Main to remember

- Bitcoin Bull Saylor has just referred to the new Acquisition of Strategy Bitcoin.

- The company provides a convertible ticket offer of $ 2 billion for Bitcoin acquisitions.

Share this article

After a brief break, the strategy may have resumed its purchase of Bitcoin. Michael Saylor published the Bitcoin Tracker on X on Sunday, which is generally followed by an advertisement announcement of Bitcoin.

I don’t think it reflects what I did last week. pic.twitter.com/57qe7qfwkm

– Michael Saylor⚡️ (@saylor) February 23, 2025

The Saylor tweet comes after the strategy announced on Wednesday an offer of convertible notes tickets of $ 2 billion, bearing 0% interest and maturation in 2030, with the product for general purposes, including the acquisitions of Bitcoin.

The company based in Tysons, Virginia, which recently renamed Microstrategy, currently has 478,740 Bitcoin worth around $ 46 billion at current prices. Its latest Bitcoin acquisition of 7,633 BTC occurred during the week ending on February 9, at an average price of $ 97,255 per room.

After its recent sale of ordinary class A shares, the strategy maintains approximately $ 4 billion in actions available for sale. The company often uses the product of these sales to finance its next purchase in BTC.

The strategy has invested around $ 31 billion in Bitcoin at an average price of $ 65,000 per room, generating nearly $ 15 billion in unrealized gains.

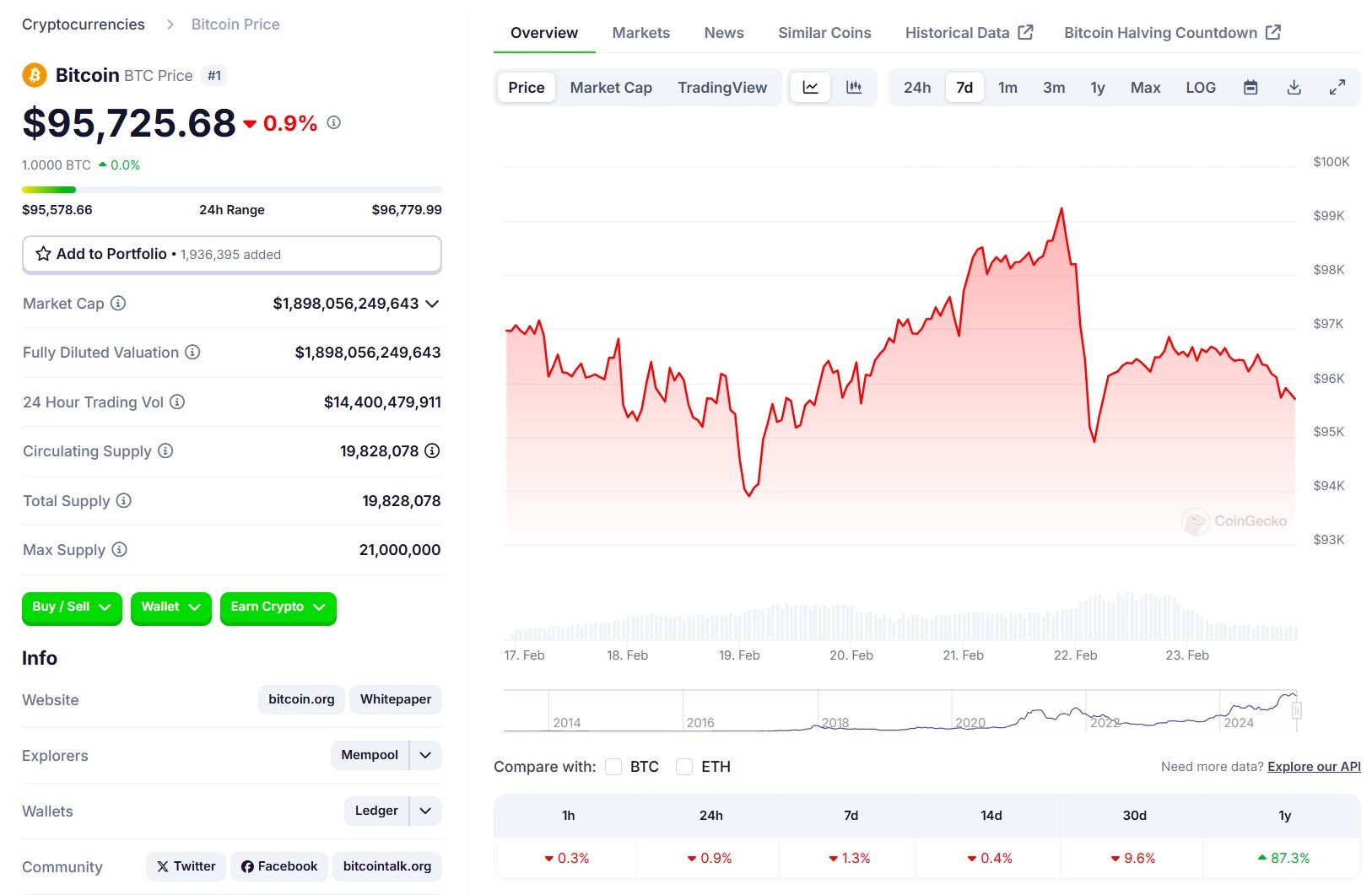

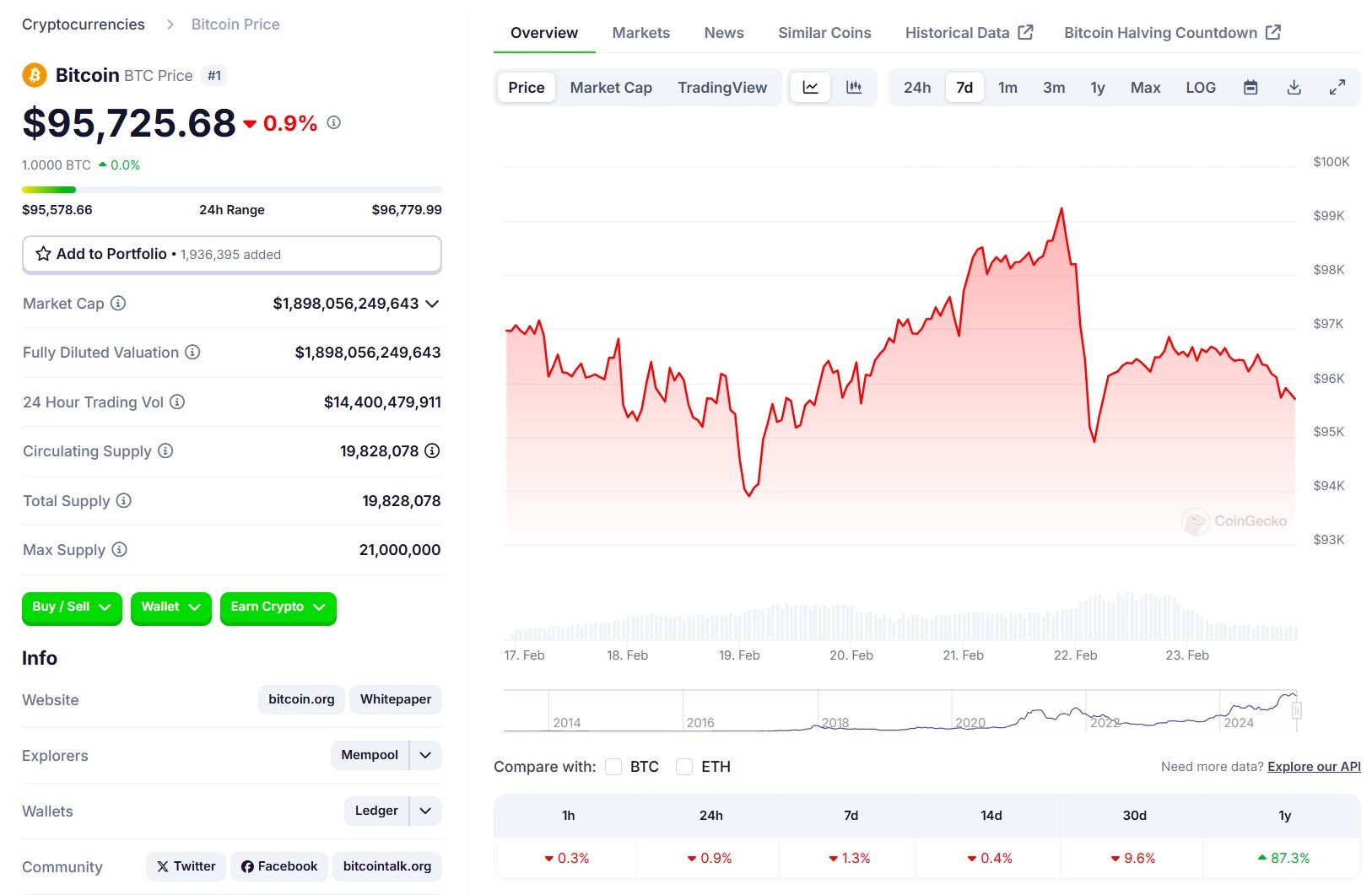

Bitcoin experienced volatility this week, reaching $ 99,000 Friday before going below $ 95,000 following a $ 1.4 billion hack bordeau, according to Coingecko data.

The digital asset is currently negotiated at around $ 95,700, showing a slight decline in the last 24 hours.

Share this article