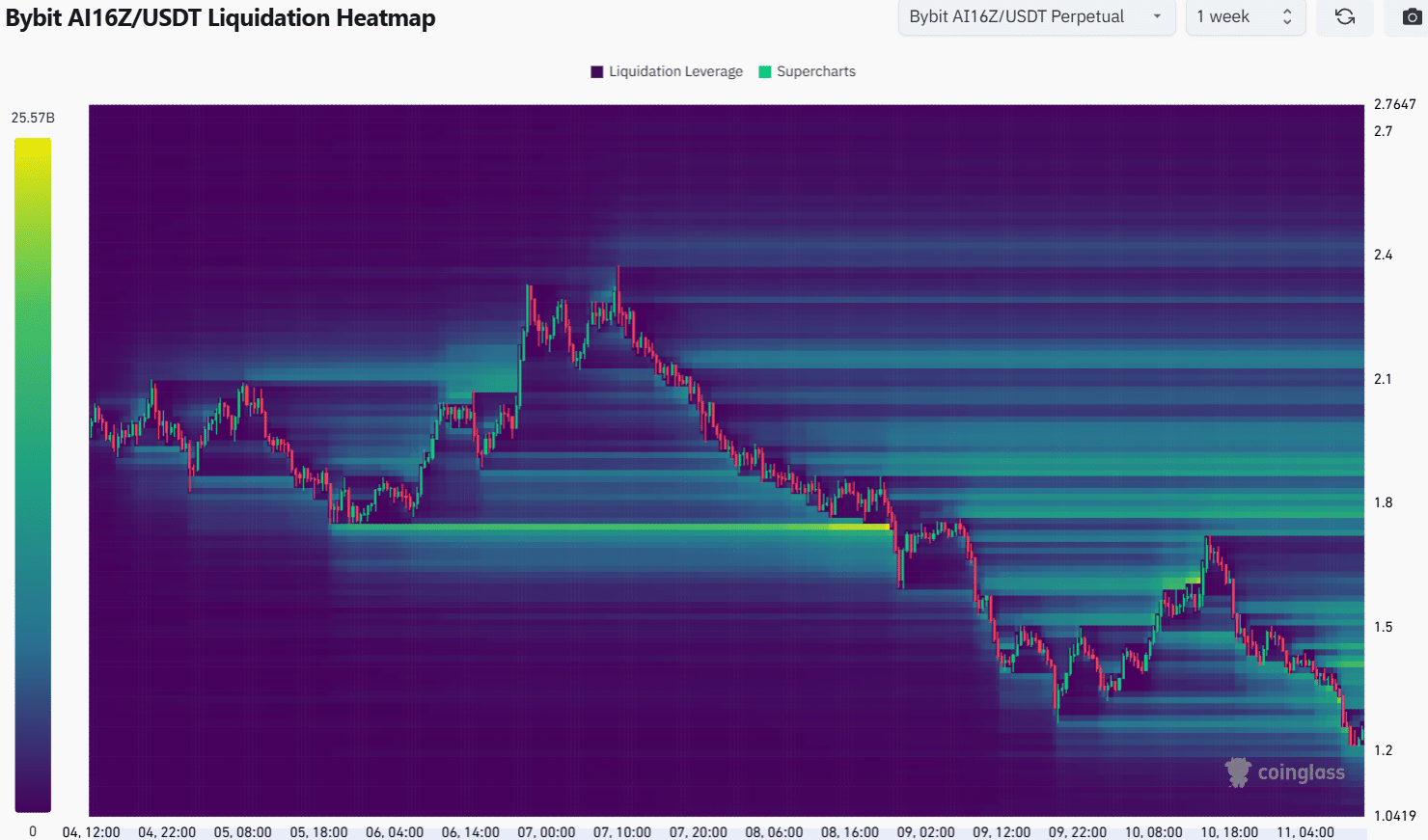

Source: Coinglass

Last week’s AI16Z liquidation heatmap highlighted the $1.4 and $1.18 levels as the closest magnetic zones. The $1.18 level was closer to the market price at press time and, more likely, the near-term target.

Realistic or not, here is the market capitalization of AI16Z in terms of BTC

This matches well with the bearish signals from the technical analysis of the 2-hour time frame. In the event of a BTC price rebound, ai16z could face a bearish reversal to the $1.4-$1.5 region. Exceeding this level would not necessarily constitute a strong bullish signal. The high below $1.72 must be crossed to reverse the structure bullishly.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.