According to experts, the convergence of decentralized finance (DeFi) and artificial intelligence (AI) is poised to redefine the cryptocurrency market in 2025. Called DeFAI, this emerging sector is already making waves, with platforms for leading companies like CoinGecko and CoinMarketCap dedicating entire sections to tracking its growth.

Industry experts predict that DeFAI will address DeFi’s long-standing challenges, making it the leading narrative in the crypto market next year.

Experts Say DeFAI Market Is Poised for Growth

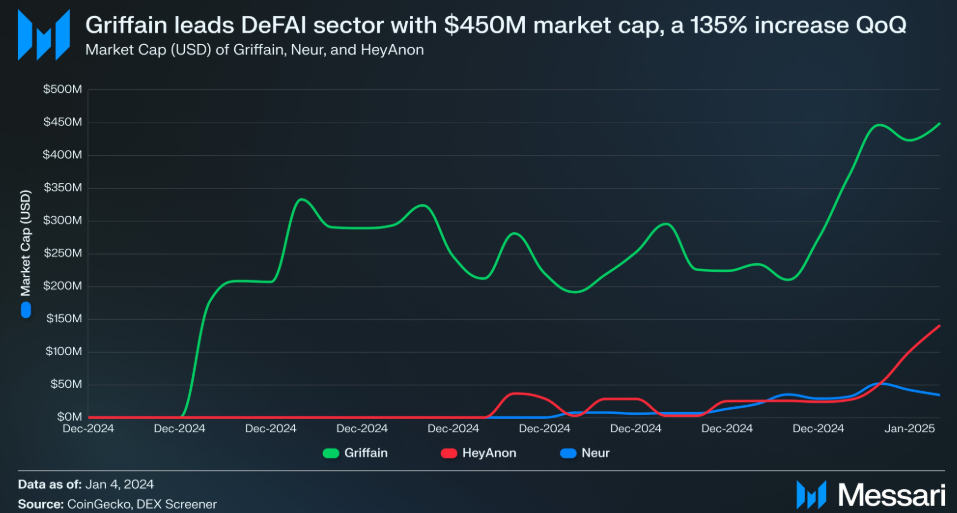

DeFAI, still in its infancy, has a market capitalization of less than $1 billion. According to Messari, Griffain leads the industry with a valuation of $450 million, a staggering 135% quarter-over-quarter increase.

Cryptocurrency analyst Hitesh.eth says this nascent market is expected to grow tenfold in the coming months. The analyst anticipates a potential increase in value to a market capitalization of $10 billion.

“The real winner will be the infrastructure, frameworks and markets for these agents. On the agent side, we are going to see general enthusiasm on the speculation side,” he said.

DeFAI represents the fusion of AI with DeFi, streamlining the notoriously complex user experience of decentralized finance. According to Daniele, a prominent DeFAI advocate, by leveraging AI, DeFAI introduces three transformative applications:

- AI-based interfaces Traditional DeFi processes, like swapping tokens or providing liquidity, often involve navigating convoluted interfaces and protocols. DeFAI replaces these with natural language commands, such as “Swap 3 ETH for USDC,” allowing the AI to handle the complexities of the backend. This simplifies transactions and reduces user errors.

- Autonomous DeFi Agents DeFAI takes automation to the next level with autonomous agents capable of executing complex, multi-step policies. For example, an agent could link ETH to another network, exchange it for a stablecoin, create a liquidity pool, and return LP tokens, all from a single order. These agents prioritize security and profitability, significantly improving the DeFi experience.

- Research and communications officers Staying informed in DeFi requires monitoring multiple data streams, from price feeds to governance forums. DeFAI’s research agents retrieve and analyze data, offering personalized insights such as optimal return strategies or asset comparisons. This innovation allows users to make data-driven decisions quickly and with confidence.

“By leveraging sophisticated AI tools to simplify user experience and streamline decision-making, DeFAI aims to lower barriers to entry and enable truly autonomous and user-friendly financial interactions,” remarked Daniele.

Lead DeFAI projects and platforms

According to analysts, Griffain, Orbit and Neur are among the first leaders in DeFAI. Griffain’s invite-only platform offers automation tools for tasks like dollar cost averaging (DCA) and token launch. Orbit emphasizes cross-chain functionality, integrating over 200 protocols. Meanwhile, Neur, focused on the Solana ecosystem, has increased its valuation thanks to its open source model.

Heyanon.ai is another promising player developing tools such as AI-based transaction interfaces and autonomous agents. Its ANON token grew from a market capitalization of $10 million to $130 million, reflecting growing investor confidence.

Meanwhile, DeFi has long been touted as the backbone of Web3, offering financial services without borders and empowering the unbanked. However, its complexity has deterred widespread adoption.

“The potential for DeFi has always been there, but the learning curve is steep,” remarked Jeff, a popular DeFi commentator.

Jeff also noted that DeFAI fills this gap, making decentralized finance as accessible as chat with AI tools like ChatGPT.

As widespread adoption of DeFAI continues, projects like Almanak and Cod3x are exploring advanced applications, from institutional-grade quantitative AI agents to no-code trading strategies. These developments promise to democratize financial tools, allowing both novice and seasoned investors to easily navigate DeFi.

Crypto analyst yyy summed it up succinctly. He indicated that by leveraging AI to automate and optimize financial decisions, DeFAI has the potential to unlock the full capabilities of DeFi for millions of new users.

“DeFAI is a tangible way to implement intent-centric execution,” the analyst said.

With its ability to simplify interfaces, automate transactions, and provide actionable insights, DeFAI is poised to revolutionize the crypto industry in 2025. As adoption accelerates, this narrative will likely become the cornerstone of a more inclusive and user-friendly decentralized financial system.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.