- Toncoin appeared to have a bearish market structure on the daily time frame

- The 50% retracement level was vigorously defended and the rising OBV gave a buy signal.

Toncoin (TON) bulls have defended the $5.19 support level over the past month. This level marks the 50% retracement of TON’s rally in February and March 2024. It saw a 58.4% rally in November when Bitcoin (BTC) rose from $70,000 to $99,000.

And yet, this strength proved insufficient to force a breakout beyond the long-term range. As the price trades near its all-time low, investors would be wondering if there are any bullish signs or if they should sell TON and look for opportunities elsewhere.

Toncoin – Accumulation or distribution?

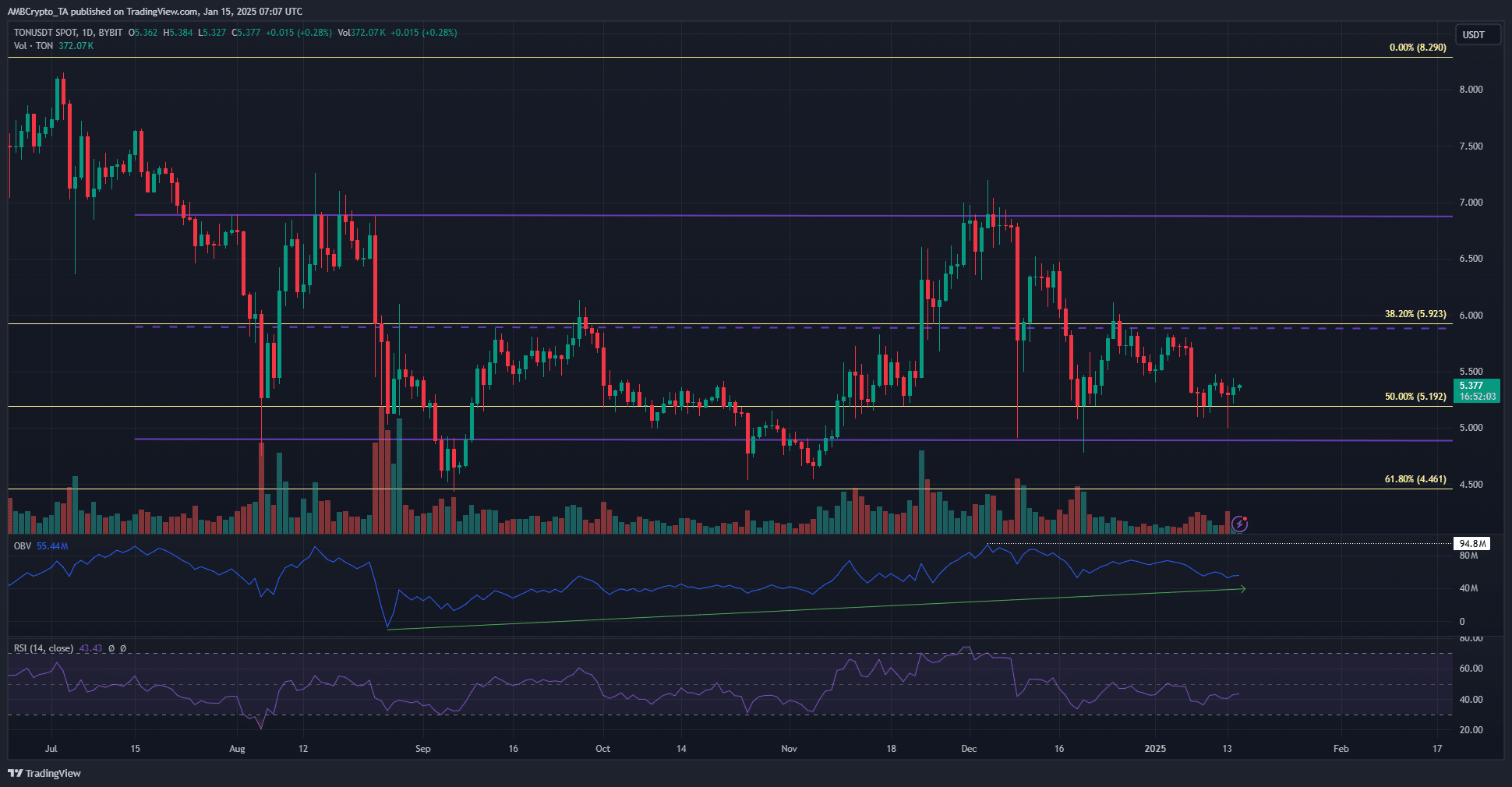

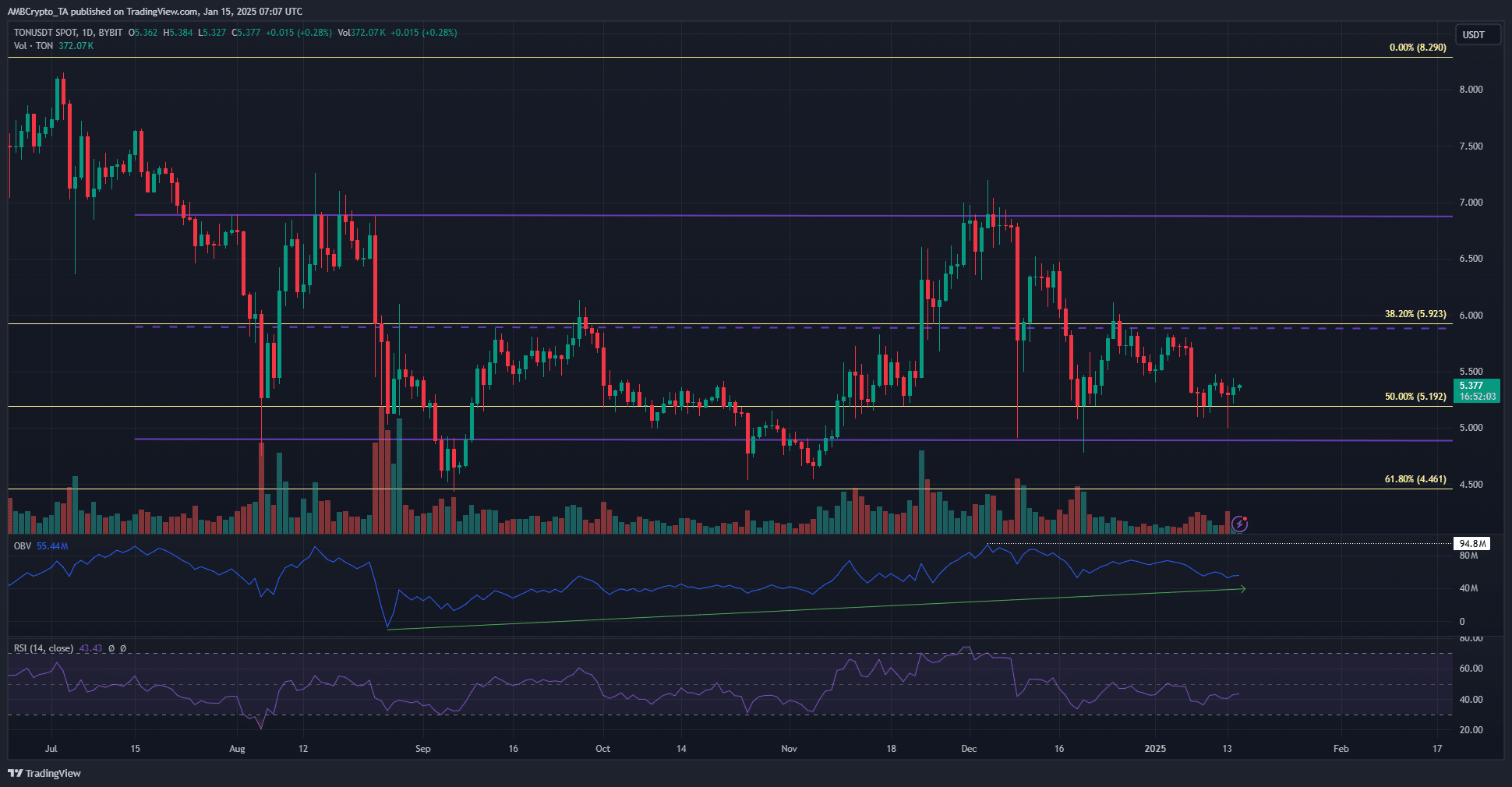

Source: TON/USDT on TradingView

Looking at the weekly price action, AMBCrypto spotted a range formation (purple) from $4.91 to $6.88. The mid-level aligned with the 38.2% retracement level at $5.92, marking intermediate resistance.

In December, after BTC bulls were exhausted and could no longer rise above $108,000, TON price was rejected at this 6-month high. The inability to escape was a disappointment. However, the defense of the lows presented a buying opportunity.

Source: TON/USDT on TradingView

The daily chart revealed that the market structure was bearish. Over the past six weeks, TON has established a series of lower highs. At the same time, its daily RSI was below 50, a neutral sign of bearish momentum.

Investors convinced of the asset can look to buy more TON at the $5.19 and $4.88 levels. A recovery was likely as OBV has been steadily rising since September. This meant that there was ongoing accumulation in the formation of a six-month range.

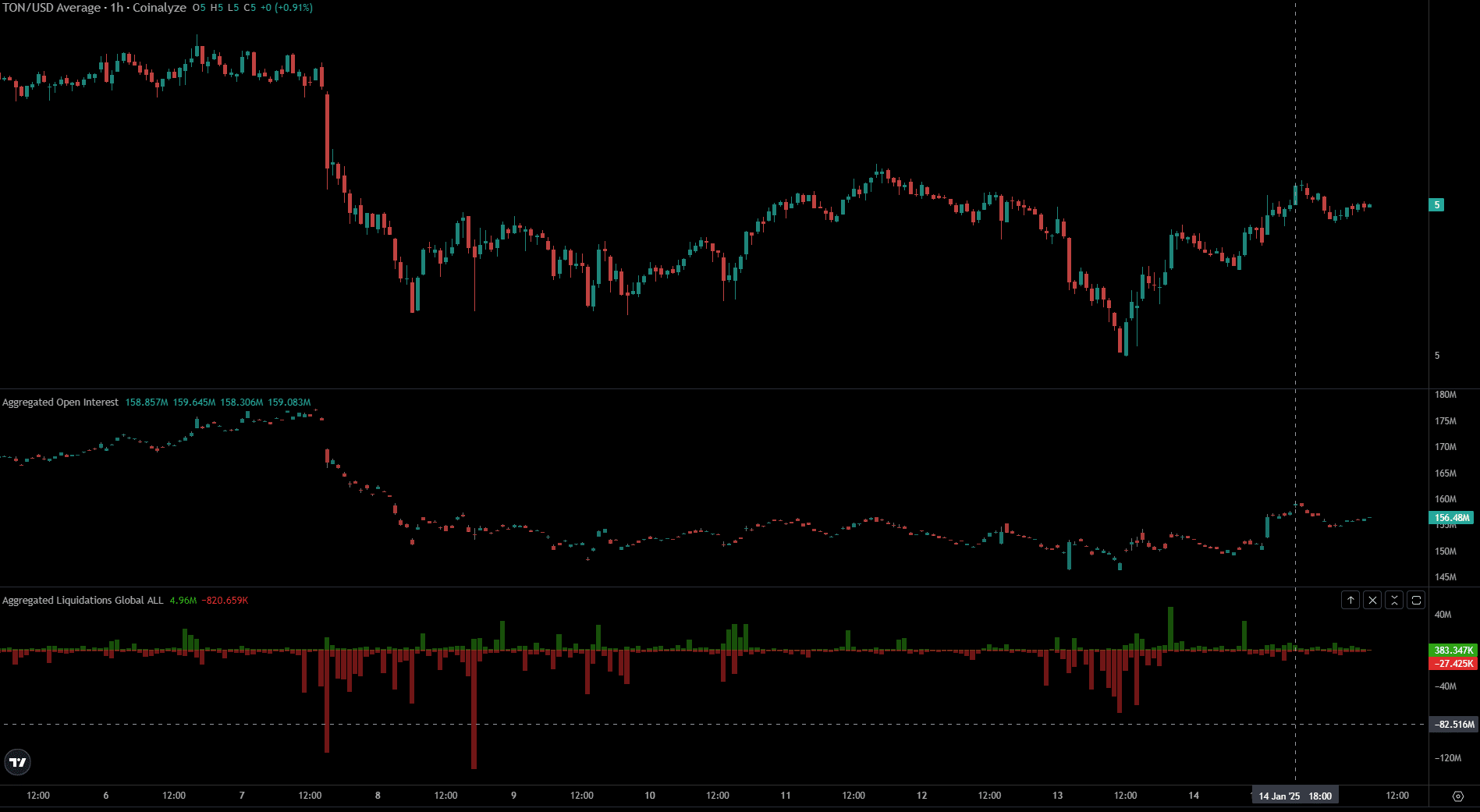

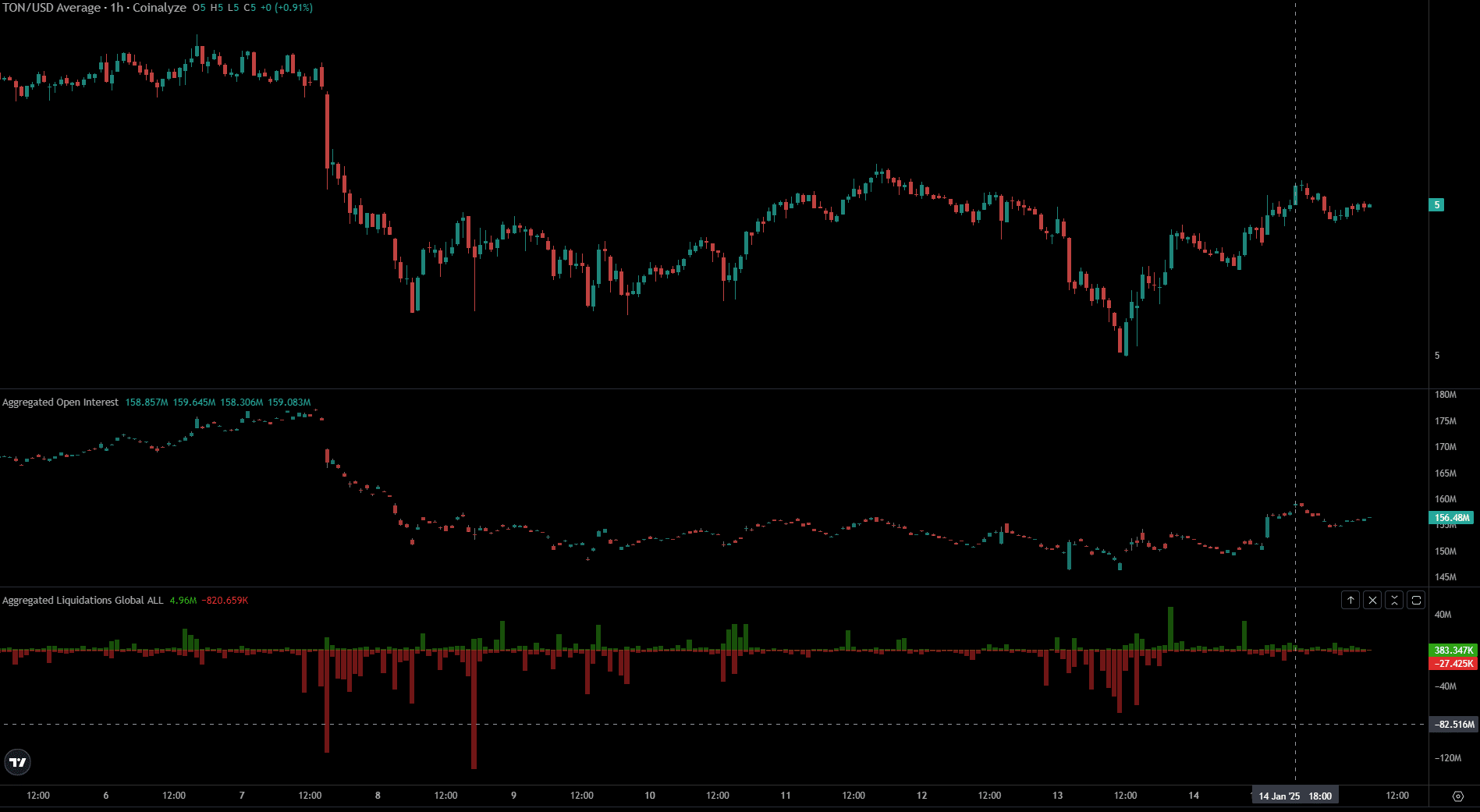

Source: Coinalyse

The lower time frames revealed that bullish sentiment has returned to the market. Open interest increased from $147 million on Monday, January 13 to $156.48 million at press time.

Read Toncoin (TON) Price Prediction 2025-26

Monday’s decline triggered a number of long sell-offs. The rapid recovery of BTC and Toncoin indicates the strength of the market. The long-term bias therefore remained bullish. In the coming days, volatility would be likely, but the $5.19 level is expected to remain stable.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.