Join our Telegram channel to stay up to date with the news

As interest in cryptocurrencies continues to grow within traditional finance, the increasing ease with which market participants can add cryptocurrencies to their portfolios is poised to have a significant impact. This rapid development underscores the growing importance of digital assets in investment strategies.

This trend is already evident, as many crypto-based ETFs have been announced. Several other crypto ETF proposals are awaiting regulatory approval, including the Solana ETF and diversified options like the Hashdex Nasdaq Crypto Index ETF. Moreover, if these developments continue, digital assets will become even more integral to the investment landscape. In light of this, investors are searching for the most profitable ETFs on a daily basis. best crypto to buy right now for potential gains.

The Best Cryptocurrencies to Buy Right Now

Aave boasts a strong commercial presence with a market cap of $1.43 billion and a 24-hour trading volume of $394.54 million. In the meantime, Celestia is gearing up for its first major update, Lemongrass, which will introduce several key improvements to its architecture and features. Additionally, Utila, a leading institutional multi-party computation (MPC) wallet, recently integrated with Injective, highlighting the ongoing developments in the blockchain space.

1. Aave (AAVE)

Aave allows users to lend and borrow digital assets without relying on intermediaries. The platform supports a range of altcoins and stablecoins, allowing users to borrow these assets at variable or stable interest rates.

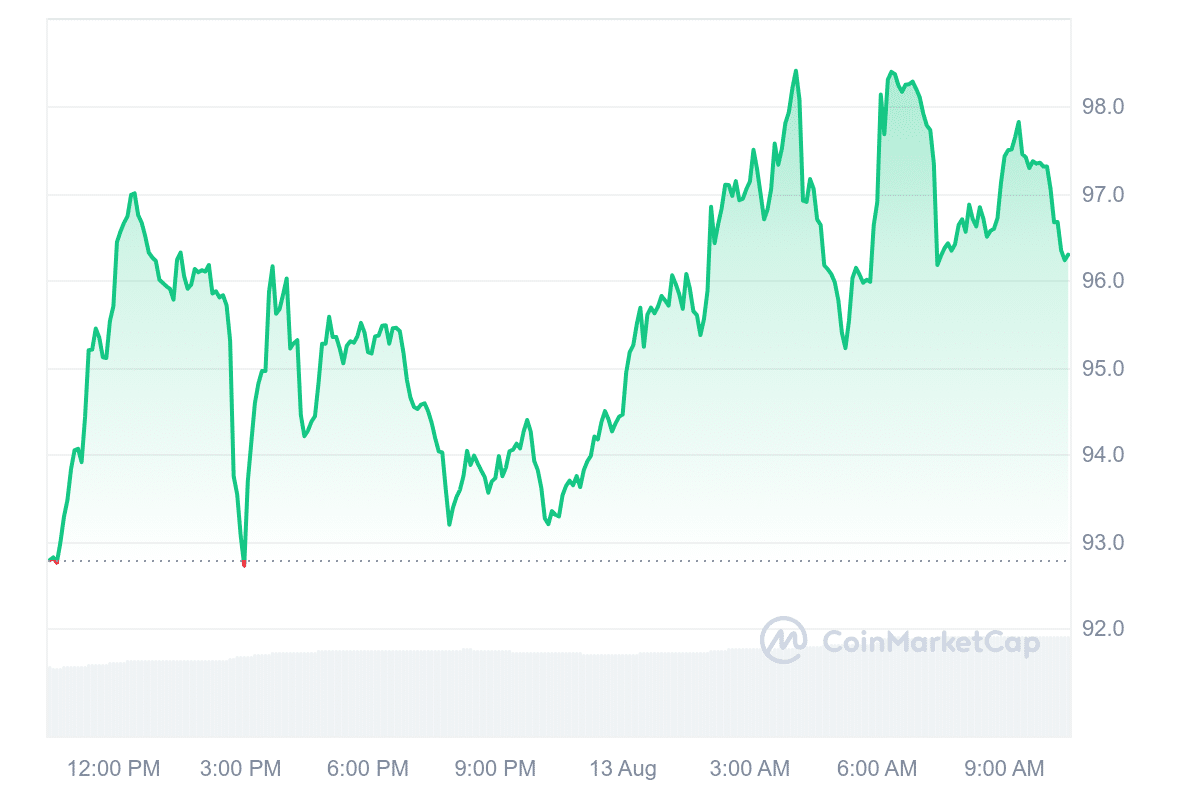

Currently, the token is trading 23.44% above its 200-day simple moving average of $78.04. Its 14-day Relative Strength Index is at 60.18, which indicates that the token is in a neutral zone and could experience sideways trading in the short term.

Furthermore, AAVE displays strong liquidity, as evidenced by its volume-to-market cap ratio of 0.2764. With a market cap of $1.43 billion and a 24-hour trading volume of $394.54 million, Aave maintains a solid trading presence. Beyond its positive technical indicators, Aave’s on-chain metrics also appear strong.

The Aave blockchain has a total value locked (TVL) of around $11.5 billion, which is considerable compared to its market capitalization. Analysts believe this could indicate considerable growth potential.

Recently, the Aave DAO launched a $100 million yield loan with key partners. This initiative shows how blockchain technology could change the way bonds and securities are issued and managed, which could benefit the AAVE token.

2. Pepe Unchained (PEPU)

THE Pepe Unleashed The project merges meme culture, particularly Pepe the Frog, with Layer 2 blockchain technology. The project has garnered considerable attention, raising over $8.5 million in its pre-sale. Its unique meme appeal and advanced blockchain features make it the best crypto to buy right now.

Pepe is on fire! 🔥 We’ve reached $8.5 million!

This journey just keeps getting more exciting, and we couldn’t have done it without you! pic.twitter.com/4ZsjnrAXAH

— Pepe Unchained (@pepe_unchained) August 13, 2024

Pepe Unchained aims to differentiate itself in the meme coin market by leveraging Layer 2 blockchain technology. This approach reduces transaction costs and speeds up transactions, which could attract market participants to the meme coin space. The integration of these features sets PEPU apart from other frog-themed cryptocurrencies.

Additionally, the platform offers its staking option, which offers early investors an annual percentage yield (APY) of 230%. Investors who participate in the presale can start staking their PEPU tokens immediately, potentially boosting their yields right from the start. Currently, each PEPU token is priced at $0.0090539.

Additionally, the presale has gained momentum, pushing the project towards important milestones. The next phase is to launch the token on multiple exchanges, which could influence PepuThe market value of the project. As the project progresses, it will be important to monitor how these developments impact its growth and adoption.

Visit Pepe Unchained Pre-Sale

3. Injective (INJ)

Injective is designed for decentralized finance applications. It provides developers with essential on-chain infrastructure modules for building decentralized applications, such as exchanges, prediction markets, and lending protocols. Its decentralized cross-chain bridging system ensures compatibility with various blockchains, including Ethereum (an EVM chain) and Solana (a non-EVM chain).

Recently, Utila, a leading institutional multi-party computation (MPC) wallet, integrated with Injective. Utila has processed over $3 billion in asset transfers and offers asset tokenization services, enabling institutions to easily onboard and manage new real-world asset (RWA) offerings on Injective.

This integration aims to expand Injective’s user base beyond retail investors and cryptocurrency enthusiasts. It positions the platform to gain institutional attention by leveraging its robust network and benefiting from Utila’s advanced security features.

Additionally, the partnership between Injective and Utila marks a significant step forward in the field of institutional DeFi and asset tokenization. By combining Utila’s secure MPC technology with Injective’s fast blockchain and advanced DeFi solutions, the collaboration offers significant benefits to institutional clients.

Utila, the leading MPC institutional wallet, has natively integrated Injective after processing over $3 billion in asset transfers to date.

Utila also offers asset tokenization capabilities allowing institutions to seamlessly onboard and manage new RWA offerings on Injective 🏦 pic.twitter.com/M168hrtdRC

— Injective 🥷 (@injective) August 8, 2024

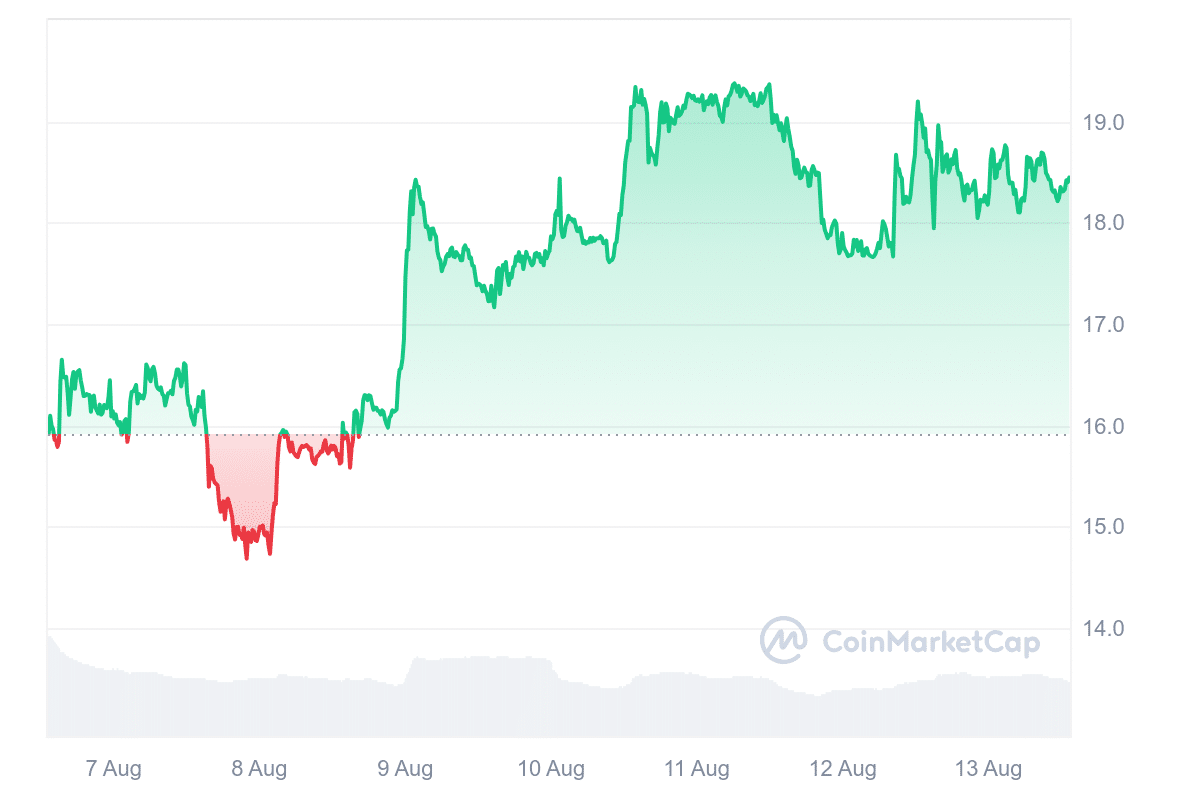

On the market front, Injective’s native token, INJ, saw a 12% surge earlier today, likely driven by a broader market recovery and a 6% increase in market cap after a recent dip.

However, the token subsequently dropped by 0.89%, although it still registered a 16.23% gain over the past week. It is also trading above the 200-day simple moving average, indicating positive performance compared to its initial sale price.

4. THOR’S Chain (RUNE)

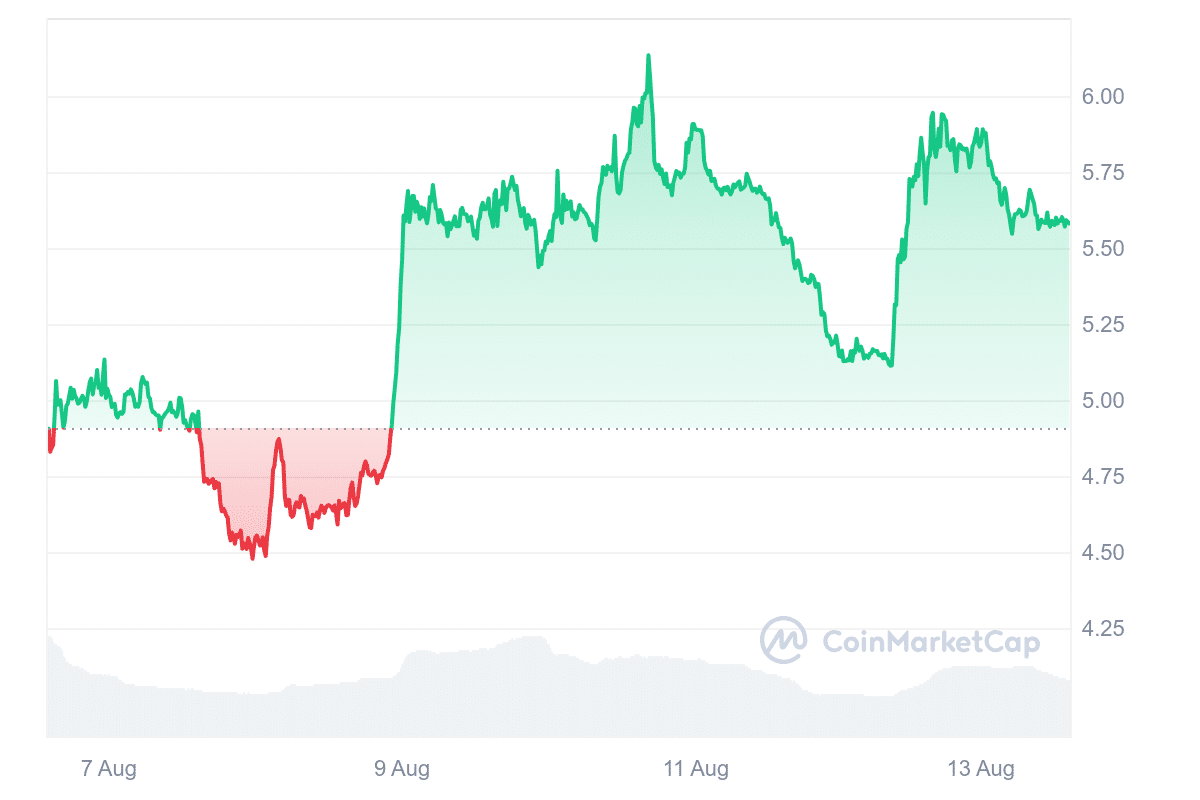

THORChain recently partnered with Kujira to introduce deep liquidity into Kujira’s DeFi suite, which could enhance the platform’s growth and stability. By integrating with THORChain’s liquidity network, Kujira is better positioned to solidify its presence in the competitive DeFi space.

A notable aspect of this partnership is the crowdfunding. Unlike traditional fundraising efforts, this initiative is open to the community, encouraging broad participation. The funds raised will help address existing debt and align the economic interests of the Kujira and THORChain communities.

This approach also aims to strengthen the connection between the two ecosystems, which could lead to a more resilient platform. The partnership also includes operational changes intended to prevent similar financial difficulties in the future.

THORChain’s next arc towards becoming stable, reliable, and composable just found a strong execution partner – @noble_xyz

Expect the best!

— THORChain (@THORChain) August 9, 2024

In addition to these developments, THORChain has partnered with SwapKit and Noble to introduce stablecoins to the THORChain AppLayer. Noble’s role in this partnership is to support the AppLayer with native USDC issuance. This feature improves the user experience by enabling one-click deposits into the AppLayer, simplifying the process for the THORChain community.

These collaborative efforts between THORChain, SwapKit, and Noble reflect a broader trend in DeFi, where platforms are working together to improve liquidity, user experience, and financial stability. By addressing existing challenges and introducing new features, these partnerships could contribute to the long-term success of the RUNE ecosystem.

5. Celestia (TIA)

Celestia is a modular data availability network designed to streamline the process of launching blockchains. By focusing on specific functions rather than managing multiple roles like traditional blockchains, Celestia aims to improve scalability, flexibility, and interoperability. This approach allows developers to build blockchain applications more efficiently, which can lead to broader adoption of the technology.

The platform is preparing for its first major update, Lemongrass. This update will bring several key improvements to Celestia’s architecture and functionality. The rollout will begin with Arabica Devnet in August, using version 2.0.0 of the Celestia application.

Additionally, further updates will follow on the Mocha testnet, with final activation on the mainnet beta scheduled for early to mid-September. Celestia’s community of developers and researchers will implement the update carefully, ensuring a smooth and successful transition. This development has led to increased investor interest in Celestia’s token.

Celestia’s first upgrade, Lemongrass, is coming. 🍵

Developed and coordinated with the community, Lemongrass includes 1-click Tia interactions with other IBC chains, Interchain accounts, and a new upgrade mechanism. pic.twitter.com/Lu6f3vWeU9

— Celestia (@CelestiaOrg) August 8, 2024

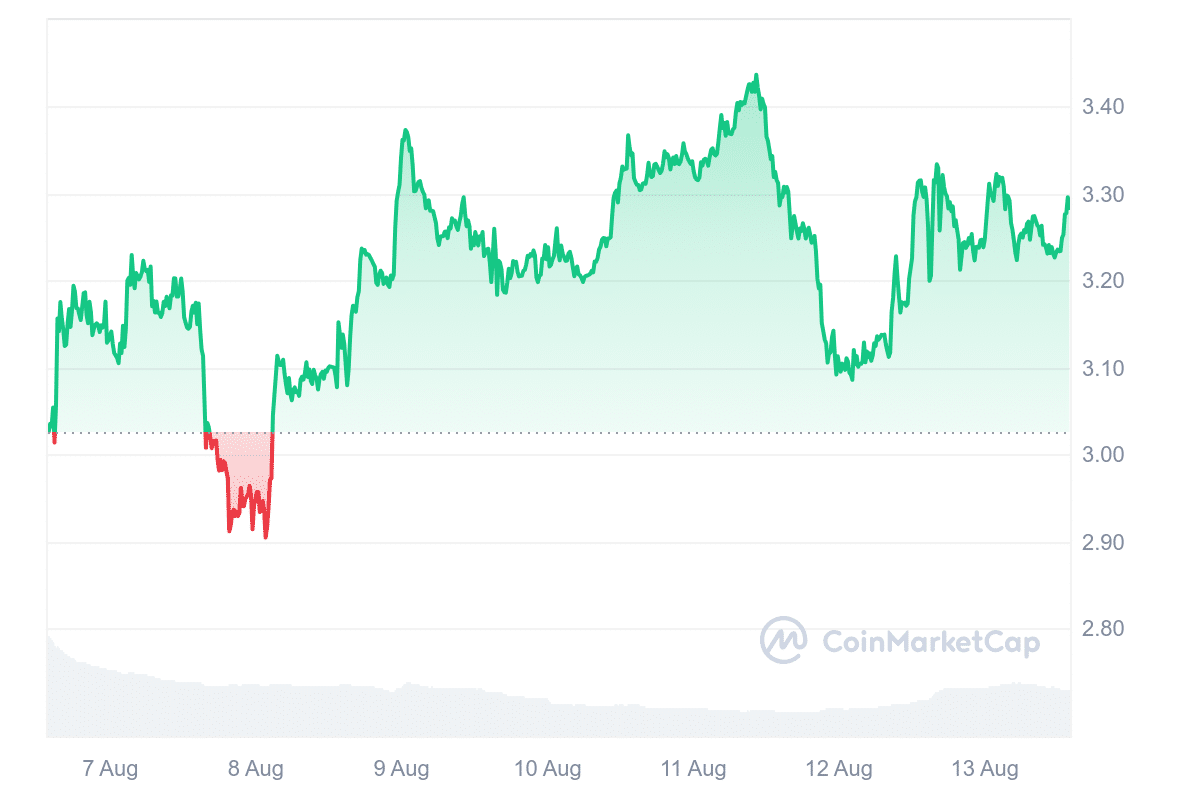

The token has shown resilience in the market, with a weekly gain of 12.93%. However, it has also seen a 2.94% decline over 24 hours. Despite this decline, technical analysis suggests that the token has growth potential. The 14-day Relative Strength Index (RSI) is currently at 50.74, indicating a neutral stance, suggesting the possibility of a sideways move.

The token is trading above its 200-day simple moving average and its market cap suggests that it has high liquidity. According to Coincodex, the current price prediction for Celestia suggests that the token could increase by 227.45%, potentially reaching $18.37 by September.

Learn more

PlayDoge (PLAY) – The Latest ICO on the BNB Chain

- Virtual Pet Dog 2D

- Play to win Meme Coin Fusion

- Staking and In-Game Token Rewards

- SolidProof Audit – playdoge.io

Join our Telegram channel to stay up to date with the news