Ethereum has suffered another blow this week, sliding at a new hollow of around $ 1,380 – a level that we have not seen since March 2023. The downward trend has left increasingly concerned investors, many now wondering if the long -term optimistic structure of ETH is still intact. Market conditions remain severe, driven by persistent macroeconomic tensions, an increase in global instability and uncertainty resulting from American trade and budgetary policies.

The feeling through the crypto space continues to deteriorate, and the action of the prices of Ethereum reflects this discomfort. After months of difficulty maintaining key support levels, the rupture of less than $ 1,500 added to the fears that a deeper correction takes place.

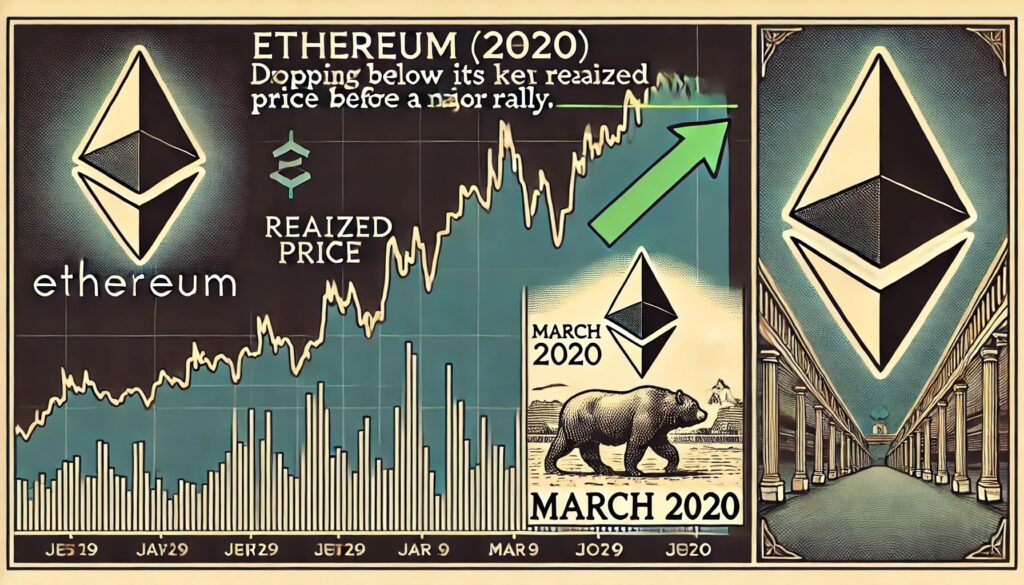

However, in the middle of the gloom, there can be a silver lining. According to Cryptorank data, Ethereum is now negotiated below its price made – a rare occurrence historically associated with market funds and solid recovery phases.

Although short -term perspectives remain uncertain, such signals on the chain could indicate that Ethereum is entering a key accumulation area. The next few days and weeks will be essential to determine whether it is another step – or the start of a long -term reversal.

Ethereum flows below the price made while fear takes control of the market

Ethereum has now lost more than 33% of its value since the end of March, arousing deep concern among investors and analysts. Prix diving brought ETH to levels that are not seen in more than two years, causing panic and despair among holders who once expected 2025 as a year of escape for altcoins. Instead, Ethereum has become a symbol of market fragility while the wider macroeconomic landscape continues to worsen.

The fears of the trade war, inflationary pressure and a potential global recession shake up the financial markets to their hearts. In this climate, high -risk assets like Ethereum are among the first to suffer. While the capital comes out of speculative assets in favor of safer Havens, the sale of ETH has only accelerated – and investors’ confidence has taken a blow.

However, there may be a glimmer of hope in the data. Top Crypto’s analyst, Carl Ruefelt, recently underlined on X that Ethereum is now negotiated below its price made of $ 2,000 – a rare event which has historically pointed out major turning point in the ethn price trajectory.

Runefelt stressed that the last time that ETH fell below its price made, it was in March 2020, when it went from $ 283 to $ 109 – to recover strongly during the following months. Although the current environment is full of uncertainty, these metrics on the chain again suggest the possibility that the ETH enters an accumulation phase.

However, confidence remains fragile and the action of prices must stabilize before any real optimistic story can return. The next Ethereum movements will be essential to determine whether this level marks a real low – or just another stop going down.

ETH struggles below $ 1,500 without clear support in sight

Ethereum is currently negotiated below the level of $ 1,500 after suffering a sudden drop of 50% since the end of February. The aggressive sale has erased from months of earnings and left investors in a state of uncertainty, because ETH shows no signs of recovery. The feeling of the market remains extremely lower, and there is little indication that a background has been reached.

At this stage, Ethereum does not have a clearly defined support area. The bulls have lost control and prices’ action continues to lower with low demand and growing fear. For a significant reversal to start, ETH must first recover the level of $ 1,850 – an area which previously served as a key support and is now a major resistance.

Until this happens, any upward attempt is likely to undergo strong sales pressure. The situation becomes even more precarious if Ethereum loses the level of $ 1380, which has so far acted as a psychological threshold. Falling below this area could open the door to a deeper correction to the fork from $ 1,100 to $ 1,200.

Macroeconomic tensions that are still high and volatility that should persist, traders and investors will watch closely to see if Ethereum can stabilize – or continue its sharp decline.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.