The StableCoin market has recently increased in evaluation, And this could be optimistic for bitcoin and other risk assets.

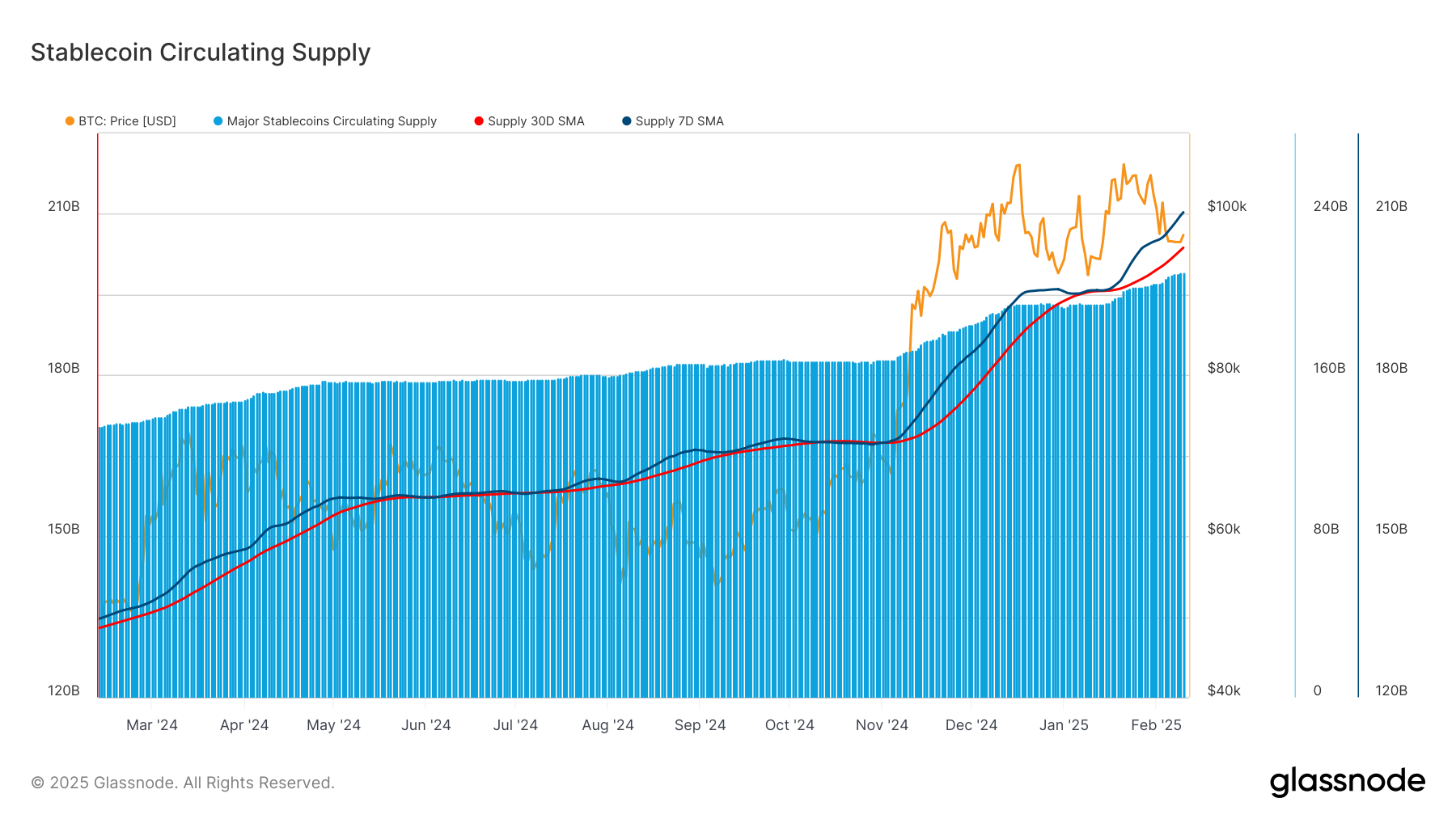

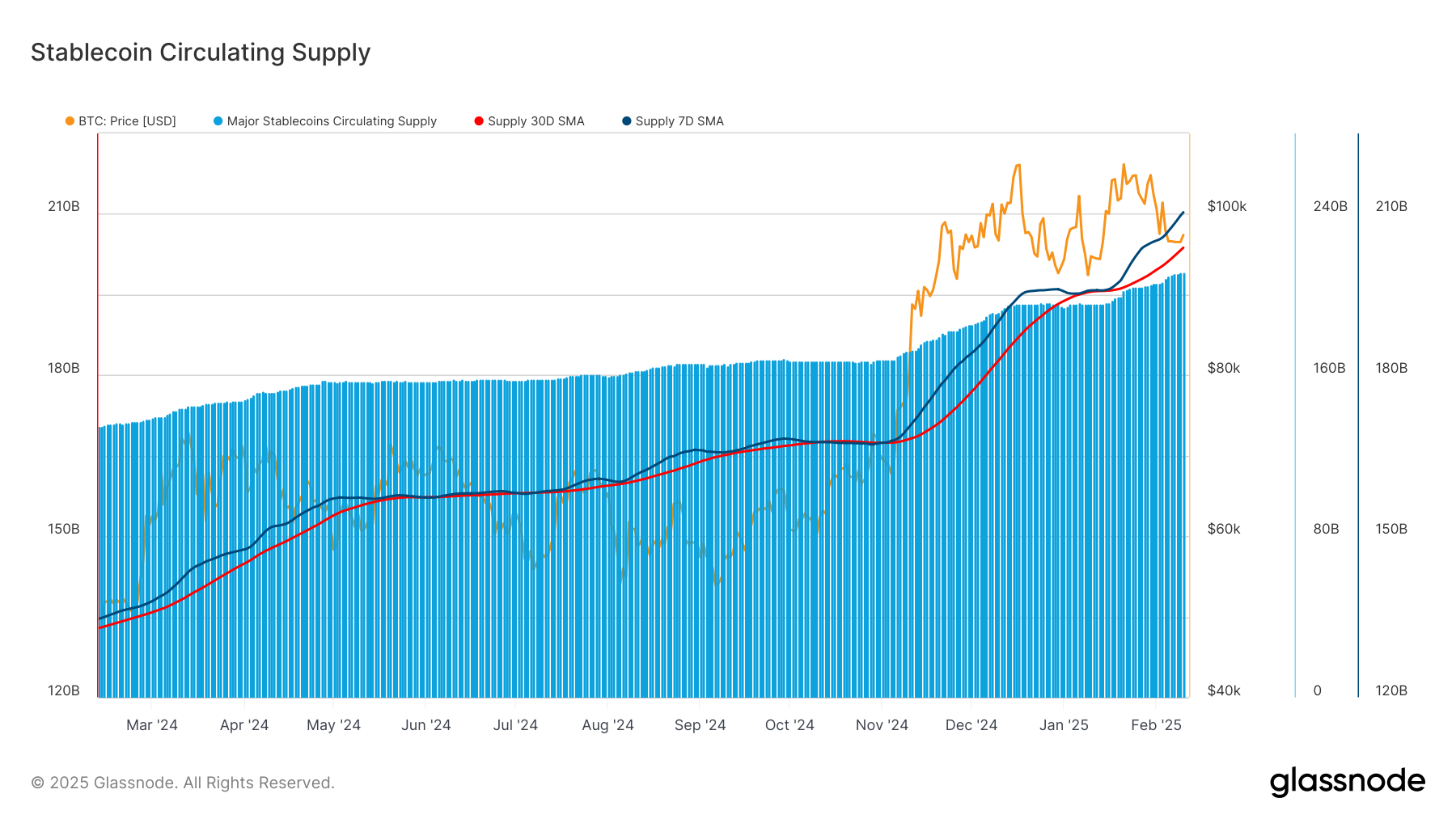

THE Stable market Has considerably developed in 2025, adding around $ 16.97 billion since the start of the year, according to the Blockchain Analytics Glassnode platform.

#Stablecoin The supply in circulation has increased by $ 16.97 billion since the beginning of 2025, from ~ 194.2 billion dollars to ~ 211.2 billion dollars. However, the rate of growth varied, with a slowdown at the beginning of 2025 before resuming in February. pic.twitter.com/tda7t3fs8t

– Glassnode (@glassnode) February 11, 2025

The company revealed that total stablecoin Power supply went from around 194.2 billion dollars to around 211.2 billion dollars this year. In particular, this growth suggests an increase in liquidity on the cryptography market.

Stablescoin growth trends in 2025

However, glass enno note This stablecoin show was not uniform throughout the year. In November and December 2024, the market increased by around $ 450 million every day.

Nevertheless, the pace slowed down in January 2025, with an average of $ 400 million per day. This month, growth picked up Again, with an average daily increase of $ 541 million.

Mid-January saw A notable peak, while the average seven -day stabbed emission exceeded the simple 30 -day mobile average (SMA). This indicated a renewed short -term request, indicating that the capital flow Back in the crypto.

For the context, several major stable shows occurred during last week. On February 4, the Whale Alert blockchain follow-up platform reported that Attached struck USDT 1 billion in a single transaction.

💵 💵 💵 💵 💵 💵 💵 💵 💵 1,000,000,000 #Usdt (1,000,415,000 USD) struck Trether Treasury

– Whale alert (@whale_alert) February 4, 2025

In addition, Circle, the USDC transmitter, struck USDC on three distinct instances on February 4, 6 and 7 with each program totaling USDC 250 million. In addition, in total, Circle created USDC 1.057 billion in February only. Paxos, the Pyusd transmitter, also added 65 million Pyusd to the offer this month.

The USDT dominates the Stablescoin market despite the challenges of the mica

In particular, Stablecoin’s market capitalization has now increased to $ 230 billion, according to CoinmarketCap. TETHER continues to lead, with a market capitalization of $ 141.9 billion, despite regulatory problems within the framework of the European Union Mica, which has Drive to crimes.

The USDC follows with a market capitalization of $ 56.2 billion. Ethena The USDE (USDE) ranks third with $ 6 billion, while DAI (DAI) holds the fourth position With $ 5.3 billion.

Why the growth of stablescoin can be optimistic for bitcoin and crypto

The growing offer of Stablecoin is often a precursor at higher purchase pressure on the cryptography market. When investors hold more stablescoins, they generally position themselves themselves to buy risk assets, which can generate higher prices.

Meanwhile, Santiment recently reported that crypto traders had moved their attention to Bitcoin and Blockchains of layer 1, such as Cardano, Toncoin, Solana and Ethereum.

😀 The cryptographic community has largely moved their attention to Bitcoin and other layers of layer 1 such as Ethereum, Solana, Toncoin and Cardano. Collectively, the higher active ingredients of layer 1 obtain 44.2% of the discussions between specific parts. Meanwhile, the best coins like Dogecoin, Shiba… pic.twitter.com/ppbjd9vsi4

– Santiment (@santimentfeed) February 10, 2025

These assets collectively represent 44.2% of discussions in the cryptographic community. Meanwhile, the interest in parts even as Dogecoin, Shiba Inu and Pepe decreased.

According to Santiment, this change leads to a more stable market environment. The pieces even generally thrive on speculative media threshing, but when the emphasis moves to Bitcoin and layer 1 networks, it suggests a more mature and durable growth phase.

Historically, excessive speculation in parts even preceded market corrections. On the other hand, the growing interest in basic blockchain infrastructure often highlights a stronger basis for long -term growth.

Difles: This content is informative and should not be considered financial advice. The opinions expressed in this article may include the author’s personal opinions and do not reflect the basic opinion of cryptography. Readers are encouraged to do in -depth research before making investment decisions. The Crypto Basic is not responsible for financial losses.