Ethereum has just lived one of the most chaotic days of negotiation in its history, with price prices resembling a roller coaster. The ETH plunged more than 30% in less than 24 hours, the fears of an American trade war, sparked a massive sale of the market. However, just as quickly as panic sets in, the market rebounded after the announcement by President Trump negotiations with Canada and Mexico to raise prices. This live reversal has injected optimism on the market, but uncertainty remains high.

Sudden drop has destroyed millions of leverages, creating one of the greatest events of liquidation in the history of Ethereum. Glassnod data reveals that yesterday, $ 76.4 million in long -standing liquidations have hit the market, with $ 55.8 million in a single hour – marking the second largest ear of liquidation in one year, just Behind the $ 56 million event on December 9. This intense action price highlights unprecedented volatility in Ethereum and the wider cryptography market.

Now accent is on Ethereum’s ability to maintain its recovery and recover key resistance levels. The uncertainty being always imminent, the next few days will be essential to determine if the ETH can find its bullish momentum or if further is on the horizon.

Ethereum open interest considerably drops

Ethereum has experienced one of the most volatile negotiation sessions in its history, lowering more than 30% in less than 24 hours in the midst of fears of the American trade war, to recover quickly after the announcement by President Trump of negotiations With Canada and Mexico. This extreme price action has shaken investors’ confidence, but analysts suggest that ETH stabilizes and is now preparing for a higher push.

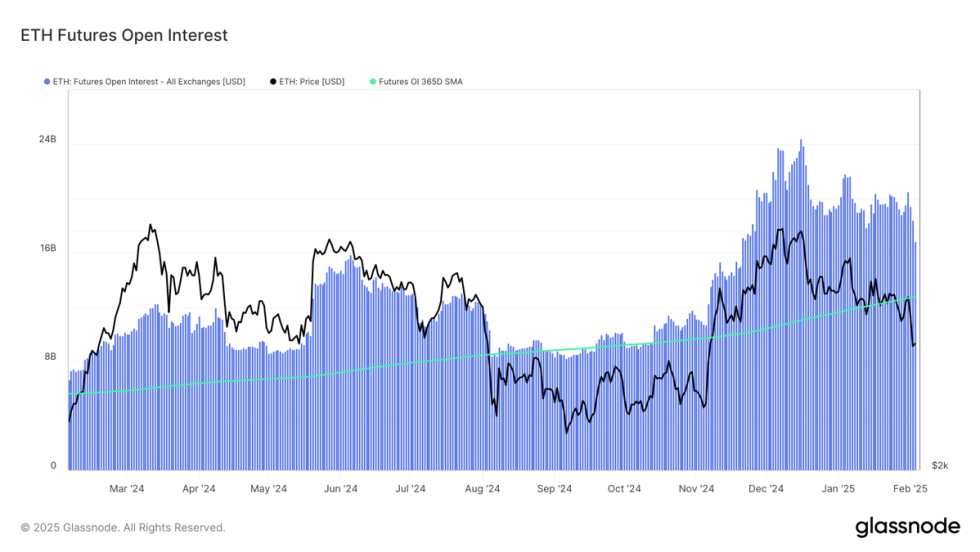

The key data from Glassnode reveal the extent of the liquidation event which has fueled this historic drop. Yesterday, $ 76.4 million in long -standing liquidations hit the market, with $ 55.8 million in one hour – the second largest peak in one year, just behind the liquidation of $ 56 million recorded December 9. The rapid drop in prices has triggered a significant denigration of open interest in the long term. ETH -term contracts increased from $ 20.5 billion in early February to $ 15.9 billion today, annihilating $ 4.6 billion in leverage.

Despite this sharp drop, Ethereum Futures Oi remains ~ 22% above its annual trend line of $ 13 billion, which suggests that the lever effect remains high. The price of Ethereum has been strongly influenced by leverage, because speculation and long aggressive positions have fueled rapid oscillations. As the market recalibbs, an evolution towards the action of stains focused could open the way to healthier and more sustainable growth.

The coming weeks will be crucial to determine if Ethereum can recover his bullish momentum. If the ETH is consolidated above key support levels and open interests stabilize, the market could be established for another higher leg. However, if the lever effect remains high and the speculative trade continues to dominate the action of prices, volatility and additional corrections can follow.

ETH fights below the key level in the middle of the uncertainty of the market

Ethereum (ETH) is traded at $ 2,810 after a very volatile start of the week. Despite a strong recovery compared to its recent stockings, the bulls are always faced with serious challenges because the exchanges of ethn lower than the crucial bar of $ 3,000, a level which also aligns the 200 -day mobile average . This key resistance has historically acted as a major pivot point for the action of Ethereum prices, which makes it a critical level to recover so that the bullish momentum resumes.

If the bulls want to establish a new upward trend, ETH must exceed the $ 3,000 mark with force and maintain it as a support. Successful recovery of this level could open the way to a sustained rally around $ 3,200 and beyond. However, not to make it makes Ethereum vulnerable to a risk of decline.

Losing the level of $ 2,800 could trigger additional sales pressure, which made it possible to re -examine the demand levels below $ 2,650 to $ 2,700. The feeling of the still uncertain market and the leveraged positions relax, the traders are watching closely to the prices for confirmation of the next major movement. That Ethereum can regain its place or cope with new drops will depend on its ability to recover key resistance levels in the coming days.

Dall-e star image, tradingview graphic