If the cryptography market feels a little calmer lately, it’s not just you. Depending on the monthly prospects of April 2025 of Coinbase, the figures confirm what many traders and manufacturers have felt: we are deep in a recharge time. However, there could be a crypto rebound later this year.

The Altcoin market capitalization – it’s anything but Bitcoin – has dropped by around 41% since December, going from $ 1.6 billion to around $ 950 billion. Ouch. It is not quite a complete merger territory, but it is a heavy comedown that tests patience at all levels.

New Coinbase report!

The crypto entering the bear territory with total market capitalization down 41% compared to December. Coin50 index less than 200 days signals of continuous weakness. But potential stabilization late Q2, recovery to Q3 possible if the overall conditions improve#Cryptomarkets pic.twitter.com/rdiwnjhbh

– Neomaventures (@neomaventures) April 16, 2025

And it’s not just the prices. The funding for venture capital, the vital element for startups that build in space, is also down. Compared to peak years 2021-2022, VC’s interest fell from 50 to 60%. For what? Mainly because the macro environment is messy. Inflation, rate changes, geopolitical tensions and persistent fear that the other economic shoe can lower tight investors. The result? Fewer checks, slower towers and many “wait and see”.

Market feeling indicators

The manager of the search for Coinbase, David Duong, does not make it sugar. He says that the data shows that we have entered a neutral protection market and that Bull Run probably exceeded in February. This timing aligns with many traders asking: “Wait … Was it?”

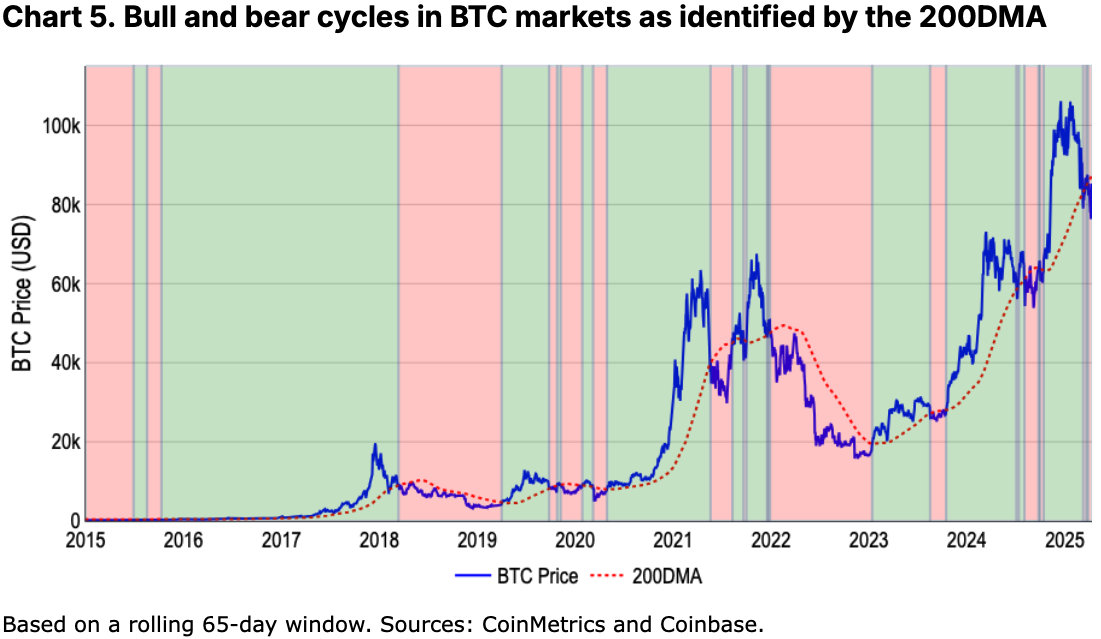

He underlines a few key indicators, including the 200 -day mobile average, which has shown that between November 2021 and November 2022, Bitcoin has dropped a lot, around 76%, but when you adjust the risk, this drop was similar to the 22% drop in S&P 500.

In other words, the two have had great movements compared to what is normal for them, even if the percentages seem very different.

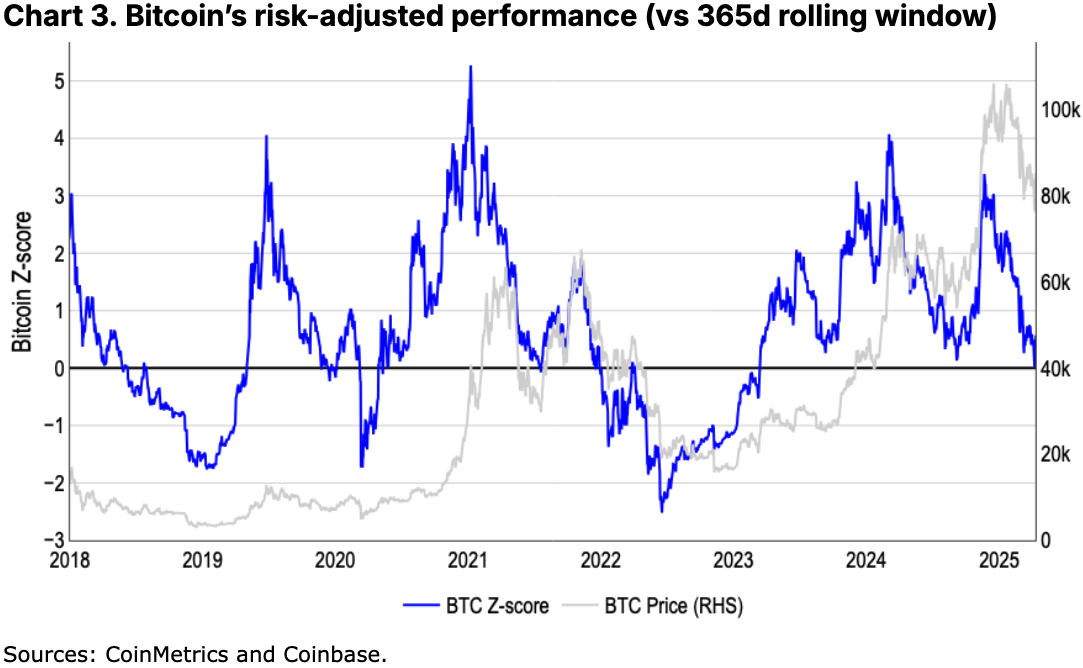

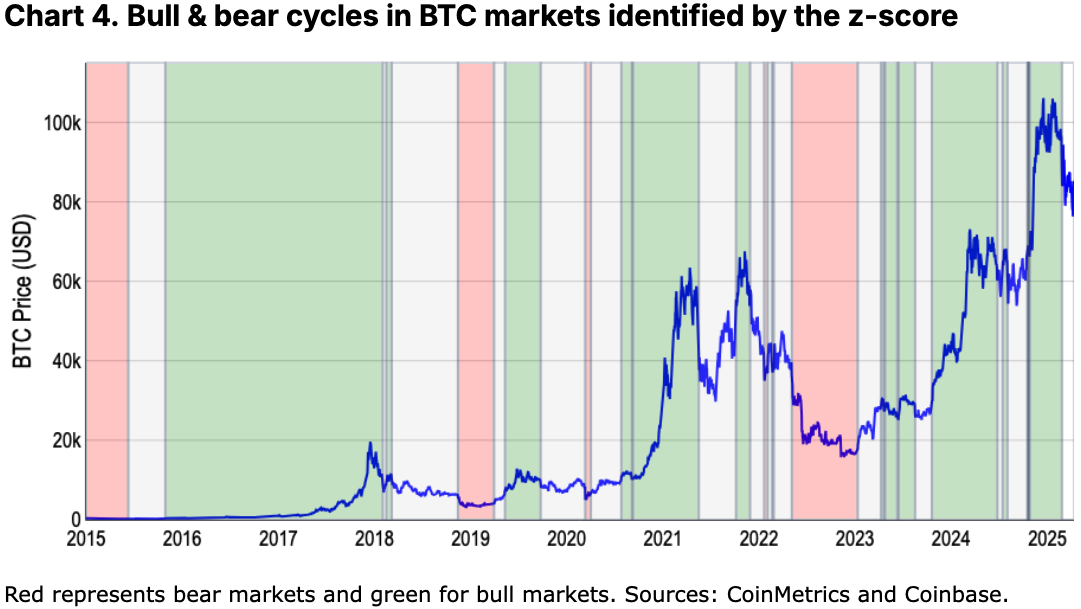

Another metric that was examined was Bitcoin Z-SCORE (which essentially measures the way in which current extreme prices are compared to historical standards). The two flash yellow, not red, but certainly not green.

Z-SCORES works well for the crypto because they adapt to the savage of price oscillations, but they are imperfect. They are a little more difficult to calculate and do not always quickly pick up trends, especially in the quieter markets. For example, the model has shown that the last Bull Run ended at the end of February, but since then it is called all “neutral”, which shows that it can be lagging behind when the market moves quickly.

So yes, it is just to call this moment what it is: a break, a reset, perhaps even the first days of another “mini winter of cryptography”.

Discover: the best new cryptocurrencies to invest in 2025

Crypto rebound potential in the second half of 2025

But, and it is a big but, Duong also sees the light at the end of the tunnel. Although Q2 can be bumpy, Q3 could be very different.

Why optimism? According to Coinbase, these types of withdrawals can be healthy. They shake the noise, reset the evaluations and cool the overheated feeling. And once the feeling is at the bottom, a rebound can hit quickly and hard, especially if the macro image improves or that new stories are launching.

It is not a promise, of course. But it is a reminder that the cycles of the crypto are cyclical. Things decrease, but they often come back stronger.

Currently, the market takes a break. Prices are down, funding is tighter and many investors are on the sidelines. But as Coinbase points out, that does not mean that it is the end. These breaks often lay the foundations for the next wave, especially if confidence is coming back and the macro opposites are calm.

So, whether you build, invest or just look at the key line, keep an eye on the second half of 2025. There could be a crypto rebound and the market might still surprise you.

DISCOVER: 20+ Next Crypto to explode in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

Altcoin market capitalization has dropped by 41% since December 2024, from $ 1.6 billion to around $ 950 billion.

-

The funding of venture capital in crypto is down 50 to 60% compared to cutting-edge levels, because investors sail in macroeconomic uncertainty.

-

Coinbase Research suggests that the market is in a bastard neutral phase, with indicators like the 200 day average and the prudence of the Bitcoin Z-Score turn signal.

-

Despite the slowdown, Coinbase sees the potential of a Q3 rebound, noting that recharge times often reset assessments and feeling before recovery.

-

Although the Q2 can remain jerky, the second half of 2025 could mark the start of a new wave – if the macro -stabilized conditions and that new stories emerge.

The post-Crypto market collapses 41%, but Coinbase sees the return of the first quarter appeared first on 99Bitcoins.

New Coinbase report!

New Coinbase report!