The cryptocurrency market never stands still: every week brings new surprises, ups and downs. From sudden market changes to unexpected trends, staying informed is crucial for anyone monitoring the crypto market.

So what happened this week? Is the market ready for a rebound, or are we ready for more twists and turns? Let’s break this down and see what’s driving the market. Ready to dive? Keep reading to find out!

US Market Weekly Update

The US market saw a decline of 1.32% over the last seven days. Although Europe and Australia recorded positive developments, most major markets were in the red. China fell 1.05%, Japan 1.79%, India 2.51% and South Africa 1.34%. In contrast, Europe increased by 1.49% and Australia by 0.40%.

This week saw a number of key economic indicators released, including the US S&P Global Composite PMI and the US unemployment rate. In December 2024, the US S&P Global Composite PMI increased from 54.9 to 55.4, the fastest growth since April 2022. Likewise, the US S&P Global Services PMI increased from 56.1 to 56.8, the highest gain since March 2022.

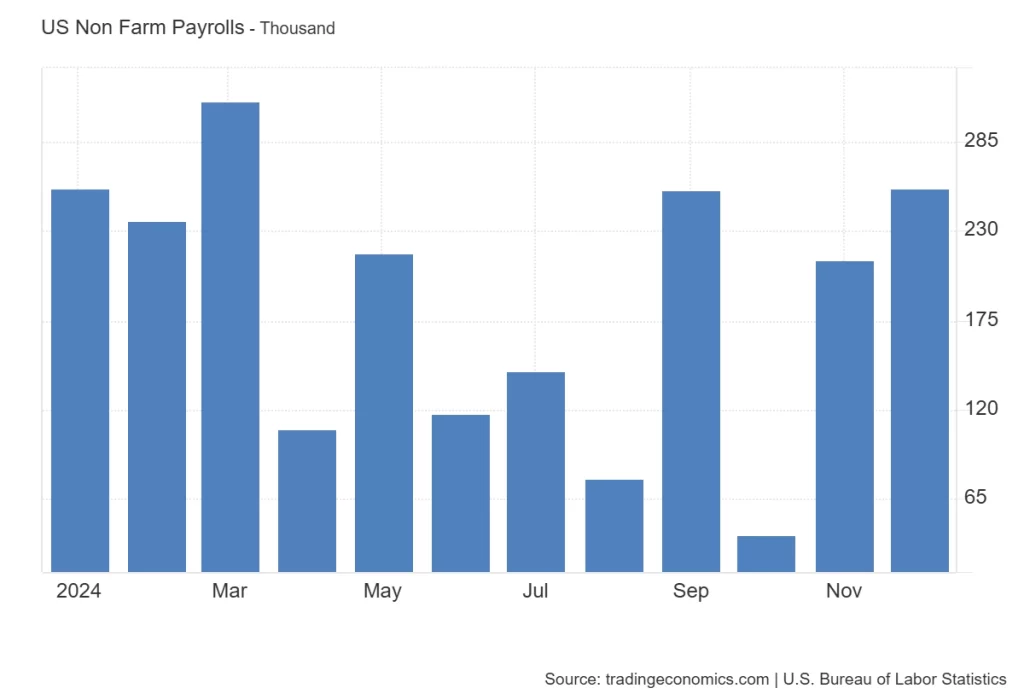

However, not all data was positive. Monthly U.S. factory order volume fell 0.4% in November, compared with an expected 0.3% decline. On a positive note, U.S. exports increased from $266.309 billion to $273.4 billion, and imports increased from $339.923 billion to $351.6 billion. U.S. initial jobless claims fell from 211,000 to 201,000 on January 4, 2025. Additionally, U.S. nonfarm payrolls increased in December from 212,000 to 256,000, exceeding the expected decline of 160 000. The unemployment rate in the United States increased from 4.2% to 4.1% in December.

The US dollar has strengthened against many major currencies, including the euro, Chinese yuan, Japanese yen and Indian rupee. The euro rose by 0.62%, the yuan by 0.17%, the yen by 0.35% and the rupee by 0.47%.

Crypto Market Scenario This Week

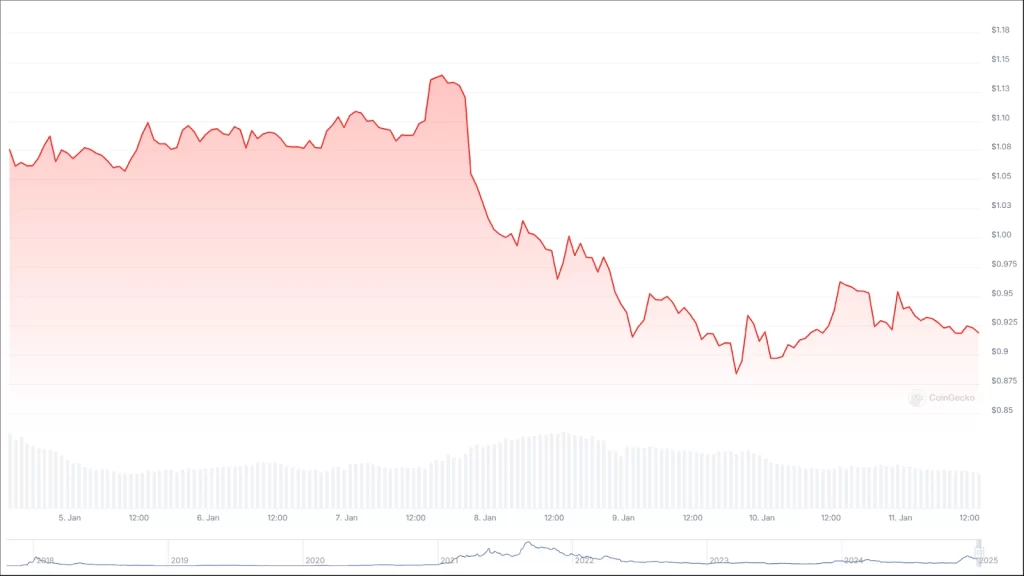

The total market capitalization of the cryptocurrency sector fell by 5.86% this week. Likewise, the altcoin market saw a decline of 8.84%. Excluding the top ten cryptocurrencies, the sector’s market capitalization fell by approximately 11.25%.

Bitcoin Market Overview

Bitcoin reached a high of $102,195.06 on January 6, but quickly fell by 9.45% between January 7 and 9. Buyers attempted to push the price back up on January 10, with a gain of 2.34%. At the time of writing, Bitcoin stands at $94,289.79, approximately 8.21% below its high this week.

Analysis of Ethereum market scenarios

Ethereum has also seen significant fluctuations. On January 6, it peaked at $3,743.68, but on the second business day of the week it saw a sharp decline of 8.2%. By January 9, the price had reached a low of $3,159.43. On January 10, Ethereum saw a slight rebound of 1.46%. Currently, Ethereum is priced at $3,244.47, approximately 13.32% below its high from earlier this week.

Top Ten Cryptos: Weekly Performance Review

This week, none of the top ten cryptocurrencies showed strong uptrends. Bitcoin fell by 3.8%, Ethereum by 9.7%, XRP by 4.9%, BNB by 3.4%, Solana by 14.2%, Dogecoin by 14.7% and Cardano by 14.8% .

Trending this week

At the time of writing, Binance Alpha Spotlight, Pump.fun Ecosystem, DeFAI, AI Meme, and Solana Meme are the top five trending categories. Over the past 24 hours, DeFAI is up 53.9%.

ANDY, MEOW, Virtuals Protocols, Hey Anon and aixbt by Virtuals are currently the five most trending cryptocurrencies. Over the past seven days, Hey Anon is up 260.1%.

- Read also:

- When will the crypto market rise again?

- ,

Crypto Category Overview

Over the past week, several crypto categories have seen declines. The currency category fell 3.65%, the blockchain category fell 9.37%, meme coins fell 15.8%, DeFi fell 14.1%, and blockchain infrastructure fell 13%. Other sectors like GameFi, NFT, and Social also saw losses, ranging from 5.37% to 15.2%.

However, Stablecoins increased by 0.31% and CeFi saw a slight increase of 1.98%.

Markets may be unpredictable, but that’s what makes the crypto world so fascinating.

Never miss a beat in the crypto world!

Stay ahead of the curve with breaking news, expert analysis and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs and more.