- Jupiter broke above the local resistance zone at $0.95 and the price was just below the $1.15 resistance at press time.

- It is possible that it could drop to $1.06 in the near future.

Jupiter (JUP) saw an increase of 36.76% on Saturday, January 18. The last 24 hours of trading saw gains of 34% and a 678% increase in daily trading volume for Jupiter. This appears to be a strongly bullish sign for the altcoin.

The altcoin market structure was bullish on the daily and 4-hour charts. However, there could be potential for a retracement towards $1. How far could this decline go? Strong support was at $1.06, almost 9% below the market price at press time.

JUP bulls challenge $1.15 resistance

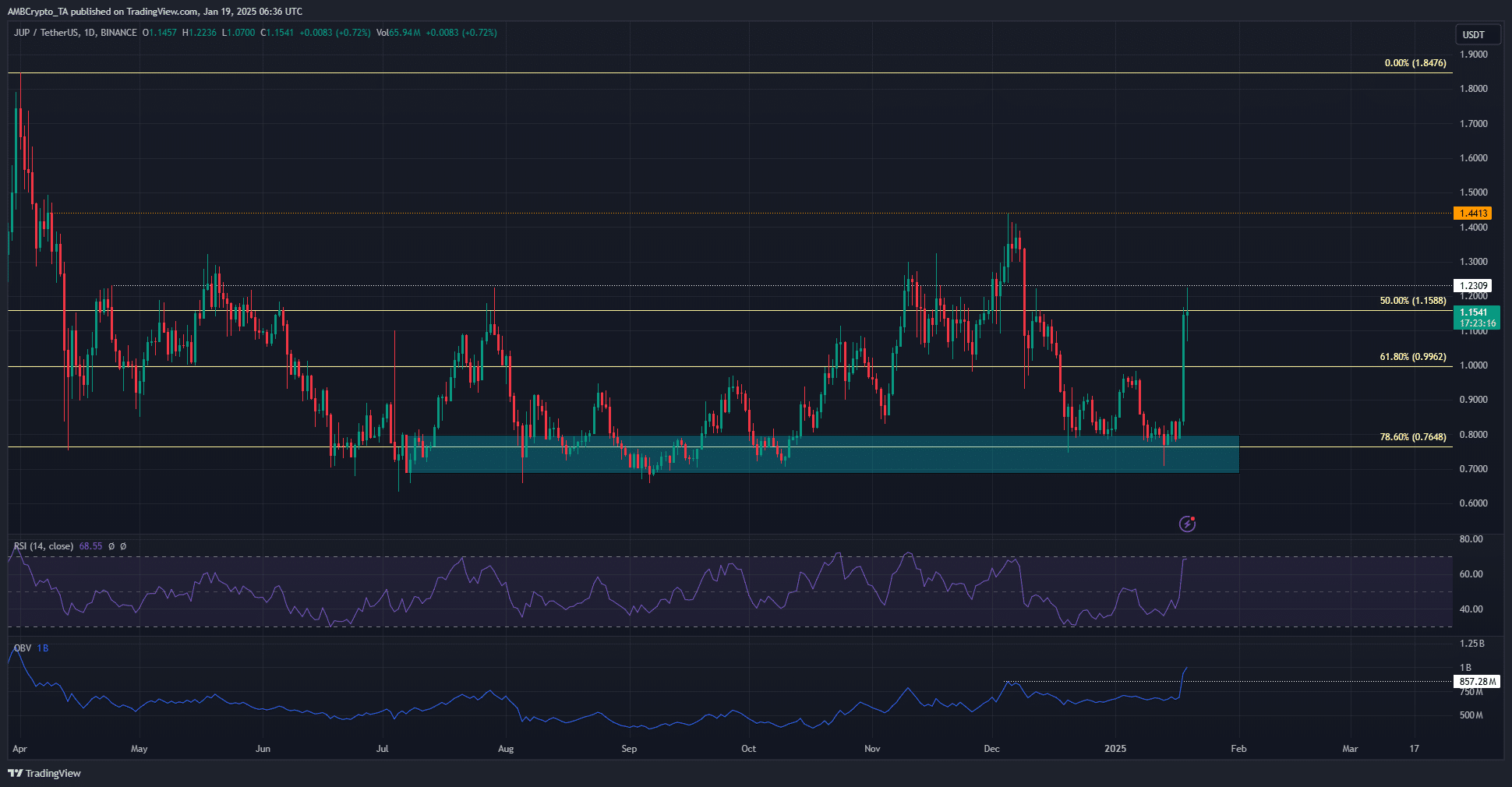

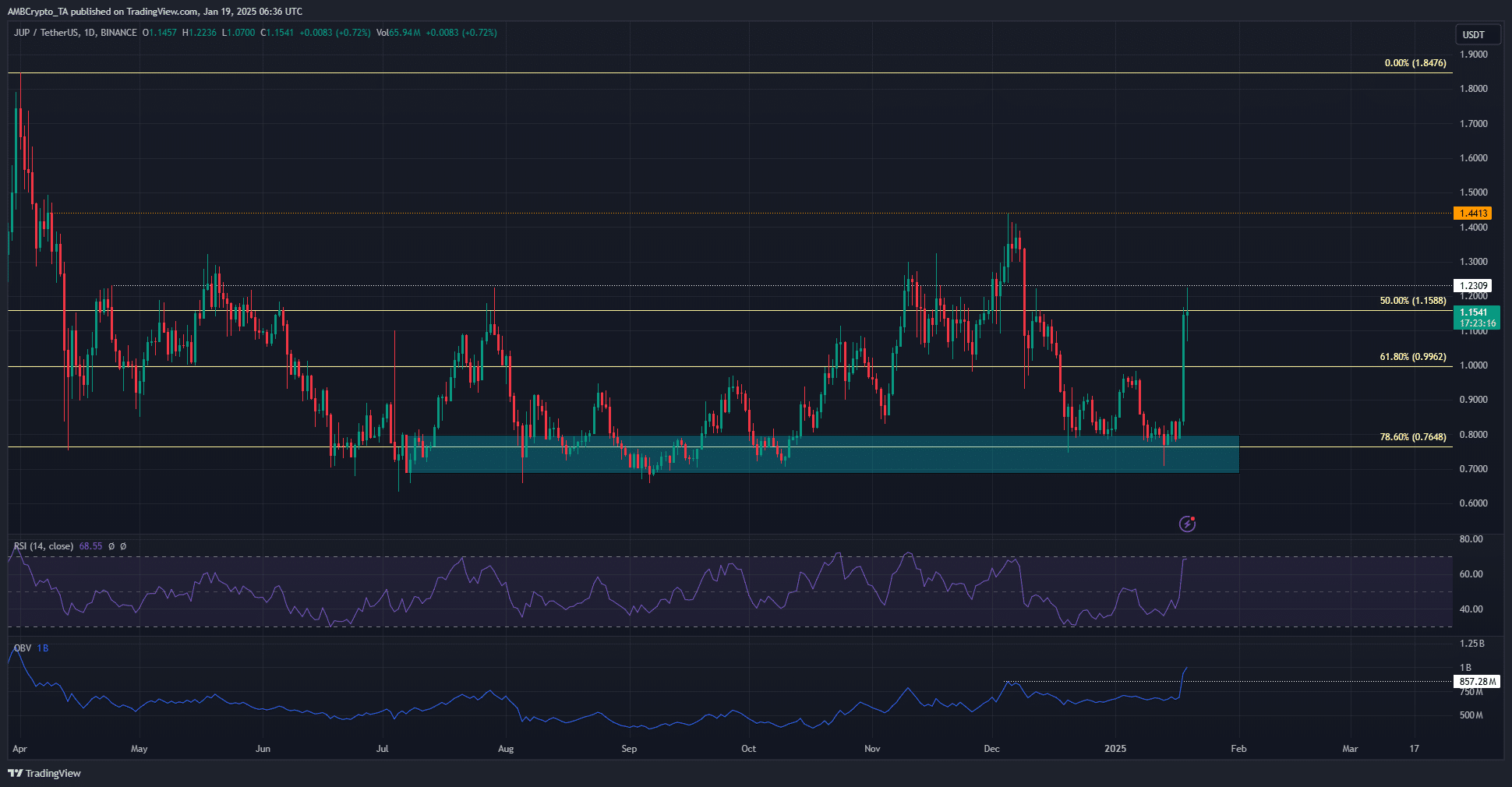

Source: JUP/USDT on TradingView

Over the past nine months, the bulls have valiantly defended the 78.6% retracement level at $0.76. These retracement levels were plotted based on Jupiter’s March rally from $0.47 to $1.84.

The bullish daily structure was encouraging and the RSI was well above neutral 50, indicating strong bullish momentum. This momentum has been accompanied by increased demand. OBV broke above a local high to also reflect increased buying pressure.

Rising demand and momentum could be enough to push JUP past its local resistances at $1.15 and $1.23. Over the next two weeks, it is likely that local highs of $1.44 will be challenged again.

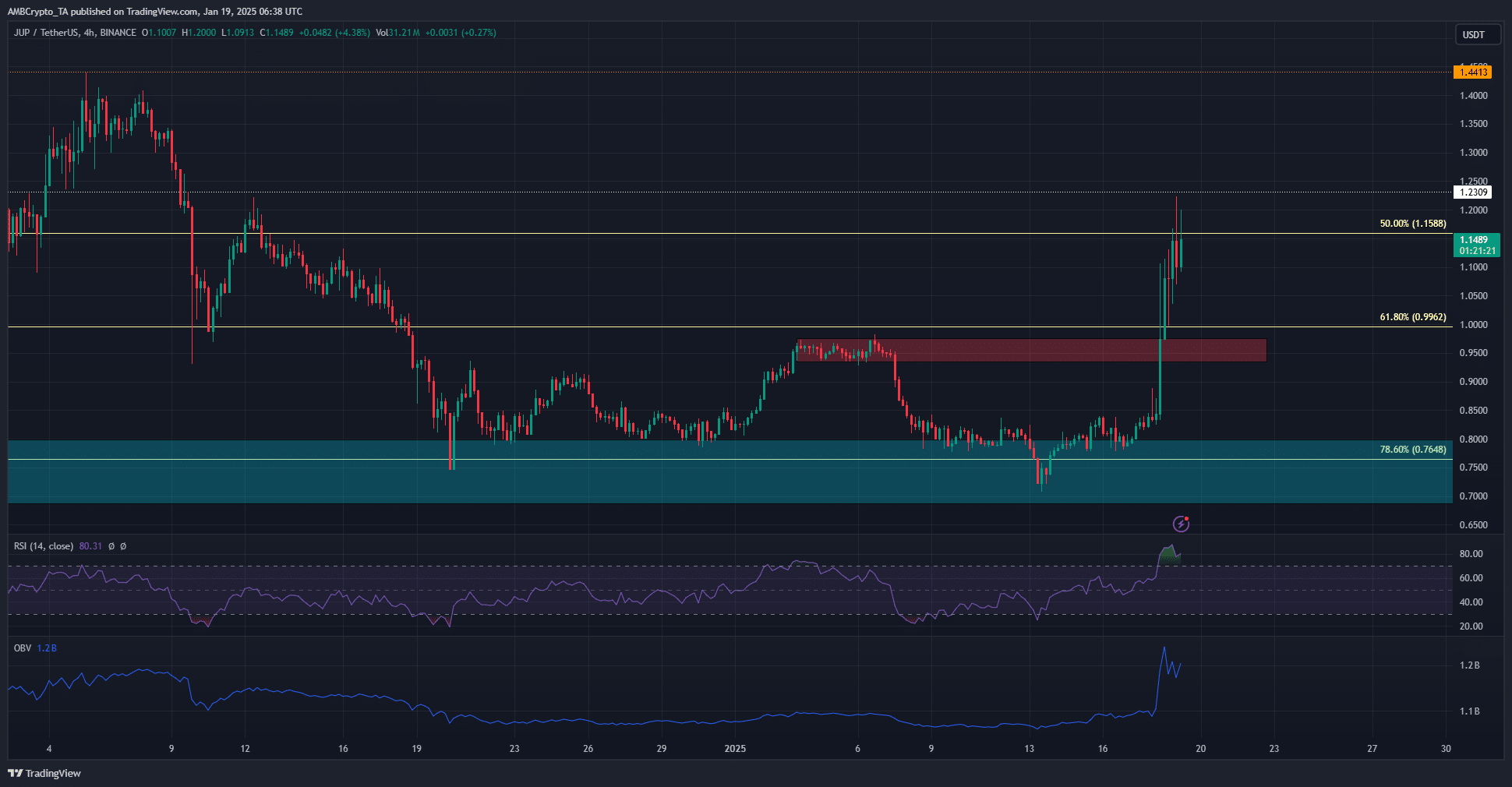

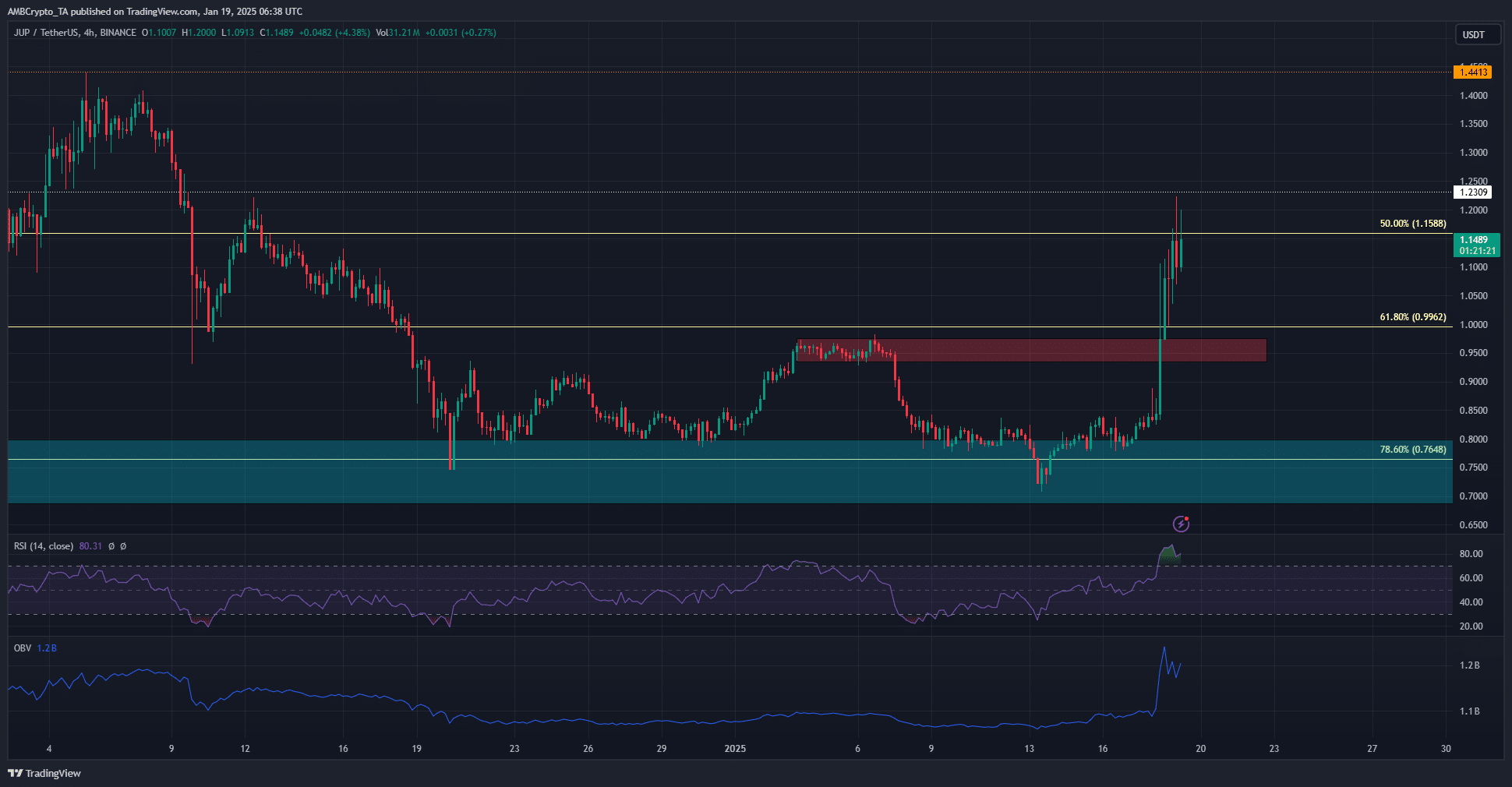

Source: JUP/USDT on TradingView

The H4 chart highlighted the intense momentum of the past few days. Local resistances at $0.95 and $0.99 were easily swept aside and barely retested as the crypto price climbed.

The 4-hour chart’s momentum was oversold, which was not necessarily bearish. However, the decline in OBV over the past few sessions indicates profit taking. A move towards the $0.95 to $1 support zone could be possible in the coming days. If tested, this area would present a buying opportunity.

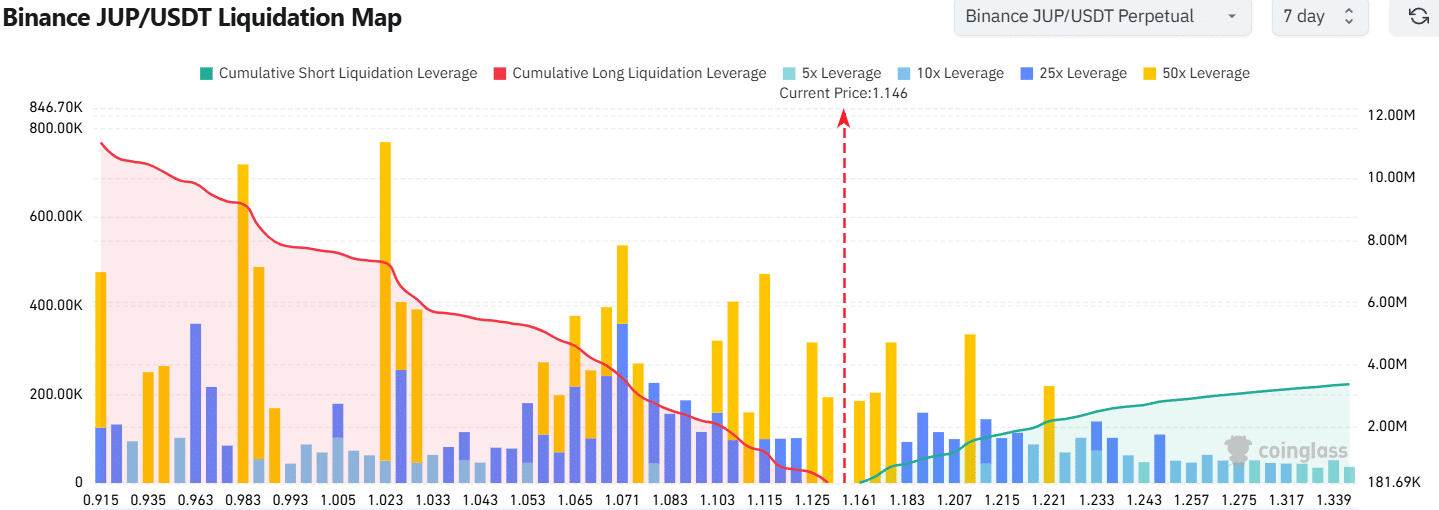

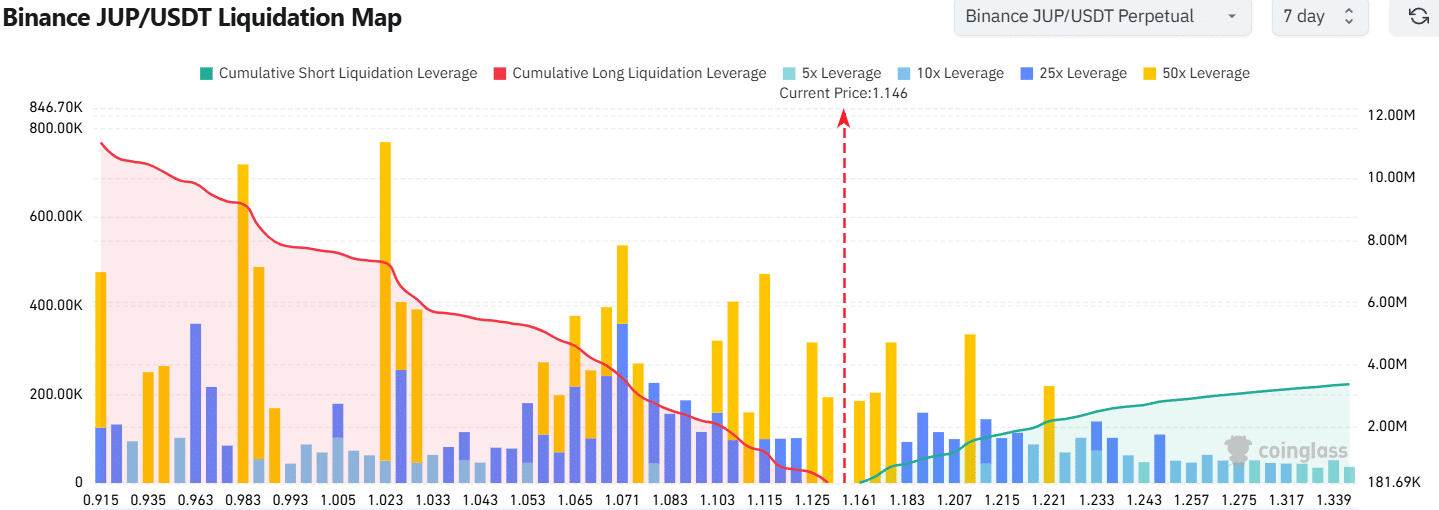

Source: Coinglass

Read Jupiter (JUP) Price Prediction 2025-26

The liquidation map noted greater cumulative liquidation leverage in the south than in the north. It is therefore possible that a hunt for liquidity and a short-term price decline will begin. The $1.11 and $1.06 levels would be the short-term targets in the event of such a decline.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.