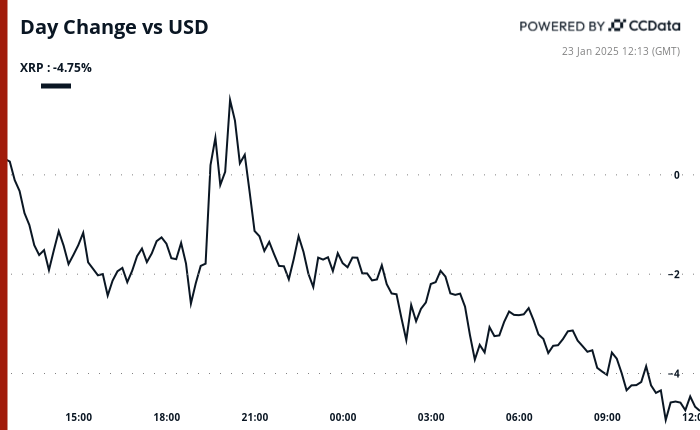

XRP is down almost 5% in the last 24 -hour period to get around the $ 3 mark in a withdrawal after having briefly seen its total market capitalization exceed that of the Wall Street Goldman Sachs giant .

Since then, XRP market capitalization has plunged around $ 20 billion, the wider market for cryptocurrencies has undergone a slight slowdown. The native token of the large XRP book plunged more than other major assets today after the Chicago Mercantile Exchange (CME) denied that it registers in the future linked to cryptocurrency.

The CME is often considered as an indirect indicator of institutional activity in the space of cryptocurrencies and previous screenshots of pages showing the potential launch of term contracts for XRP and Sol began to circulate on networks social. These rumors triggered the launch on February 10.

The exchange, however, revealed that it was “beta pages” of his website which were “published in the error”. A company spokesperson told Coindesk that models had been included in his test environment, no decision having been made on these term contracts.

Like most cryptocurrencies, XRP saw its price at the end of last year due to the expectations of a more favorable regulatory environment under the administration of the president elected Donald Trump. The planned policy changes, such as the creation of a strategic bitcoin reserve and the appointment of Paul Atkins as head of the Securities and Exchange Commission (SEC), have considerably strengthened the confidence of investors.

It should be noted that ATKINS is considered a user -friendly figure to lead the regulatory agency, which was involved in a legal battle with Ripple, a leading player in the XRP ecosystem. This legal dispute focuses on Ripple XRP sales.

Trump’s pro-Crypto position has led to a lot to speculate that XRP could soon launch a funded fund for the Crypto-money. Several companies have already requested XRP Spot ETF, including Bitwise, Canary Capital, Wisdomtree and 21Shares. The CEO of Ripple, Brad Garlinghouse, expressed the conviction that such a fund is “inevitable”.

Star image via Pexels.