A Bitcoin cycle indicator from analytics firm CryptoQuant suggests that BTC has transitioned into a bearish phase following the crash.

CryptoQuant’s Bitcoin Bull-Bear Cycle Indicator Now in Negative Territory

In a new article on X, CryptoQuant’s Head of Research Julio Moreno discussed the latest development of the “Bull-Bear Market Cycle Indicator” designed by the analytics firm.

This metric is based on CryptoQuant’s P&L index, which itself is a unification of a few different popular on-chain metrics related to unrealized and realized profit/loss.

The P&L index is basically used to determine whether BTC is currently in a bear or bull market. When the indicator crosses above its 365-day moving average (MA), it can be assumed that BTC has entered a bullish phase. Similarly, a drop below the MA implies a bearish transition.

The Bull-Bear Market Cycle Indicator, the actual metric we’re focusing on here, visualizes the P&L index in a more convenient form by keeping track of its distance from its 365-day moving average.

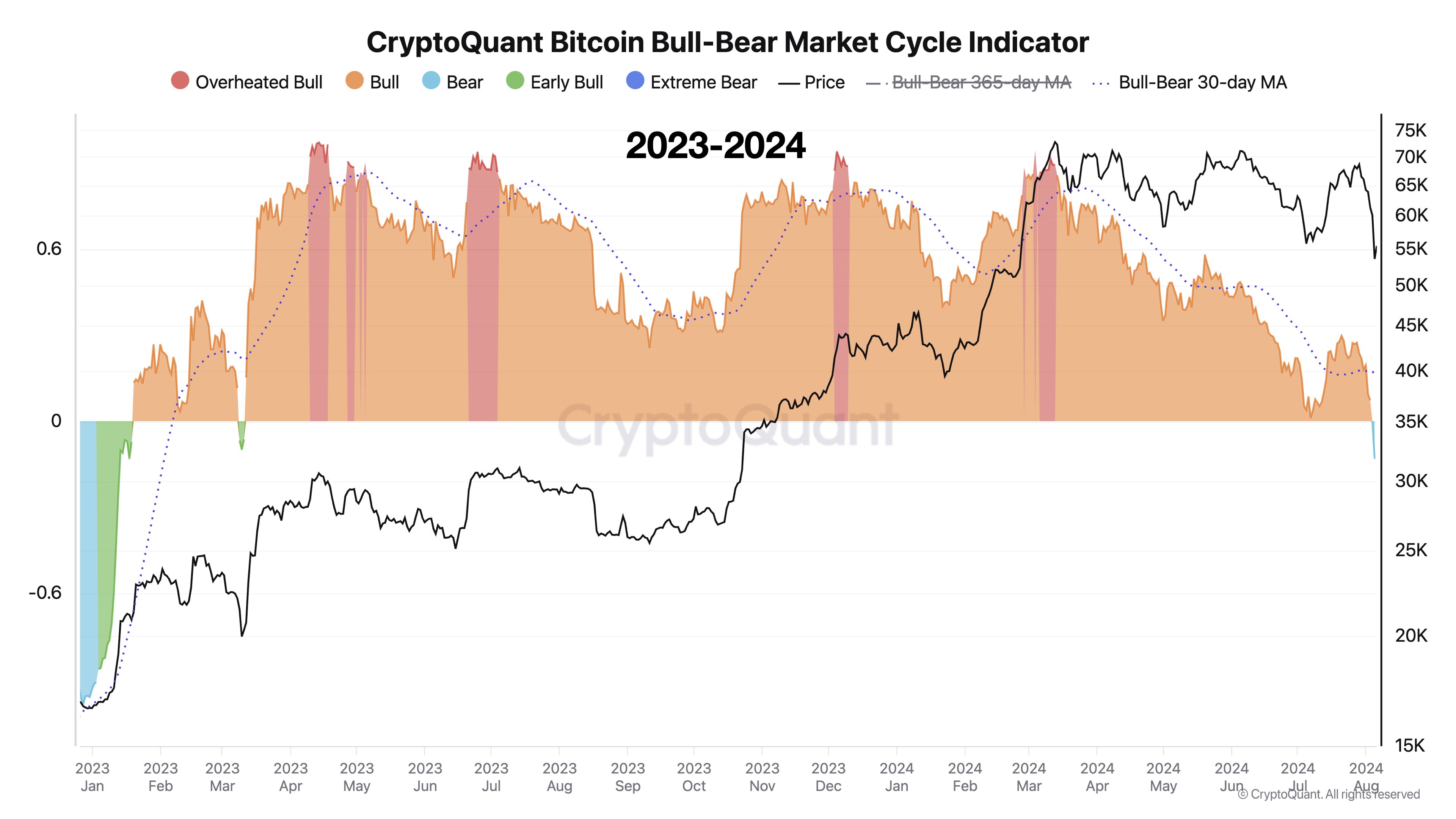

Now here is a chart that shows the trend of this Bitcoin indicator over the past two years:

The value of the metric appears to have plunged into the negative territory in recent days | Source: @jjcmoreno on X

As seen in the chart above, Bitcoin’s bull-bear market cycle indicator had spiked earlier in the year as the asset’s price hit a new all-time high (ATH) and reached territory known as the “overheated bull.”

At these values, the P&L index is significantly away from its 365-day moving average, which is why the asset price is considered overheated. Along with these overheated values, the asset has reached a peak that continues to be the peak of the rally so far.

After spending months in normal bullish territory, the indicator appears to have dipped below the zero mark, implying that the P&L index has now crossed below its 365-day moving average.

The bull-bear market cycle indicator is now signaling a bearish phase for Bitcoin. Moreno notes that this is the first time since January 2023 that the indicator has given this signal.

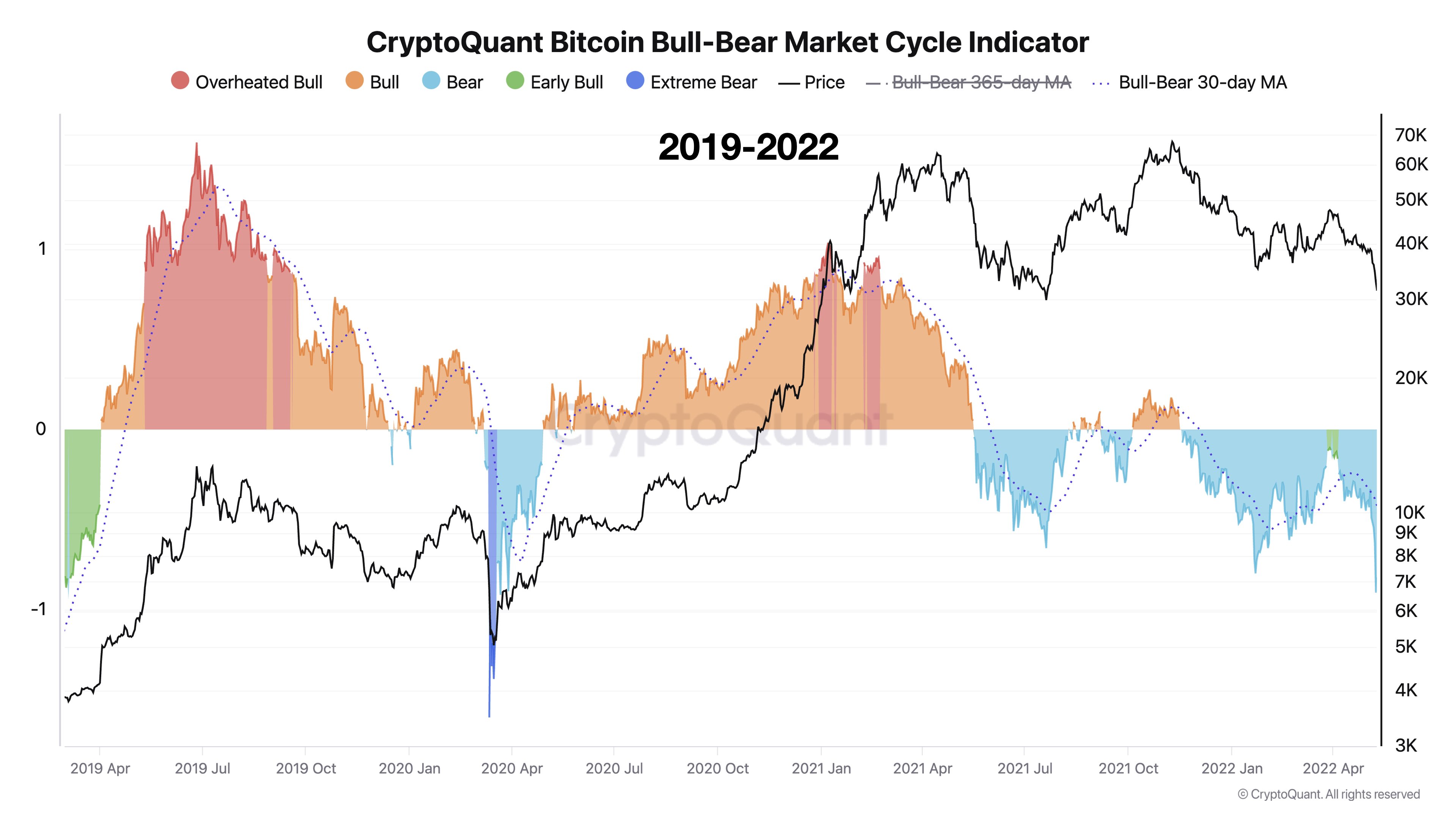

It should be kept in mind, however, that this signal does not necessarily mean that the cryptocurrency is heading towards a prolonged bear market. As the head of CryptoQuant pointed out, there have been periods in the past when the indicator only temporarily signaled a bearish phase for BTC.

The previous bear phases for the asset | Source: @jjcmoreno on X

From the chart, it is clear that the COVID-19 crash in March 2020 and the mining ban in China in May 2021 both led to temporary bearish phases from the indicator’s perspective.

It now remains to be seen whether the Bitcoin bull-bear market cycle indicator will also remain in the negative territory for a brief period this time or not.

BTC Price

At the time of writing, Bitcoin is trading just below the $57,000 level, down nearly 14% over the past seven days.

Looks like the price of the coin has been making recovery since the crash | Source: BTCUSD on TradingView

Featured image by Dall-E, CryptoQuant.com, chart by TradingView.com