- Canary Capital filed an ETF TRX marked with the dry.

- Despite the FNB deposit, Tron is faced with a strong lower feeling.

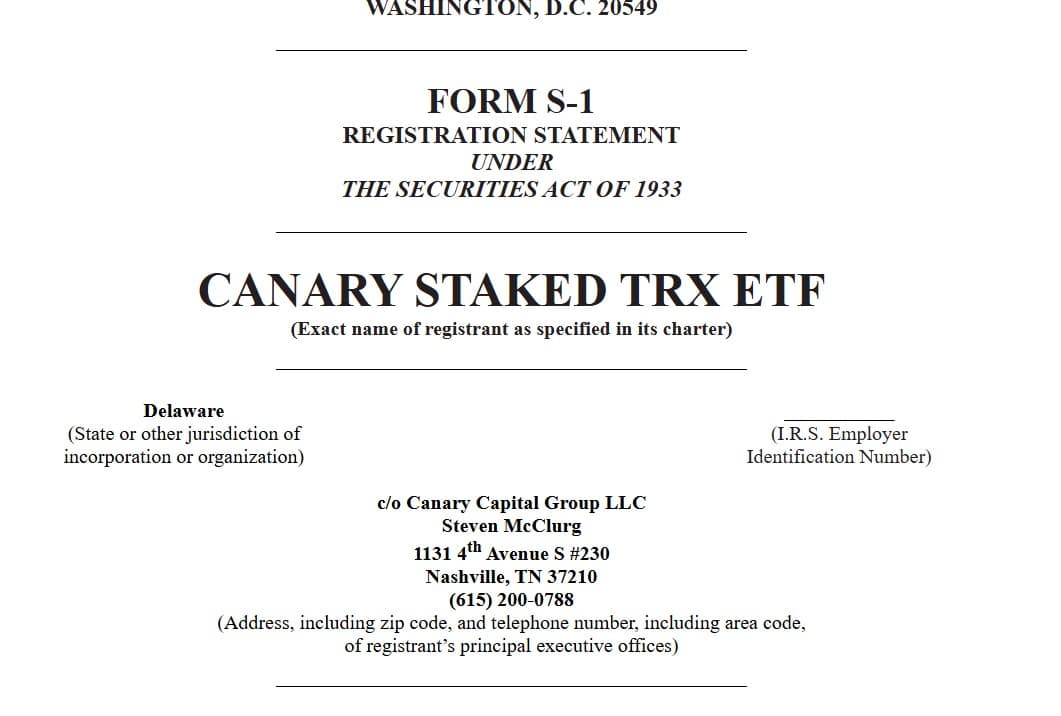

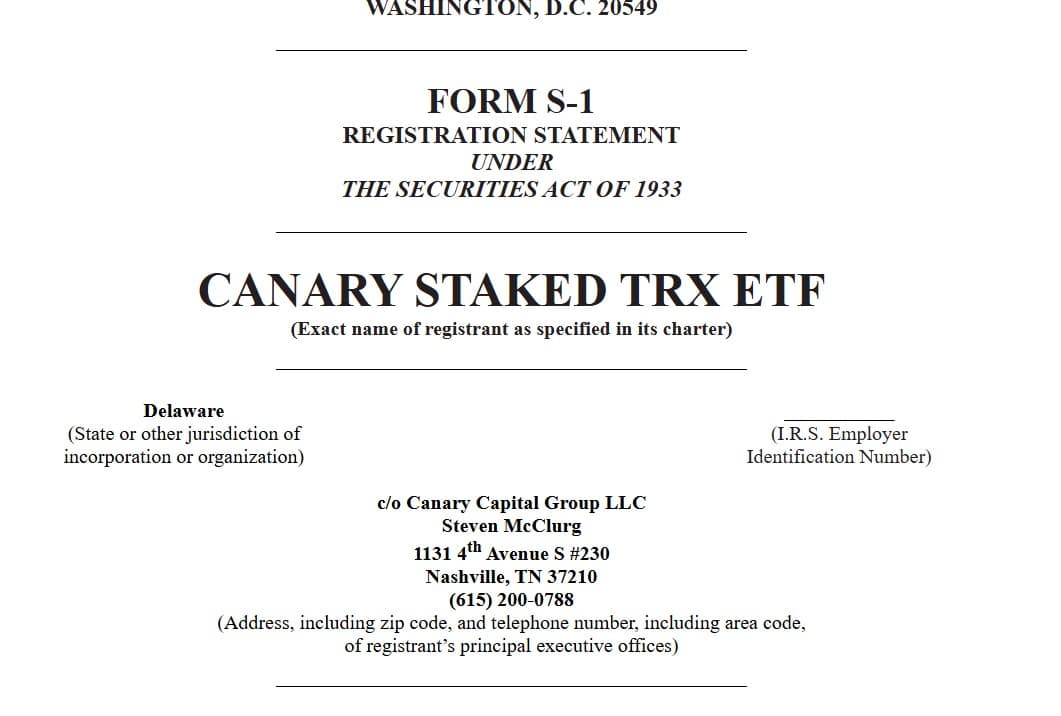

According to reports, Canary Capital, an asset manager of the United States, has applied for a listed an ETF holding token token native of Tron. Depending on the company, the proposed product is called ETF TRX marked by Canari.

According to the file, said funds aim to maintain the TRX spot and put it to generate an additional return. Thanks to the FNB, investors will have regulated access to cleansing awards and exposure to the market.

If it is approved, Canary Capital will manage ETF operations and supervise its overall performance.

Source: dry.gov

Over the past four months, to try to capitalize on a dry pro-Crypto in the United States, there has been a biddling of submissions aimed at registering the ETF.

Since the start of the Trump administration, American regulators have received several deposits.

In the middle of this frenzy of FNB, Canary filed various ETF Altcoin, notably Litecoin (LTC), XRP, Hedera (Hbar), Su (Su) and the Grassouillant Penguins (Pengu).

Is an ETF the Boost Trx needs for recovery?

Although it is planned that such good news has a positive impact on the price movement, this remains to be reflected. Insofar as Tron remains in a high downward trend.

In fact, at the time of the editorial staff, Tron was negotiated at $ 0.24. This marked a 1.28% drop on daily cards. On weekly graphics, Altcoin decreased by 2.8%.

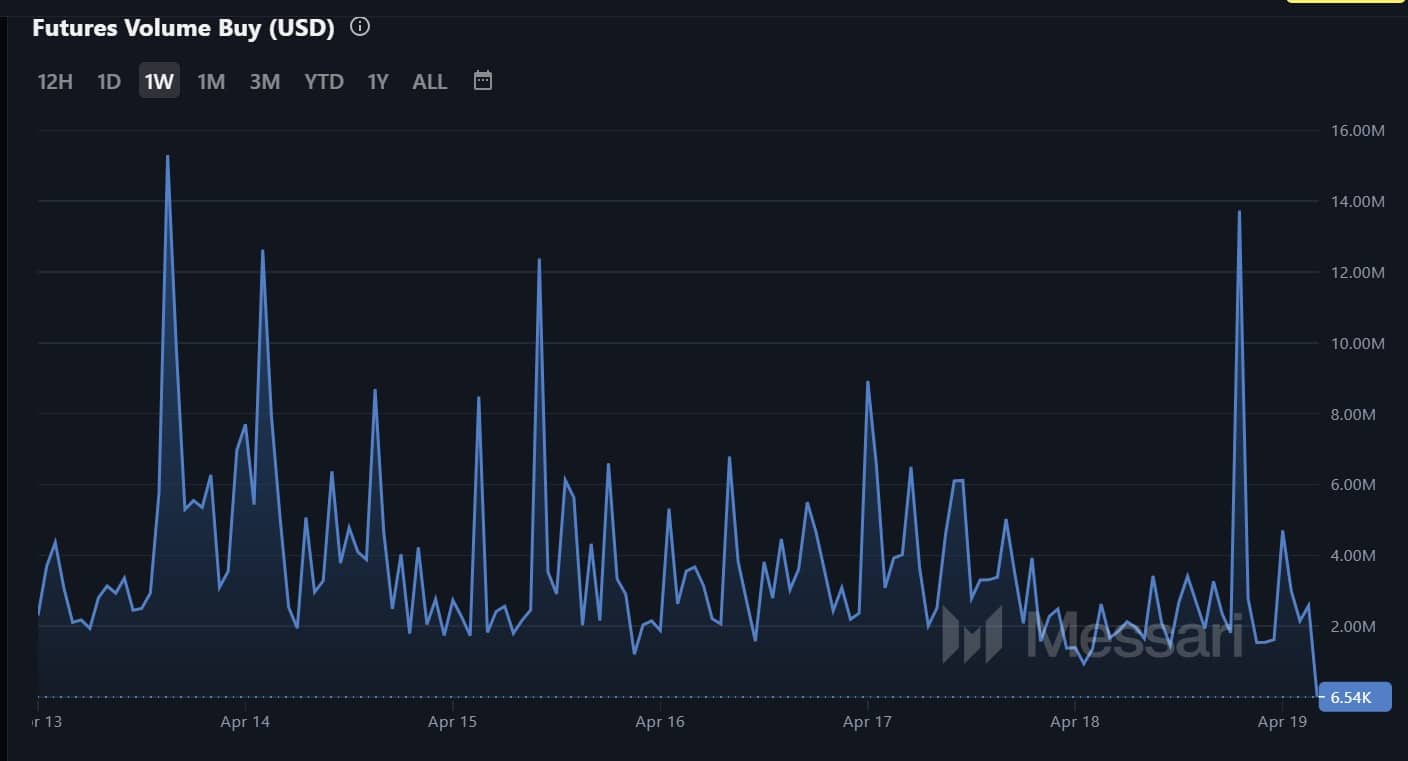

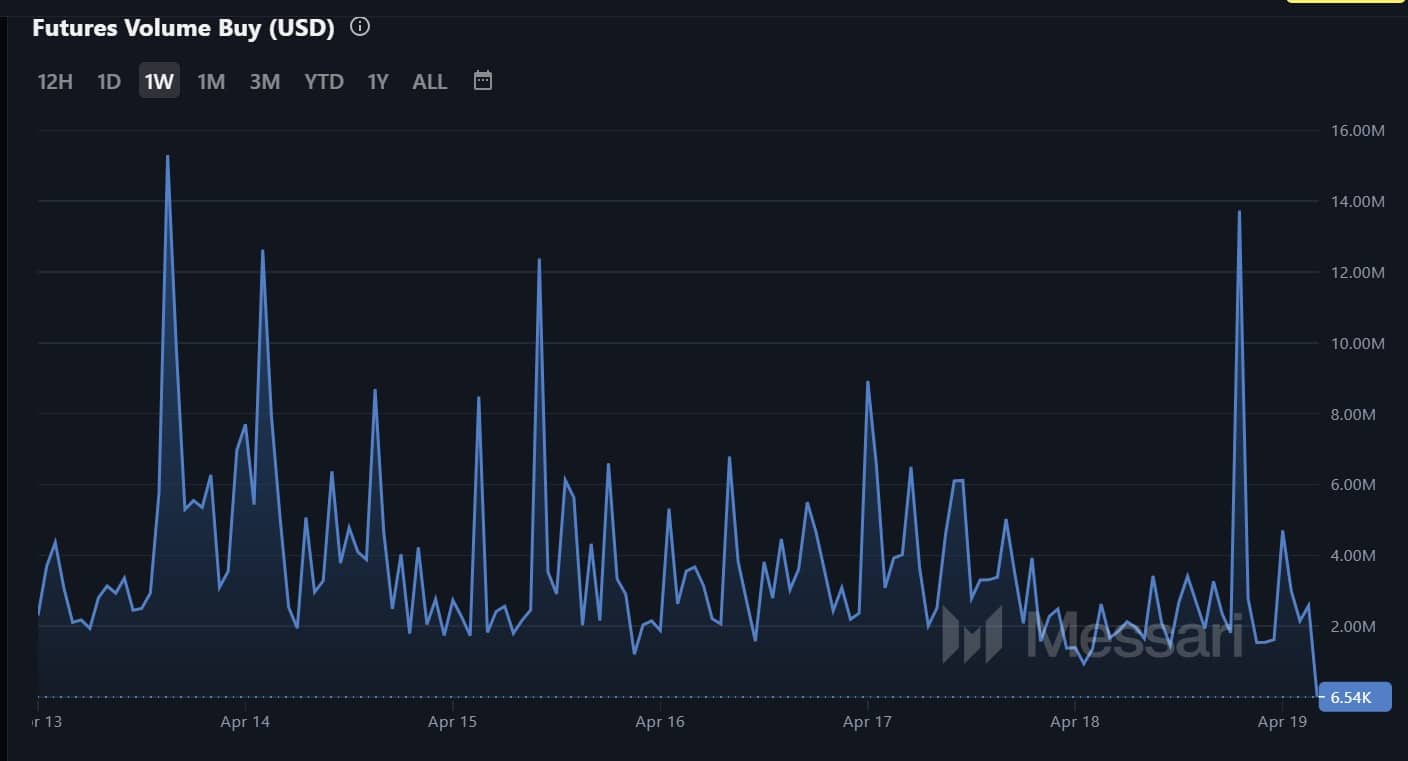

In the midst of these losses, slows down the demand and assembly of the downward feelings. To begin with, tron buyers have almost disappeared from the market. The long -term purchase volume also fell to a weekly hollow of $ 6.5,000.

Such a decline suggests that investors do not currently have the motivation to believe in a potential upward trend. As such, there is a low conviction raised on the market.

Source: Messari

According to the funding rate (weighted in volume), there has been a drop in demand for long positions, the funding rate with a low monthly in negative territory.

When metric is defined as this, this suggests that short-circuited tron investors because they expect prices to decrease.

Source: Messari

Therefore, an ETF would change the situation for Tron and its native token. An ETF will create space for more adoption as institutional investors enter the market, which leads to higher demand.

Currently, the deposit has not had a positive impact on the action of TRX prices. If the development is felt on the market, we could see TRX recover $ 0.259.

However, if the feeling of the market in force holds a drop to $ 0.23 is inevitable.