This article is also available in Spanish.

Dogecoin has faced a tough time amid the recent market sell-off, experiencing a sharp 20% decline from its local highs. Despite this setback, the leading meme coin still maintains a bullish structure, holding above a crucial demand zone.

Related reading

Renowned crypto analyst Ali Martinez recently shared compelling on-chain data revealing that whales have been actively accumulating DOGE during this downturn. In the last 48 hours alone, more than 470 million DOGE tokens have been acquired by large holders, suggesting confidence in the recovery potential and long-term value of the asset. This significant accumulation indicates strong interest from institutions and whales, even as the broader market remains uncertain.

Dogecoin’s resilience at current levels reflects its ability to capture investors’ attention, especially during volatile times. As the broader market looks for direction, DOGE’s ability to maintain its bullish structure could pave the way for a substantial rebound.

Dogecoin prepares for a big move

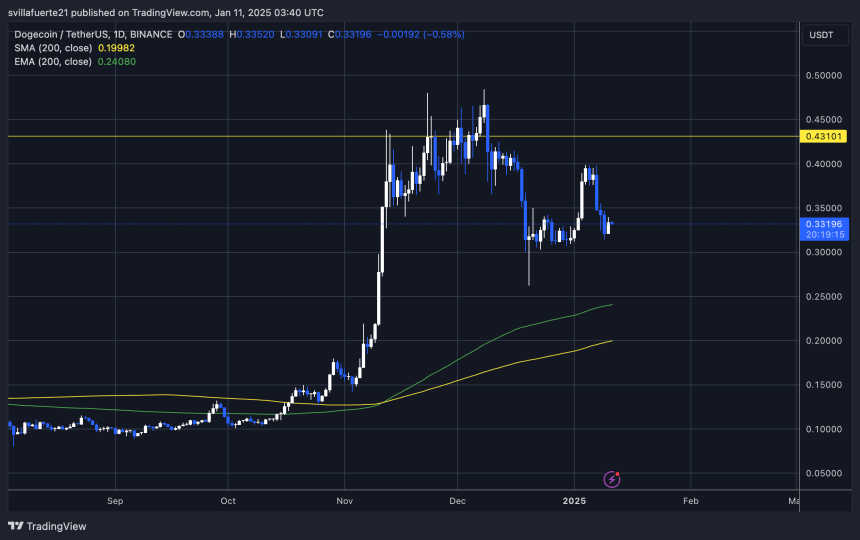

Dogecoin is showing resilience as it holds above the $0.33 mark, despite a notable decline from its recent local highs. This level has become a key demand zone for the same coin, serving as a basis for a potential recovery and bullish momentum. Market analysts and investors are closely monitoring DOGE price action, anticipating a continuation of its upward trend, as expectations of a strong recovery this year increase.

Martinez recently highlighted compelling on-chain data on X, revealing that whales have accumulated over 470 million DOGE in the last 48 hours. This increase in whale activity during a period of price consolidation highlights the growing confidence of large holders in Dogecoin’s long-term prospects.

Historically, such accumulation has often been the precursor to large price movements, as institutional and wealthy investors prepare for the next big move.

Related reading

Bullish whale activity adds a layer of optimism for Dogecoin, even though the market as a whole is going through a period of uncertainty. With smart money actively accumulating, DOGE appears to be in a strategic accumulation phase, paving the way for a possible breakthrough. If this trend continues, Dogecoin could see renewed retail interest and return to higher levels, solidifying its position as one of the most closely watched assets in the crypto space.

Pricing Analysis: Key Supply Levels

Dogecoin is trading at $0.33, showing resilience as it remains above the critical demand level of $0.31 despite recent market volatility. This support zone has provided a solid foundation, but price continues to face significant resistance on its path to recovery. Every day DOGE stays below the $0.40 mark increases the risk of a deeper correction, putting pressure on bulls to return to higher levels to maintain the bullish structure.

For Dogecoin to regain momentum and inspire investor confidence, the price must break above the $0.40 mark and hold it as support. This level constitutes a key psychological and technical hurdle, and recovering it would signal strength, encouraging additional buying pressure. Beyond $0.40, the $0.43 mark becomes the next critical target. A breakout above this level would open the way for Dogecoin to enter price discovery mode, potentially reaching new highs.

Related reading

Failure to overcome these resistance levels in the short term could lead to prolonged consolidation or a retest of lower support zones. However, with recent whale activity and strong demand at current levels, Dogecoin has the potential to reverse its downward trend and resume its upward trajectory. The next few days will be crucial as the market awaits a decisive decision.

Featured image of Dall-E, chart by TradingView