- Retail investors dominate trading activity on CEXs.

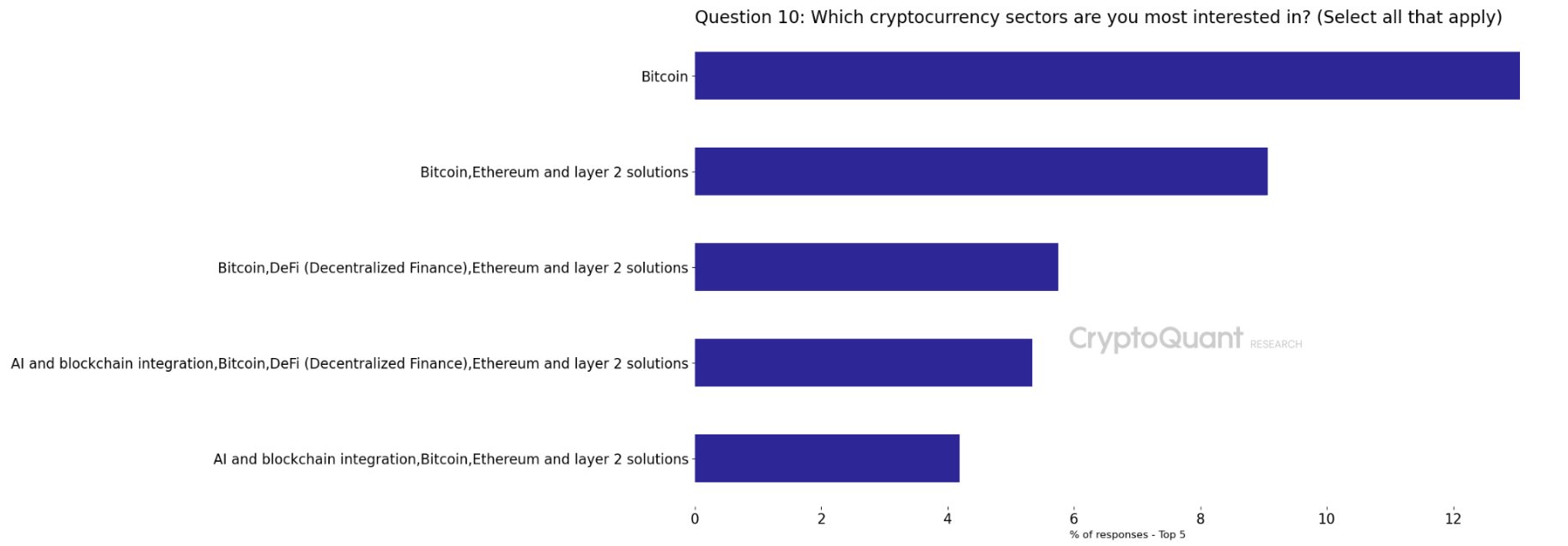

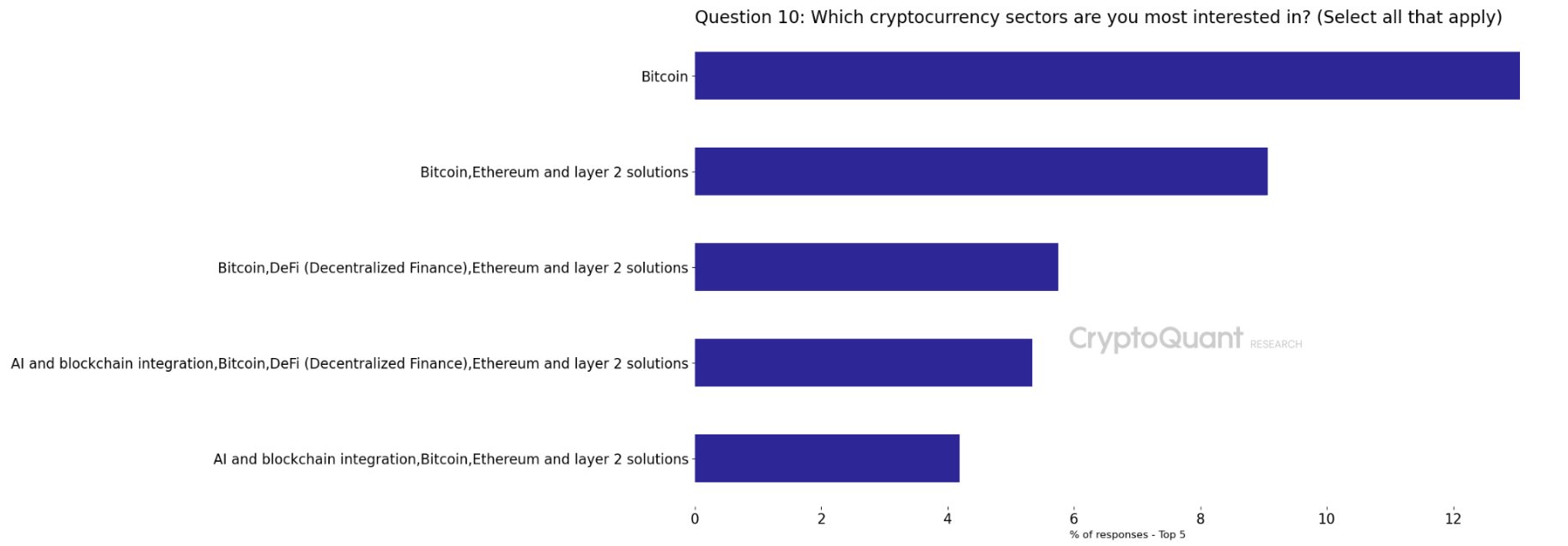

- Most traders focused on the BTC, ETH and AI narratives.

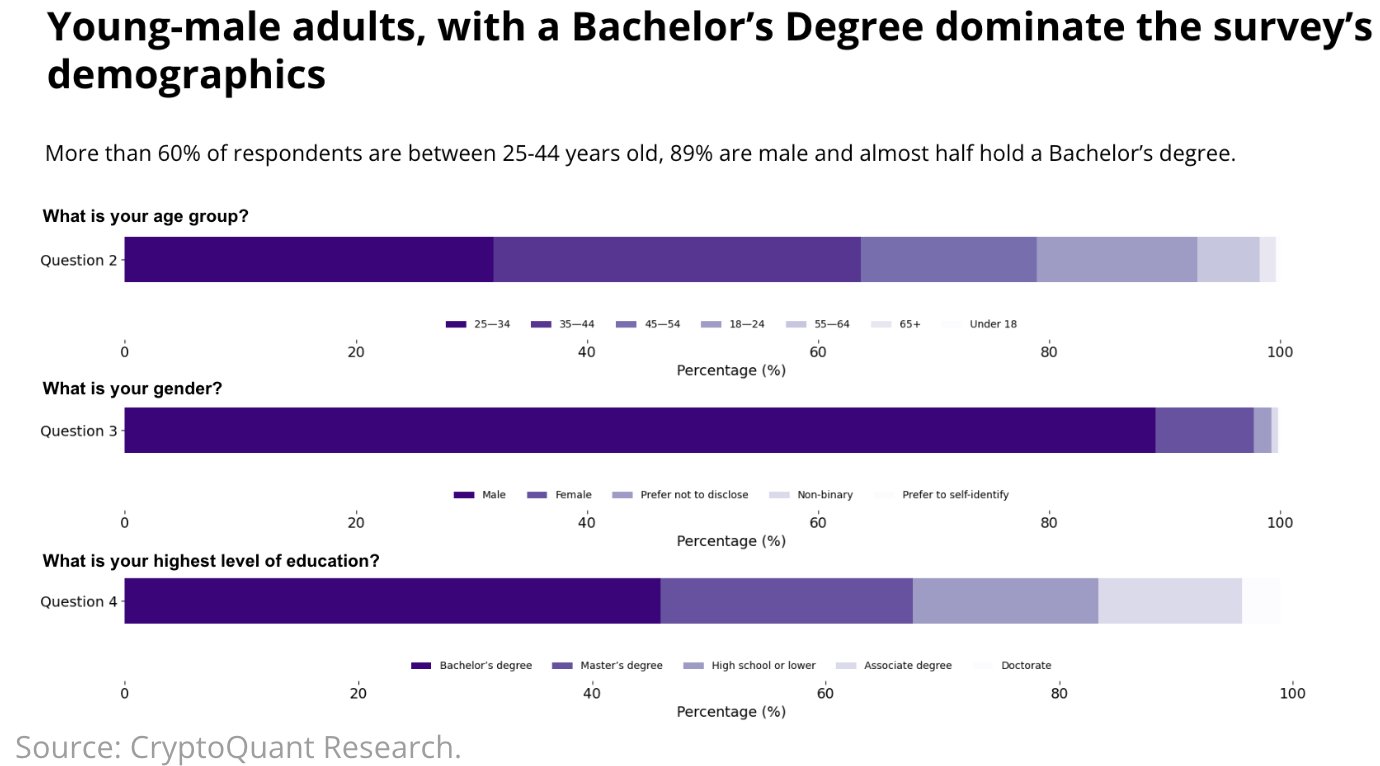

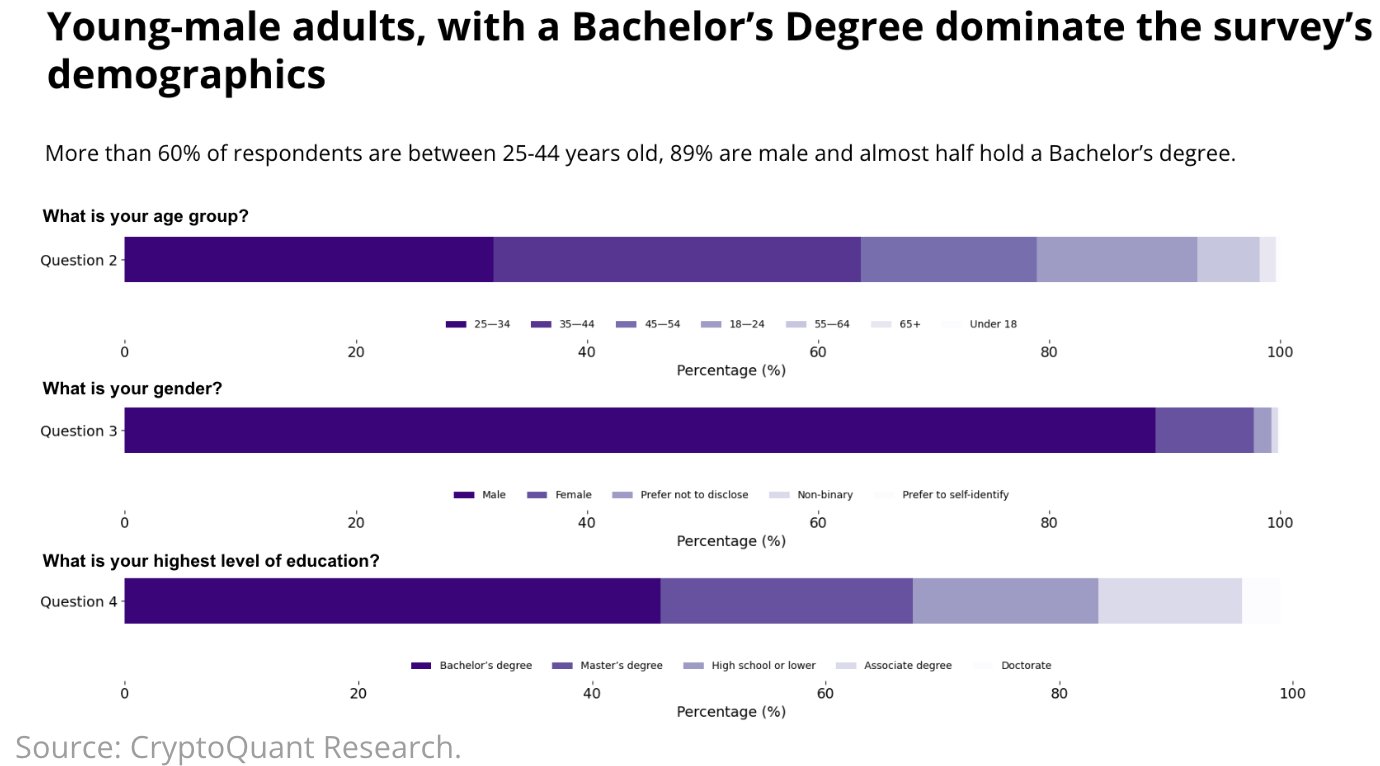

According to the latest CryptoQuant report, retail crypto traders dominate centralized exchange (CEX) activity.

More than 60% of them are young, educated men with more than three years of experience in the field.

Part of the report read,

“The survey shows that crypto users are young, experienced and educated. 60% are aged 25 to 44, and more than 62% have more than 3 years of experience in the industry. Most invest less than $10,000 per year, reflecting the dominance of retail investors.

Source: CryptoQuant

Binance leads in global usage

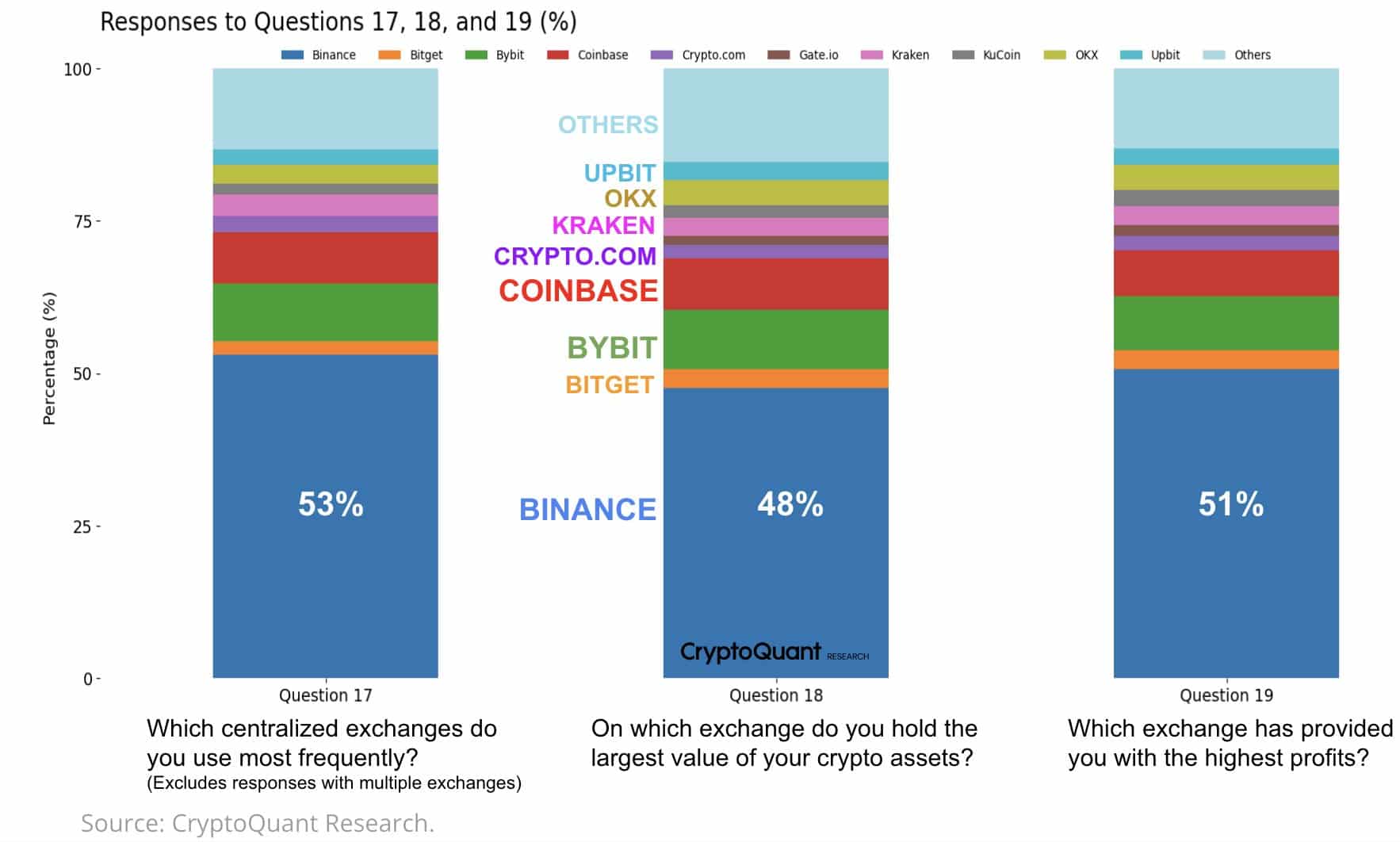

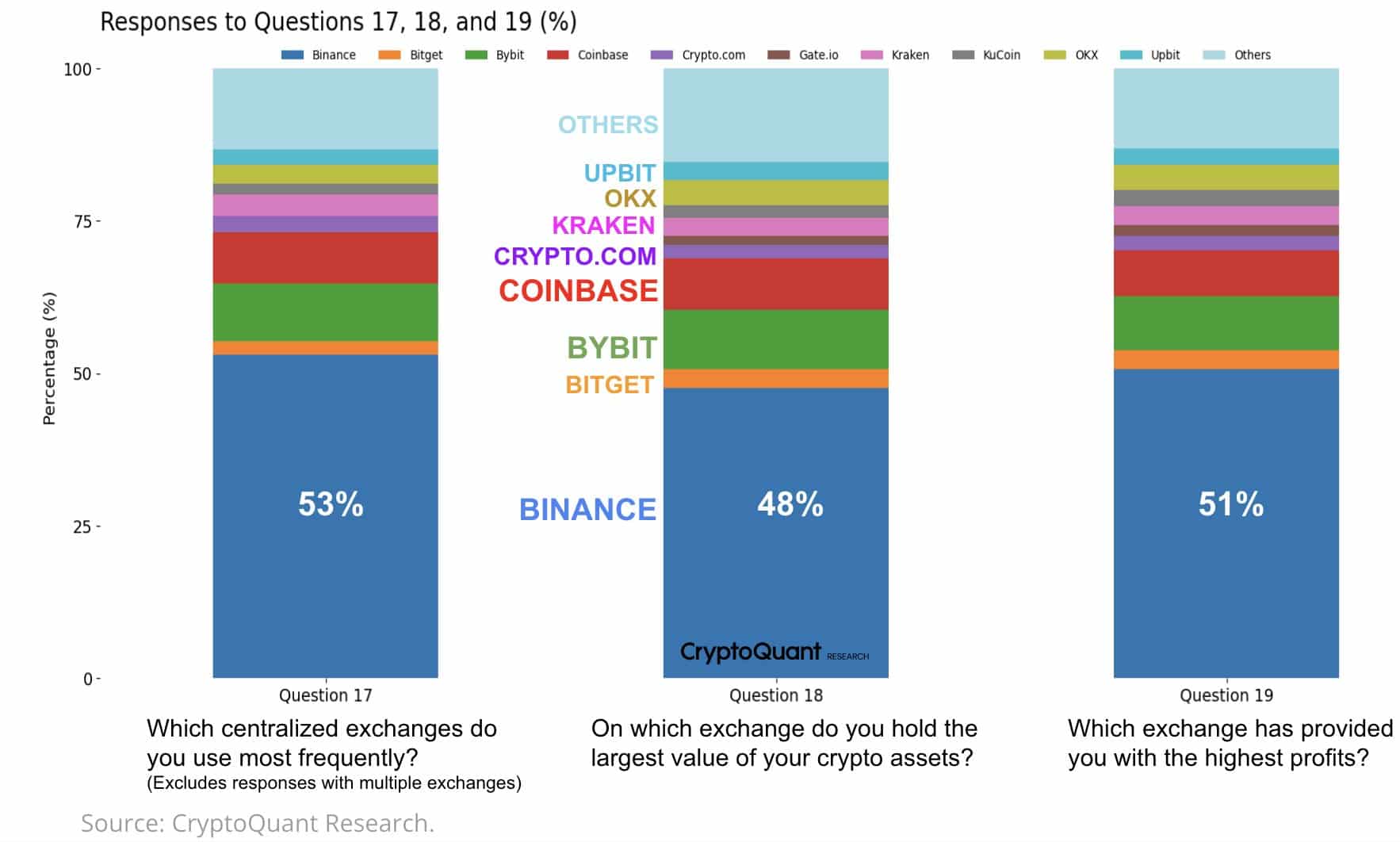

In terms of global usage, Binance has dominated CEX dominance, as over 50% of respondents frequently use it as their primary platform.

Additionally, almost half of those surveyed kept their assets on the platform, boosting their confidence in the exchange.

Source: CryptoQuant

Additionally, it has become the preferred platform for full-time traders, followed by Bybit and OKX. Well, this was probably due to its significant liquidity, which makes it easy to enter and exit trades with low slippage costs.

The report adds that Bitcoin (BTC), Ethereum (ETH), and AI tokens were the most traded cryptocurrencies in most CEXs. BTC and ETH could gain momentum as markets focus on President Donald Trump’s pro-crypto policies.

Source: CryptoQuant

It is worth noting, however, that the discourse around AI has gained momentum over the past four months. AI agent sub-sector arouses market enthusiasm.

With speculation that artificial general intelligence (AGI) could be realized this year, the AI/AI agent narrative could assert its dominance in 2025.