Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum was faced with massive pressure and volatility in the last month, while all trends in the downward cryptography market, pushing the ETH to crucial demand levels. Uncertainty dominating the market, the merchants remain cautious while Ethereum has trouble recovering lost ground.

Related reading

Analysts expect even more volatility following the decree of the American president Trump on Thursday, which created a strategic bitcoin reserve. Although the announcement was to stimulate the feeling of the market, it introduced more uncertainty, leaving uncertain investors of its long -term impact on cryptographic space.

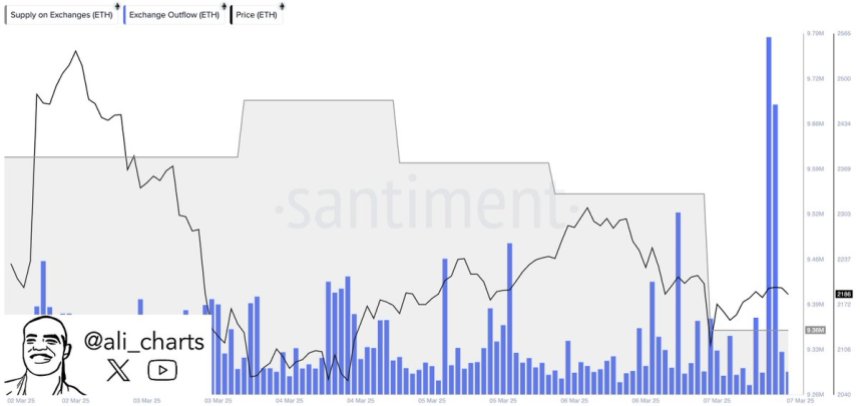

Despite the decrease in progress, data on the Santiment chain reveal a Haussier signal – 330,000 Ethereum have been removed from exchanges in the last 72 hours. Such outputs often indicate that investors move the ETH in private portfolios, suggesting reduced sales pressure and possible long -term accumulation.

And Ethereum hovering for the main levels of support, the next few days will be essential to determine if the ETH stabilizes or faces the decline. If the feeling of the market is improving and the exchange exits are continuing, Ethereum could see a strong recovery. However, if the sales pressure persists, another stage of the leg remains a possibility, keeping traders on high alert.

Ethereum faces a critical test

Ethereum has lost more than 50% of its value since the end of December, triggering a massive fear and a sale of panic throughout the market. Formerly a main force in crypto gatherings, ETH now has trouble resuming momentum, leaving investors wondering if long -awaited allusivity will materialize this year. Many analysts speculate that it will not be, because Ethereum and most Altcoins continue to fight, unable to recover optimistic parameters or establish a clear recovery trend.

Despite the lowering feeling, there is still hope for a rebound, because the data on the chain suggest potential optimistic catalysts. Ali Martinez shared data on santly, revealing that 330,000 Ethereum have been removed from exchanges in the last 72 hours. This important outing could indicate that investors move the ETH in private portfolios, reducing immediate sales pressure and potentially preparing the path for compression of the offer.

Pressure of the offer occurs when the available offer of an asset on exchanges decreases, which makes more difficult for sellers to lower prices. If Ethereum continues to have key demand areas and purchase pressure increases, the reduced exchange supply could cause high recovery to higher price levels.

Related reading

For the moment, traders are looking at if ETH can stabilize and recover critical resistance levels. If the bulls regain momentum, Ethereum could start a recovery trend in the coming weeks. However, if the sales pressure persists, another downward movement wave remains a possibility, keeping the market on board. The next few days will be crucial to determining the short -term management of Ethereum and if the recent exchange of exchange reports a turning point for ETH.