The price of Ethereum (ETH) showed a significant change in the last day, increasing by 1.86%. However, according to CoinmarketCap commercial data, the popular Altcoin has recorded negative growth since December 2024 despite some significant gains in the last month. Interestingly, the underlying activity of the market indicates a potential price escape.

Ethereum sees a strong accumulation activity in the middle of the drop in prices

Since he hit the price mark of $ 4,000, Ethereum has dropped in a downward trend of $ 3,000. In the midst of notable Bitcoin gains in January, Ethereum continues to fight against the lower stockings consistent during this period.

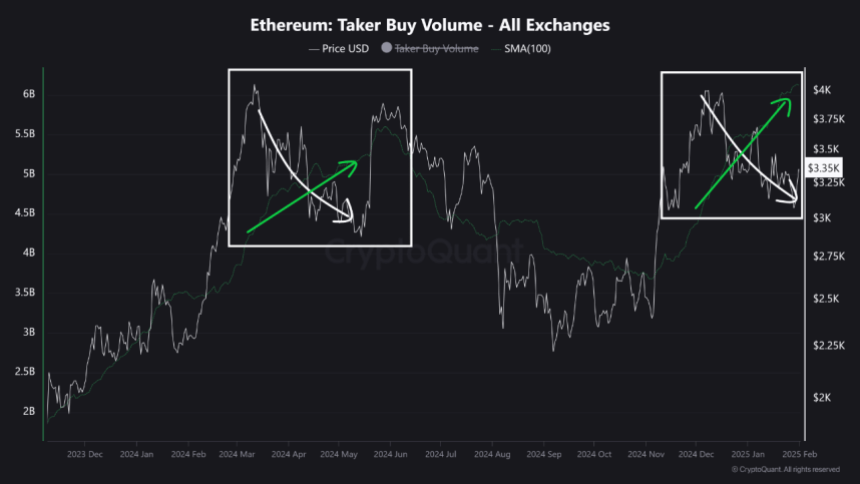

However, an expert by cryptocurrency on the market named the name of Crypto Sunmoon noted an increase in the volume of purchase of the market in the middle of the current drop in prices indicating a bullish divergence on the ETH market. For the context, an upward divergence occurs when the price of an asset makes lower stockings while an indicator of Momentum makes higher stockings, thus referring to a potential reversal or an ascending movement.

As for Ethereum, the increase in the volume of purchase in the middle of downward prices indicates a high demand from buyers, in particular at current price levels. This development also suggests strong confidence in the profitability of assets, because investors expect the purchase pressure exceeds the sales activity in the coming days.

Based on historical data, Crypto Sunmoon predicts that Ethereum can feel a wave of prices such as that in May 2024 when a similar optimistic divergence occurred for the last time. During this month, ETH increased by more than 21% suggesting that Altcoin will likely amount to $ 4,000 if the price escape occurs, according to current market prices.

Long -term ETH holders report high market confidence

In other news, Intotheblock reports that long -term Ethereum holders currently have an average duration of 2.4 years showing massive confidence in the future value potential of Ethereum.

However, Ethereum is confronted with other problems, including the absence of short -term participants, which prevents ETH from living important speculative trading levels that can increase prices. In addition, the rapid growth of layer 2 solutions such as optimism and blockchains of layer 1 such as Solana also falsified potential market demand and attention for Ethereum.

At the time of the press, the ETH is negotiated at $ 3,306 after a gain of 1.86% compared to the last day as indicated above. At the same time, the daily negotiation volume of the assets increased by 55.69%, which resulted in a value of $ 30.3 billion. On the larger time, Ethereum is also up 0.22% on its weekly table, but down 2.27% on its monthly graph, leaving a lot of time to many short -term investors.