Main to remember

- Janover bought 80,567 Solana tokens worth $ 10.5 million, increasing its total Solana Holdings to 163,651 soil.

- The company plans to operate the Solana validators to pay assets and generate network security awards.

Share this article

The Janover software company announced Tuesday that it had acquired 80,567 Solana (soil) for around $ 10.5 million.

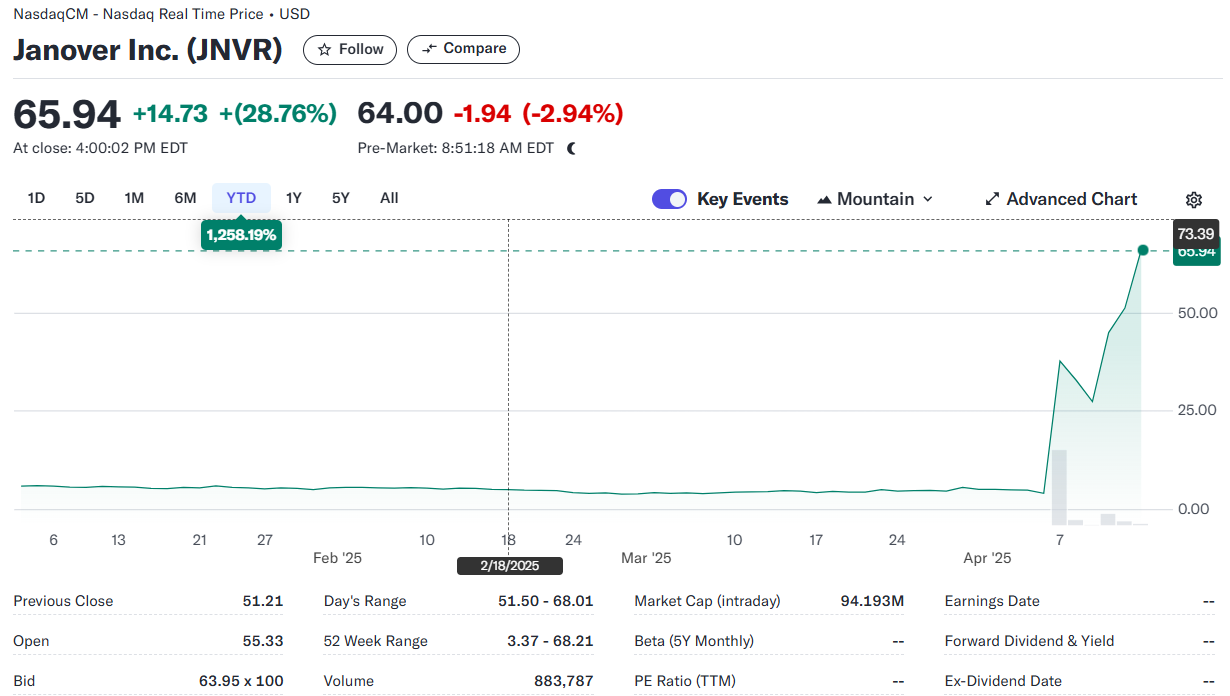

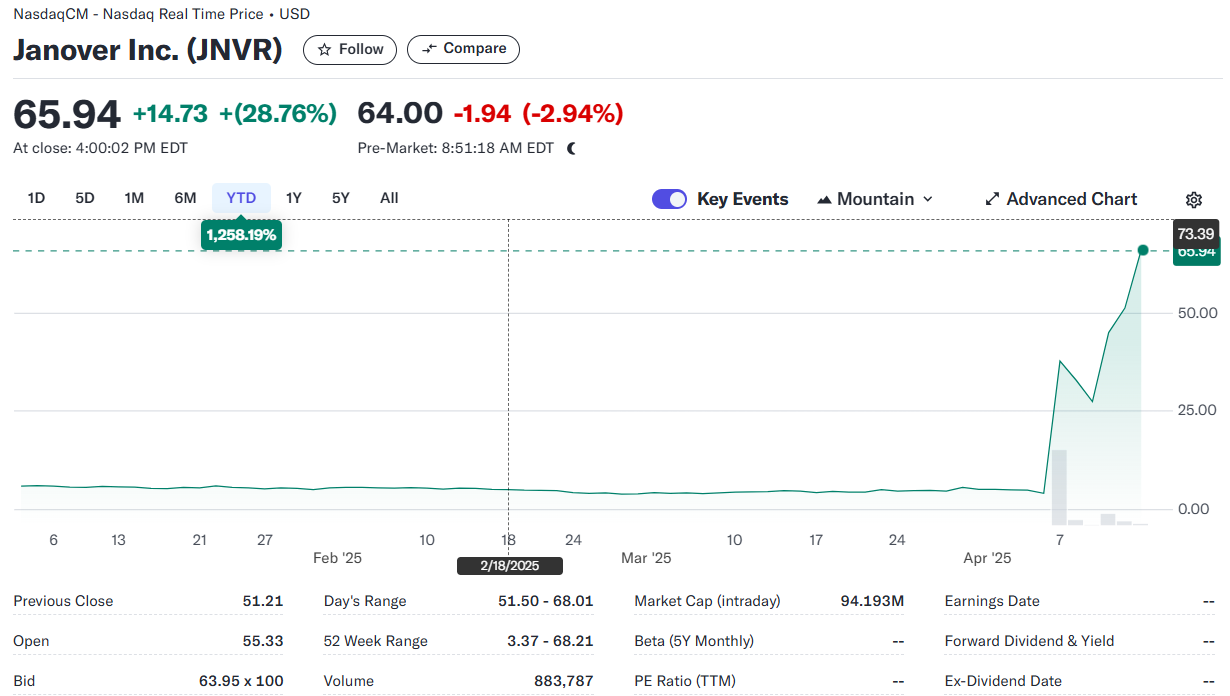

This marked the company’s third floor purchase as part of its digital cash plan, and it was revealed after its actions reached a summit of nearly $ 66 in Market Close on Monday, according to Yahoo Finance data.

The shares have bordered lower before the market opened today, but they have still increased by more than 1,200% so far this year.

The new acquisition stimulates Janover soil at around 163,651 units, worth around $ 21 million. The purchase was funded thanks to the company’s $ 42 million in the company.

Janover plans to immediately start to mark out his newly acquired soil to generate income while supporting the Solana network.

This decision follows the recent change in Janover leadership, with a team of former Kraken managers acquiring the majority property of the company. Under a new leadership, the company focuses on filling the gap between traditional finances and decentralized finance.

Earlier this month, Janover’s board of directors approved a new cash policy, authorizing the long-term accumulation of cryptographic assets starting with Solana.

Janover also plans to operate one or more Solana validators, allowing him to set up his treasure assets, participate in network security and earn awards. Employed income will be reinvested to acquire more soil.

“The speed and clarity of the execution are at the heart of our model,” said Parker White, COO and CIO in Janover, in a press release during the first purchase of the company. “We plan to continue to build our soil position at the level of our strategy – and we believe that today’s market conditions have offered an imperative opportunity to take our first step.”

The company listed at Nasdaq also plans to change its name to Defovement Corporation and revise its Ticker symbol.

In addition to Bitcoin, global companies also explore the integration of other major digital assets in their strategic reserves.

Worksport, a company specializing in the design and manufacturing of truck accessories, announced last December that it had started to adopt XRP, alongside Bitcoin, as an active treasure.

Salts Sol was negotiated at around $ 132 at the time of the press, up almost 24% last week, according to TradingView.

The digital asset has dropped by around 30% the year up to date in the middle of a market -scale decline triggered by the American tariff policy.

Share this article