- TRX and ADA are in a fierce battle for market domination

- A flip could be in progress soon if some key measures turn around

Tron (TRX), Cardano (ADA) and Dogecoin (Doge) compete for domination, TRX and ADA have been locked in a tight competition for 9th place in the stock market capital classification. However, the prolonged consolidation of Cardano less than $ 1 has raised concerns about its ability to maintain the confidence of investors.

In fact, the chain data revealed structural weakness in the activity of the ADA network – daily active addresses contracted 30.3% from one year to another, while the generation of costs slipped below pre -electoral levels at only $ 8.1,000.

These deteriorated measures alluded to a decreasing demand profile, which potentially led the rotation of capital to Tron as a more resilient “alternative”.

To assess whether this transition materializes, Ambcrypto has analyzed the key blockchain data, monitoring the migration of capital, implementation trends and the positioning of whales.

Is it “structurally positioned” to overtake Ada, or does he have the weakening principles of Cardano who gave him an advantage?

Comparative analysis has revealed key ideas

Chain analysis highlighted a striking divergence between Tron and Cardano. While the activity of the Cardano network has deteriorated, the liquidity inputs of Tron remain robust, driven by the domination of the stables.

A new USDT mint of $ 1 billion on a tron has strengthened its set of regulation layer, potentially amplifying the request for the implementation of TRX and the utility of the network.

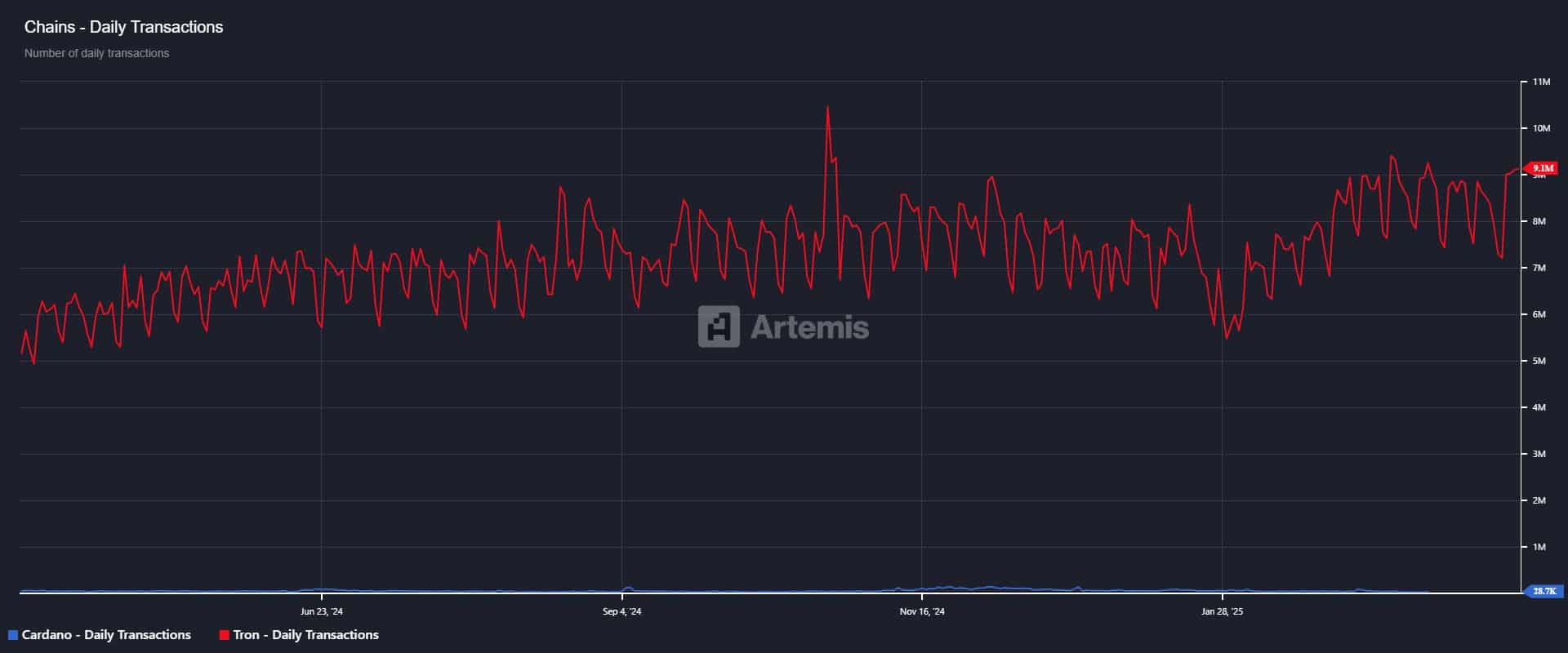

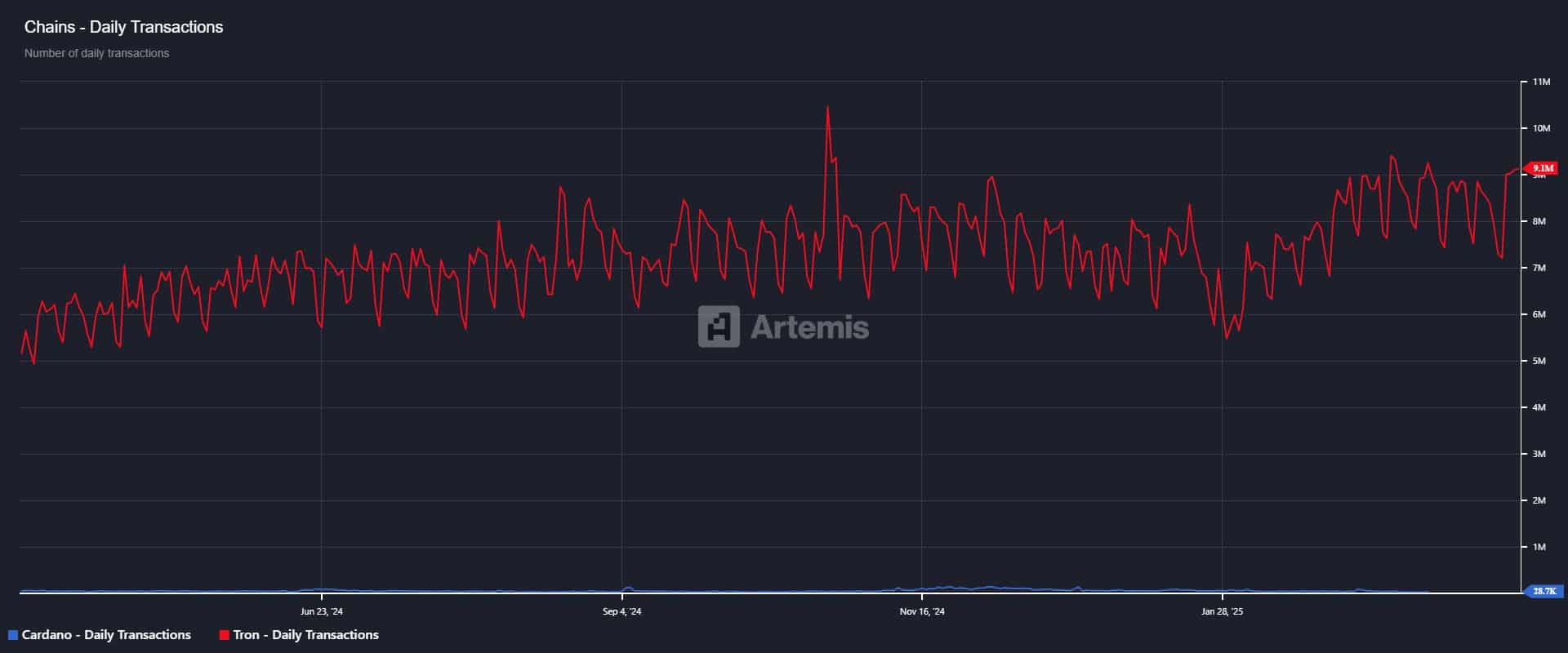

The contrast is obvious in transaction measures – daily TRON transactions jumped from 76.8% in annual sliding to $ 9.1 million, while Cardano dropped from 38.8% to only 28.7,000, reflecting a sustained structural weakness.

Source: Terminal artemis

However, the total locked tron value (TVL) fell 9% to 7.3 billion dollars, reporting that the domination of the stablescoin did not lead to a challenge of challenge. Conversely, Cardano TVL climbed 17.4% in annual sliding to $ 431 million – a sign of increasing adoption of challenge.

Despite the DEFI offset, the TRX negotiation volume climbed from 179.4% per day to 955.27 million dollars, with sustained address growth – indicating persistent market demand for the asset.

These data underline a critical change – the structural advantage of Tron on Cardano is not simply a function of the fundamentals of deterioration of ADA.

Instead, it is a direct result of the expansion liquidity base of TRX, the usefulness of increased settlement and the robust positioning of the market.

Price action implications – ADA VS TRX

The structural divergence between ADA and TRX is more and more reflected in their price action. ADA closed the first quarter with a 21%draw, while TRX showed relative resistance, limiting losses to 8%.

More critical, ADA’s monthly performance highlighted the persistent pressure of the persistent sale, recording a sharp drop of 15.63%. On the contrary, TRX challenged wider macro opposites, gathering 7% over the same period.

However, the two active ingredients share a similar post-electoral reversion. The ADA remains 52% below its high cycle, while TRX follows closely with a reduction of 47%, indicating that a large part of the network participants remains in an unrealized loss position.

Chain trends seemed to strengthen this ditch. The growing activity of Cardano dormant currency highlighted the potential risks of capitulation, because ADA violated the key support thresholds. Meanwhile, TRX maintained prices stability in its accumulation range from $ 0.25 to $ 0.20 for more than four months.

Source: TradingView (ADA / USDT)

Structurally, TRX has a more favorable breakup configuration, strengthening its claim in 9th place in the classification of stock market capitalizations.

If this trend persists, TRX could challenge the top 8, with its market capitalization looking at potential expansion beyond $ 24 billion.