The long -term gold price has torn the ceiling of $ 3,000, reaching $ 3,001.30 in the term contracts in April and cement a rise of 20% in a few months. This record race was motivated by the geopolitical chaos of the US President Donald Trump and the challenges that investors are confronted in adaptation.

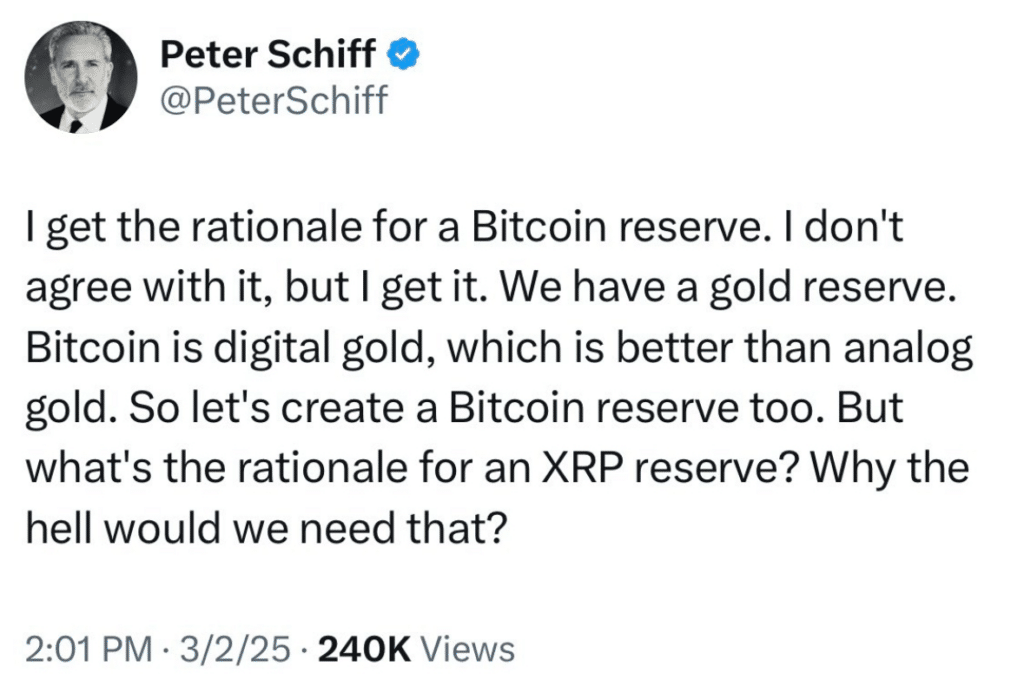

And, of course, the largest Gold Girl cheerleader, American broker Peter Schiff, celebrated the record price of X.

We are sure that Schiff thinks: “Oh, did you think your little funny internet money was worth the value of real and usable real gold 50 times?” No. That’s right. Now say my name.

So where is the gold which then heads and will it surprise the BTC?

The long -term gold price crushes $ 3,000 per ounce

Gold hit $ 3,000 like a beating ram, powered by a jump of $ 57.90 (+ 1.97%) in one day. The PPI report of February was added to the momentum, showing a 3.2% increase in wholesale prices from one year to the next, signaling a cooling saving and speculating on Fed rate reductions. “This flight to gold signals deep discomfort,” said Robert Yawger by Mizuho Financial Group.

Gold draws silver like a black hole while the markets are billed under pressure. The trifecta of climbing prices, geopolitical disorders and tight investors lead flows in future, ETF and ingots. The actions are out, stability is in it.

While shares and Bitcoin are decreasing again today, gold is up $ 40, reaching another record. Gold costs only $ 25, reaching $ 3,000. Instead of wasting time understanding how to add to its Bitcoin reserve, why is the United States government not added to its existing gold reserve?

– Peter Schiff (@peterschiff) March 13, 2025

A softer consumer price index adds to the frenzy, suggesting that the economy could cool faster than expected. Lower inflation reinforces the chances of a dominant diet, preparing the ground for gold to extend its race like the essential coverage.

A look at the bullish predictions

The gold rush crosses borders and breaks the barriers. Traders and jewelers, especially in India, feed the frenzy. The Multi Commodity Exchange reported a turnover per day of $ 7 billion in February from the gold options alone, which represents 26% of the total negotiation volume.

Gold analysts cut their bets according to which the current Boom of Gold has legs, projecting a ascending trajectory well in 2025:

- Macquarie Bank Increased its 3rd $ 3 150 peak price of gold price forecasts, which potentially affected $ 3,500 in certain scenarios adjusted to inflation.

- BNP Paribas provides that gold is climbing over $ 3,100 / oz in the second quarter, citing pricing threats and evolving international relations as catalysts.

The upcoming road

Golden bugs like Peter Schiff’s analysis stem from long -term ramifications of monetarist interference in the economy. The distortions he creates will cause long -term problems, such as the need to create inflation.

The problem with PM experts is that the story they are talking about has a much longer calendar than they really refer. So, if you are going all in PMS in 2008, you missed many gains from the same inflation you needed to protect yourself. This is why it is important to remember that Schiff believes in gold and has long abandoned the idea that this will go zero.

So, a friendly reminder that even Peter Schiff admits that Bitcoin is “digital gold”, and addition to your battery has been an intelligent decision for 15 years.

He is also a Grinking boomer, but we love it. His podcast teaches you a lot on the economy. In addition, he says that the next great opportunity will be gold extraction stocks, who go Gigapump this year.

“If you are thinking of buying precious metals, I think Silver is the best purchase,” published Schiff on Twitter. “But the best purchase is gold and silver extraction stocks. They are still negotiated below where they were before Trump was elected. The best way to buy minors is $ epgix. »»

Explore: the XRP price jumps 11% after the progression of dry crypto unit tease xrp etf

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

The long -term gold price has torn the ceiling of $ 3,000, reaching $ 3,001.30 in April in the long term.

-

A friendly reminder that even Peter Schiff admits that Bitcoin is “digital gold”, and addition to your battery has been an intelligent decision in the past 15 years.

The post-Gold’s long-term price has managed to reach all time: what does gold mean for the BTC price? appeared first on 99Bitcoins.