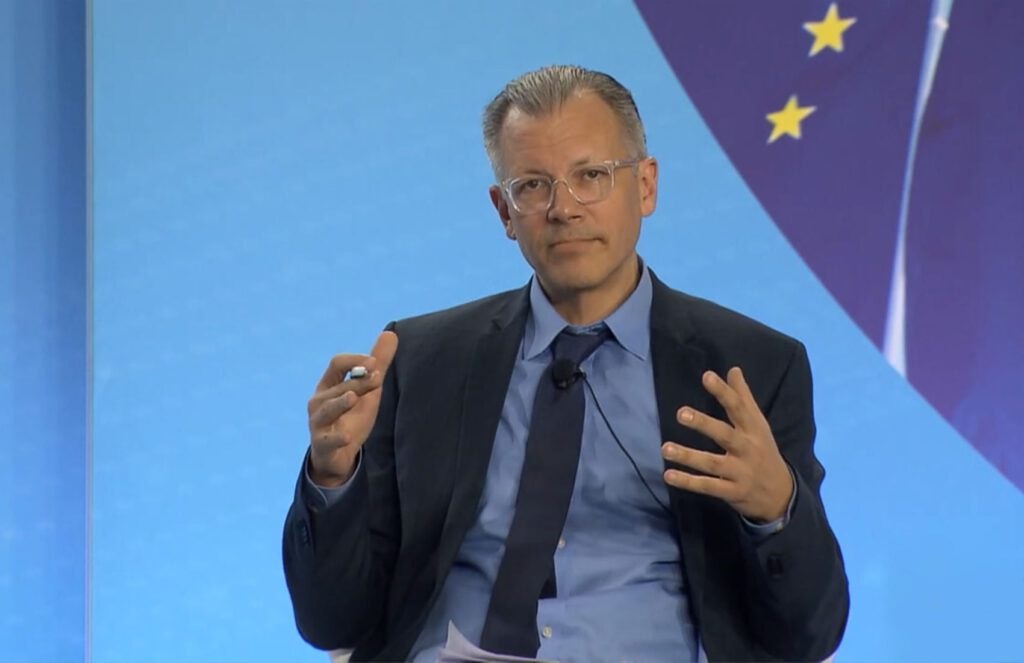

A recently published article explores the relevance of “public cryptography networks” for financial market infrastructure. He was co-written by Ulrich Bindseil, Managing Director of the European Central Bank (ECB) for infrastructure and market payments, alongside Omid Malekan from the University of Columbia. Overall, it is very positive on the potential for financial innovation on cryptographic networks.

The authors conclude that many of the advantages of public blockchains “could allow cryptographic networks to provide unprecedented financial market infrastructure”. This includes their support for decentralized finances (DEFI), their ability to eliminate intermediaries and allow automation.

Assuming that the digital euro obtains a green light from regulators, Europe could have a digital currency from the Central Bank (CBDC) in three or four years. The document indicates: “There is no technical reason why a CBDC cannot be issued on a public cryptography network. A central bank – if it is comfortable with risks … – could also make a cash complaint against its assessment on Ethereum as it could on a large “unified” book authorized by the bis. »»

On the point of authorized DLTS, the authors express a certain skepticism despite (or because of?) The recent trials of wholesale settlement of the BCE, which mainly implied the authorized DLTs. They express the argument of most defenders of cryptography – that an authorized blockchain is a complex database with cryptographic bloating. The authors note that the main reasons for their use by institutions include confidentiality, scalability and regulatory requirements.

The document concludes that the “largest beneficiaries of the continuous ICT improvement could end up being financial engineers who will one day be able to design new products inspired by what can be and unloaded by what has been.”

A summary

The document explores blockchains without authorization through five dimensions, starting with a temporal perspective. Public blockchains operate 24/7 and there is no technical reason why large central bank systems do not work on weekends. Each blockchain is distinctive in terms of block time and finality.

The other dimensions discussed include:

- Streaming payment potential

- Blockchains support all types of assets and conditional transactions

- Programmability

- Disintermediation.

Given the involvement of a central banker, the newspaper offers a certain balance. It addresses some of the drawbacks of public chains such as the risk of hacking, governance and illegal finance.

On previous occasions, Mr. Bindseil was very critical of Bitcoin, including in a recent report. This position is not incompatible with the last article. His main concern with Bitcoin is that it is an unproductive speculative asset. Consequently, it could remove the capital from more productive investments in the real world. In addition, he sees a transfer of wealth from the first Bitcoin holders to those later.