- Analysts predicted a 46% upside for Arbitrum if it breached the $0.78 resistance in the descending triangle.

- On-chain data showed bearish sentiment, but traders are targeting $1.0690 if bullish momentum returns.

Arbitrum (ARB) was trading in a classic descending triangle pattern, a structure often associated with potential breakout opportunities.

Analysts suggest a breakout could lead to a 46% price rise, highlighting ARB’s next move. As price currently consolidates near key support levels, traders are watching for critical price reactions.

At the time of writing, ARB was trading at $0.7066, with a 24-hour trading volume of $606,785,204, reflecting a decline of 3.51% over the past day.

ARB also saw a 7-day decline of 3.24% and its market capitalization is currently valued at $3.05 billion, with a circulating supply of 4.3 billion ARB tokens.

Key support and resistance levels

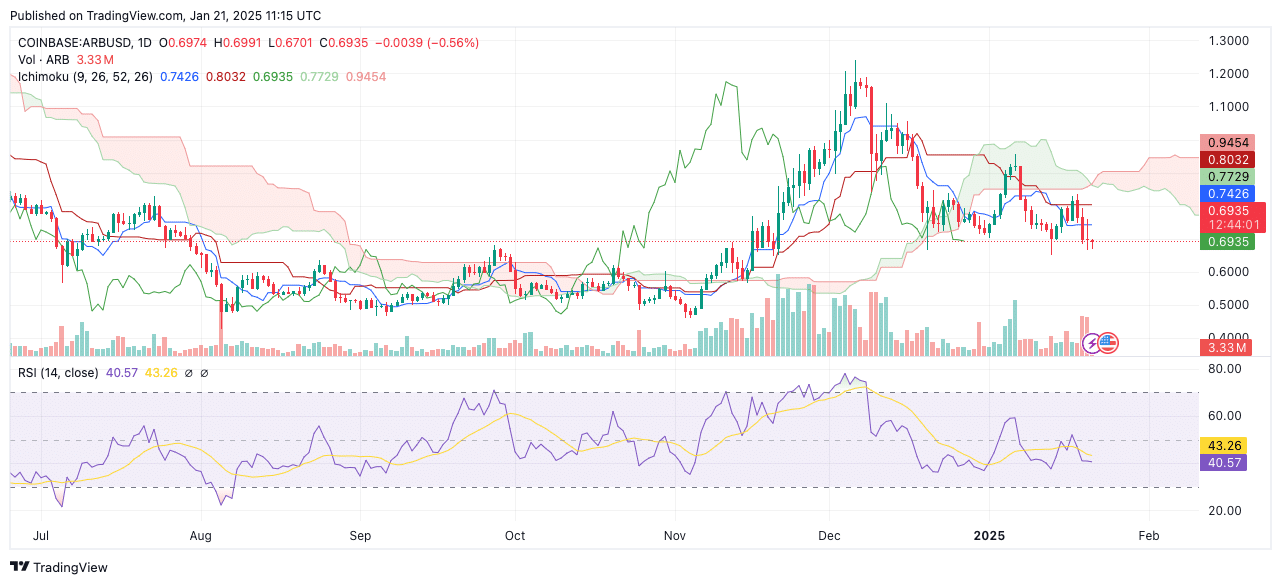

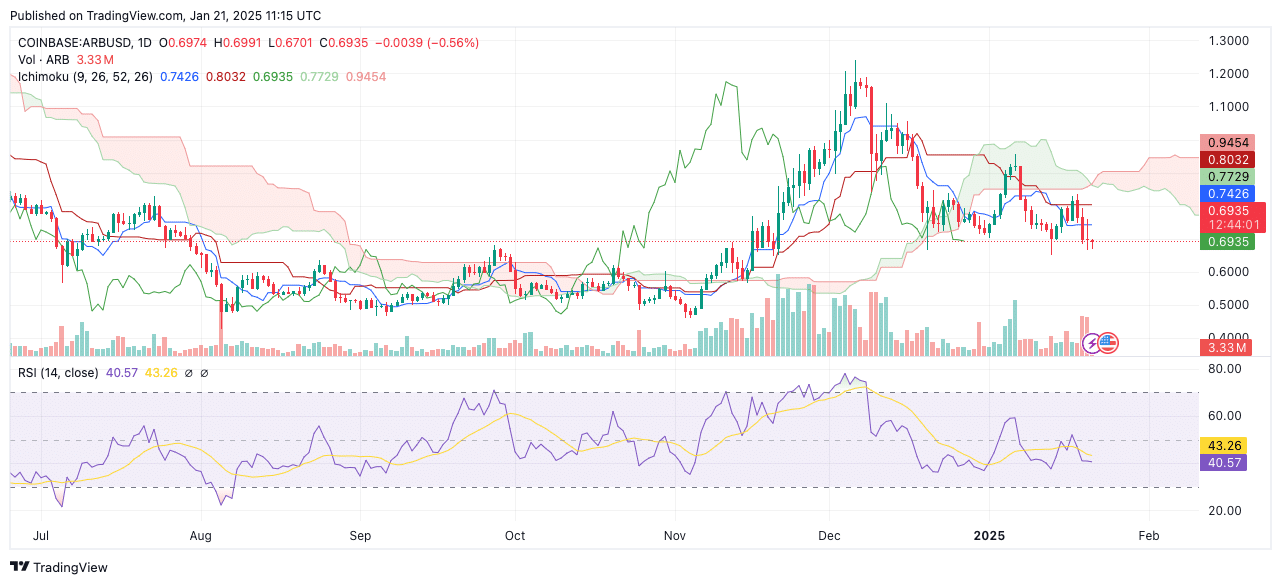

The ARB/USDT chart indicates bearish pressure with the price consolidating near the $0.6890 support level, which is key for stability.

Failure to hold above this level could send prices lower, potentially testing $0.6500, a level of psychological support.

Immediate resistance is noted at $0.78, where the descending trendline has rejected price movements repeatedly.

The Fibonacci retracement levels at $0.8661 (0.618) and $0.9077 (0.786) represent key obstacles if ARB attempts a move higher.

Source:

According to analysts, a decisive break above these levels could pave the way for an upward trajectory towards $1.0690 or higher.

Indicators signal bearish sentiment

Technical indicators align with a short-term bearish outlook. ARB’s Ichimoku Cloud analysis shows prices trading below the cloud, suggesting dominant bearish momentum.

Additionally, the Tenkan-sen ($0.7426) and Kijun-sen ($0.8032) lines act as important resistances.

The relative strength index (RSI) stands at 40.57, just above oversold territory, indicating weak momentum. Despite this, there are no signs of bullish divergence, suggesting that sellers continue to dominate.

Source: TradingView

The low volume activity further reinforces the lack of buying interest, making the next move heavily dependent on ARB’s ability to reclaim the $0.74 level.

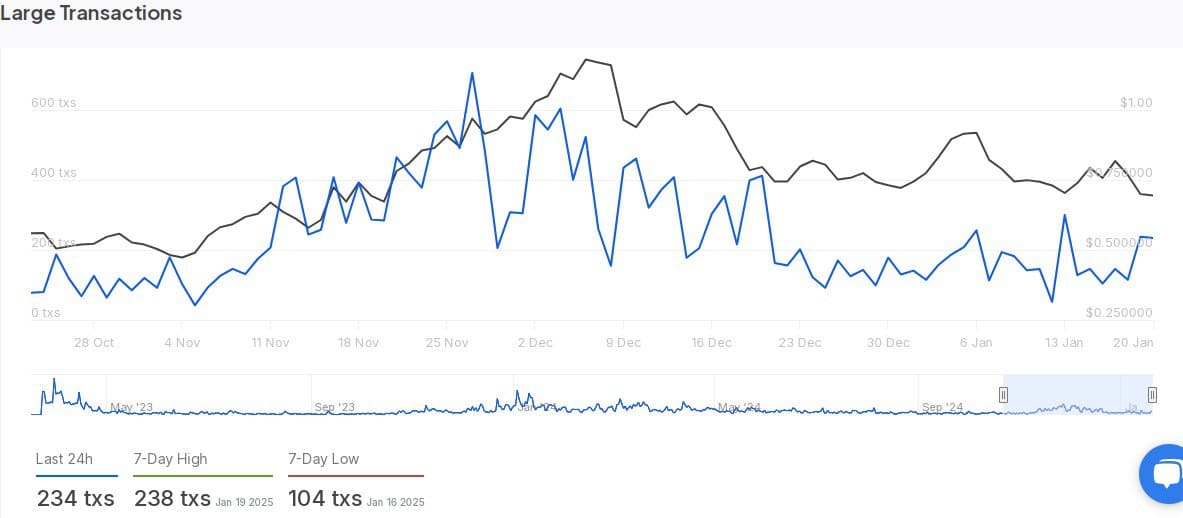

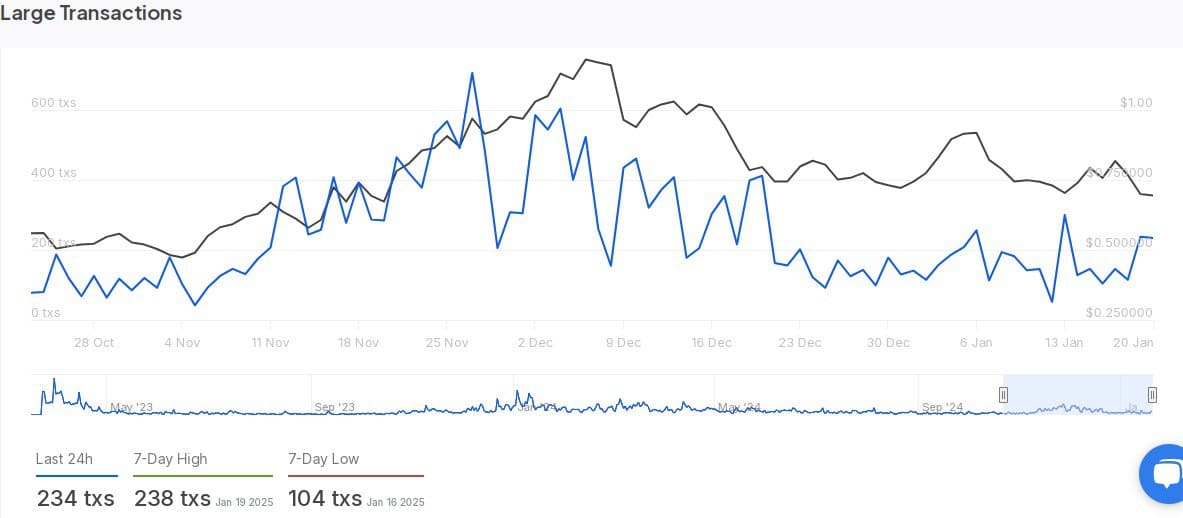

On-chain metrics reflect declining participation

On-chain data In the block indicates bearish sentiment, with all four metrics trending negatively.

Net network growth at -1.10% shows reduced activity from new participants. The “In the Money” indicator stood at -2.09%, highlighting a decrease in profitable wallet addresses.

Large transaction activity remains subdued, with 234 transactions in the past 24 hours, compared to a 7-day high of 238.

Analysts attribute this decline to a lack of interest from high-value investors, correlating with the price stagnating near $0.50.

Source: In the block

Traders eye potential rebound

Despite the bearish signals, analysts remain optimistic about a possible breakout of the descending triangle.

Premium Pink Signals projects upside targets at $1.0690, $1.3053, and $1.5804, provided ARB can break above the trendline.

Source:

Read Arbitrum (ARB) Price Forecast 2024-2025

As ARB consolidates its close support, the next move could define its medium-term trajectory, with traders closely monitoring a possible breakout.