Key dishes to remember

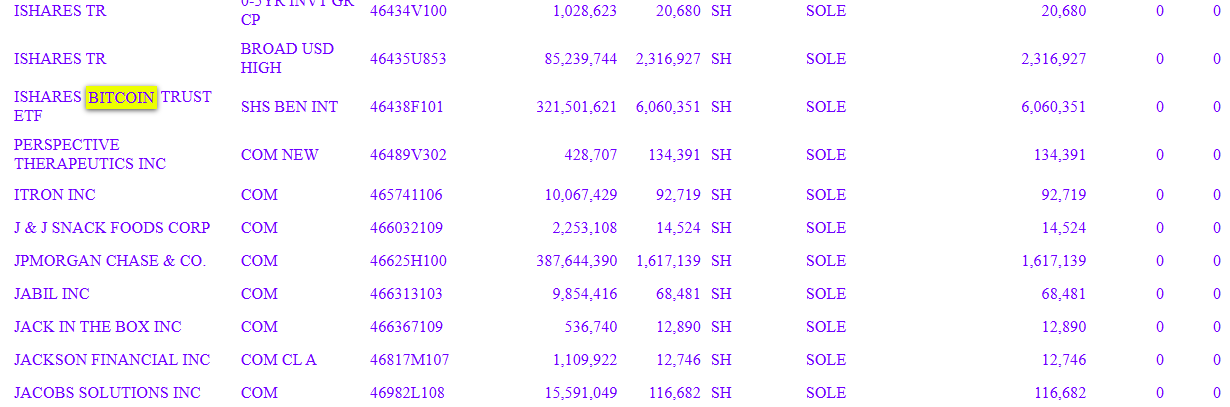

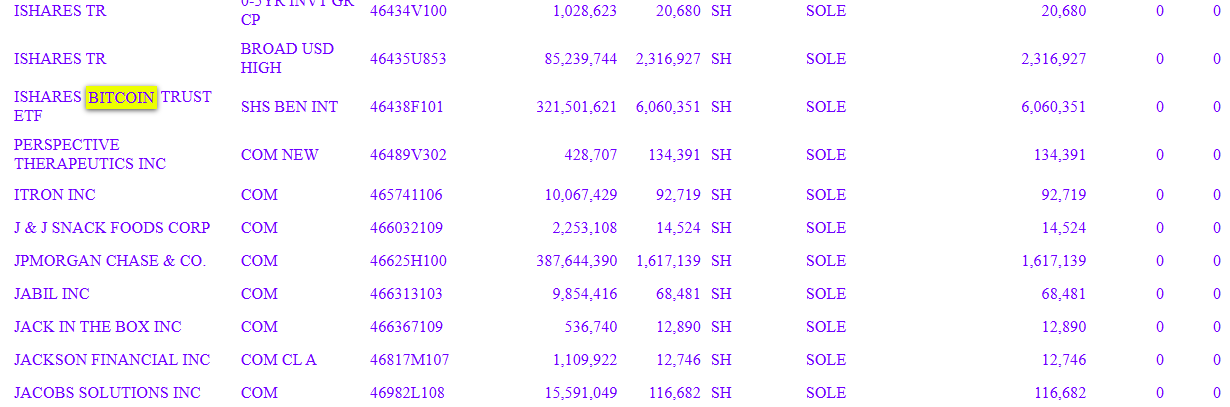

- The Wisconsin Investment Board has doubled its assets in Ishares Bitcoin Trust of BlackRock at 6,060,351 shares worth $ 321.5 million.

- The Wisconsin Board of Directors has also diversified investments in Crypto -related companies such as Coinbase and Digital Marathon.

Share this article

Wisconsin’s investment office (Swib) has doubled its assets in Ishares Bitcoin Trust (IBIT) in BlackRock, adding more than 3 million shares to reach 6 million shares valued at more than $ 321 million at 31 December 2024, according to a recent dry deposit, according to a recent deposit of the dry, dry.

The increase marks a remarkable expansion of approximately 2.8 million shares that the state pension fund held at the end of September 2024. The board of directors sold its position of 1,013,000 shares of the Graycale Bitcoin Trust (GBTC) During the second quarter of 2024, before relaxing its Ibit investment.

Ibit has become the fastest Bitcoin Bitcoin Fund, accumulating around $ 41 billion in net entries since its launch. The assets of the management fund reached $ 56 billion on February 14.

The Wisconsin Board of Directors has diversified its investments related to the crypto beyond Ibit, with Coinbase issues, Mara Holdings, Robinhood and Block Inc.

Earlier this week, Goldman Sachs disclosed his assets of more than $ 1.5 billion in funds (ETF) negotiated in exchange for American Bitcoin, including approximately $ 1.2 billion in Ibit and $ 288 million in Bitcoin funds de Fidelity (FBTC).

Share this article