Este Artículo También is respondable in Español.

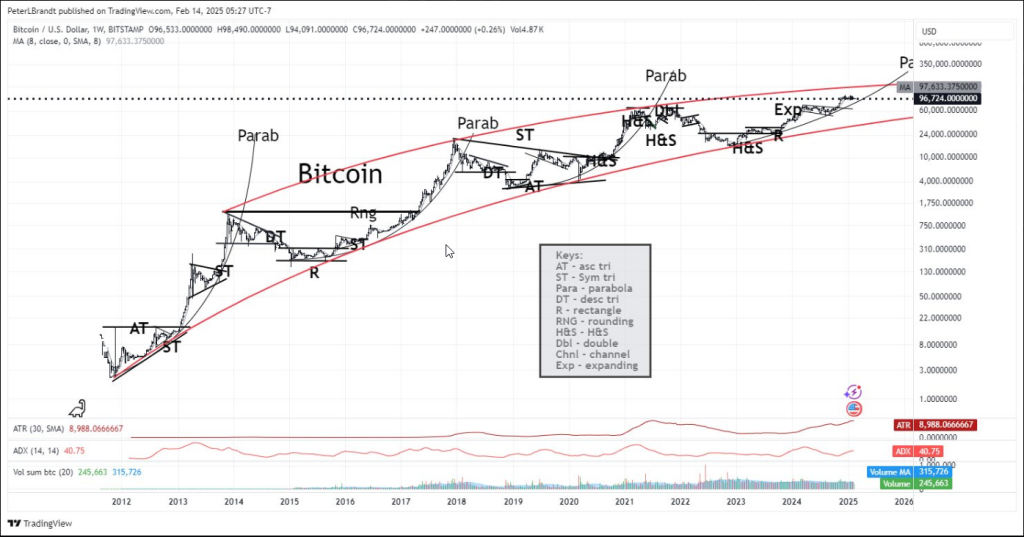

Peter Brandt, a experienced merchant, rejected optimistic predictions following the recent Bitcoin increase to $ 97,000 +.

His latest technical analysis indicates that the most important cryptocurrency may have difficulty exceeding the coveted threshold of $ 200,000 before 2030.

Bitcoin demonstrated a mixed performance, with a daily gain of 0.17% and a drop of 2.85% during the week, which caused forecasts.

Related reading

The prolonged path to six digits

Bitcoin will face important challenges to vioder the psychological barrier of $ 100,000. The 8-week mobile average of $ 97,633, which has always rejected the upward movements, presents the cryptocurrency with significant resistance.

From the world of crazy ideas comes this thought – a thought, not a job

Unless Bitcoin has an exhaust speed by the higher parabolic resistance line, BTC is very unlikely to be negotiated over $ 200,000 at the end of this decade. Only, an answer. No interest in non-☑️replies pic.twitter.com/7a5n7gliw8– Peter Brandt (@peterlbrandt) February 14, 2025

The average real beach (ATR) of 8,988 and the average directional index (ADI) of 40.75, which both support a strong trend, show increased volatility under current market conditions.

Historical models paint an edifying story

Since 2012, Bitcoin has developed a distinctive model that has captured the interest of technical experts. In a redheaded channel, cryptocurrency bounces between two crucial lines of trend that serves as price barriers.

Bitcoin’s trend is particularly intriguing to net corrections and parabolic movements. Market veterans have increased their antennas due to the striking similarities between the current rally and these previous cycles.

Trading volume increases red flags

The figures tell an interesting story about how people participate in the market. There is a chance that the current rally will not be stable because the total volume of 20 bitcoin periods of 245,600 is low compared to other stages in small groups.

Maintaining a long -term upward trend could be difficult in the absence of a significant increase in the volume of trade. For analysts who look at the next major Bitcoin movement, this low volume was an increasing concern.

Related reading

Support and resistance: drawing of battle lines

Bitcoin’s future depends on critical price levels that could determine its fate. Solid support is present in the range of $ 60,000 to $ 70,000, while a solid resistance zone is looming between $ 100,000 and $ 120,000.

If the situation is getting worse, Bitcoin can review the lower limit of its long -term channel, which is about $ 40,000 to $ 50,000.

Brandt’s analysis indicates that the Bitcoin trajectory at $ 200,000 by 2030 is doubtful in the absence of a significant rupture above the upper limit of its parabolic trajectory.

The veteran merchant underlines the need for sustained momentum and the ability to go beyond critical resistance levels in order to obtain such high assessments.

Pixabay star image, tradingview graphic