The past few days have been tough for Ethereum investors, as the altcoin leader began 2025 with a steep 15% decline from local highs, plunging toward lower demand levels. This sell-off reflects the volatility of the market as a whole, leaving many wondering about the strength of ETH’s recovery potential. Despite a rocky start, ETH fundamentals continue to show resilience, providing optimism for long-term holders.

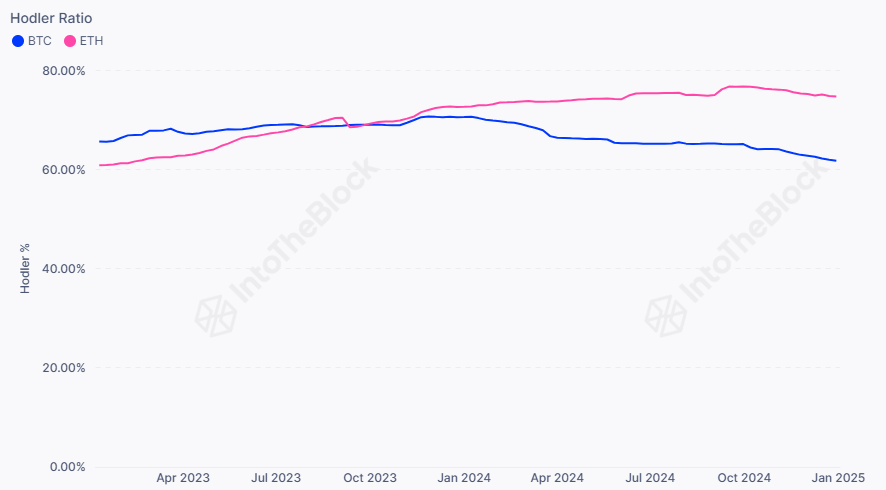

Key insights from blockchain analytics firm IntoTheBlock highlight Ethereum’s strong foundation. According to their data, 74.7% of ETH addresses are now classified as long-term holders, far surpassing Bitcoin in this measure. This milestone highlights the growing trust in the Ethereum ecosystem and its role as a cornerstone of decentralized finance and blockchain innovation.

Market sentiment remains cautious, but Ethereum fundamentals paint a different picture. With long-term holders dominating the network, attention is now shifting to its potential for recovery and sustained growth in 2025. Will ETH regain its position as the market leader, or will the downtrend persist- she? Investors remain optimistic as Ethereum’s strength as a long-term asset continues to shine despite the turbulence.

Ethereum at a crucial crossroads: can 2025 be its year?

Ethereum finds itself at a defining moment, as investors and analysts expect 2025 to be a breakthrough year for the altcoin leader. Although many altcoins are underperforming, largely influenced by ETH’s disappointing price action, ETH’s fundamentals remain strong. The market is closely watching ETH, in hopes that it will set the tone for an altcoin resurgence.

IntoTheBlock recently shared compelling data on X, revealing that 74.7% of ETH addresses are now long-term holders. This figure far exceeds that of Bitcoin and highlights growing confidence in Ethereum’s long-term potential.

This trend is likely to persist until ETH approaches its all-time high, at which point profit-taking activities could begin. For many, the question is not if ETH will recover its ATH, but rather when. Analysts agree that this step seems inevitable, even if the path to get there remains uncertain.

Despite this optimism, risks remain. The current downtrend suggests that lower prices could be tested before the next bullish leg begins. This could be a temporary setback, as many view any decline as a buying opportunity to capitalize on Ethereum’s long-term strength. Investors and analysts are united in their anticipation, waiting for ETH to break out and lead the market into a new phase of growth.

Price Update: Testing Key Levels Amid Selling Pressure

Ethereum is currently trading at $3,300 after dropping to $3,150, marking a new local low. Despite the recent bearish momentum, ETH has managed to hold above this critical level, providing a glimmer of hope for investors looking for a reversal. However, progress is far from assured, as selling pressure continues to weigh on the altcoin leader.

The $3,000 mark appears to be a crucial psychological and technical level for Ethereum. If the price holds above this zone, it could trigger strong demand and potentially shift the prevailing bearish sentiment. This would signal a significant level of support, attracting both institutional and retail investors looking to profit from falling prices. Conversely, failing to maintain this level could open the door to further declines, with ETH potentially testing even lower demand zones.

The next few days will be crucial for Ethereum as it attempts to recover from recent losses. A sustained push above $3,300 could provide the momentum needed to retest higher resistance levels. However, the market remains uncertain and ETH will need strong buying interest to break free from its bearish grip and reestablish its upward trajectory. Investors should closely monitor key levels as the battle between the bulls and bears continues.

Featured image of Dall-E, chart by TradingView