Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Solana shows signs of resistance after weeks of increased volatility and aggressive sales pressure. While the wider cryptography market stabilizes in the middle of continuous macroeconomic uncertainty and global trade tensions, Solana has managed to get closer to a level of critical resistance. Despite the risks that are still looming, in particular with the rhetoric of trade war between the United States and China, some market players think that the conditions align for a potential recovery rally.

Related reading

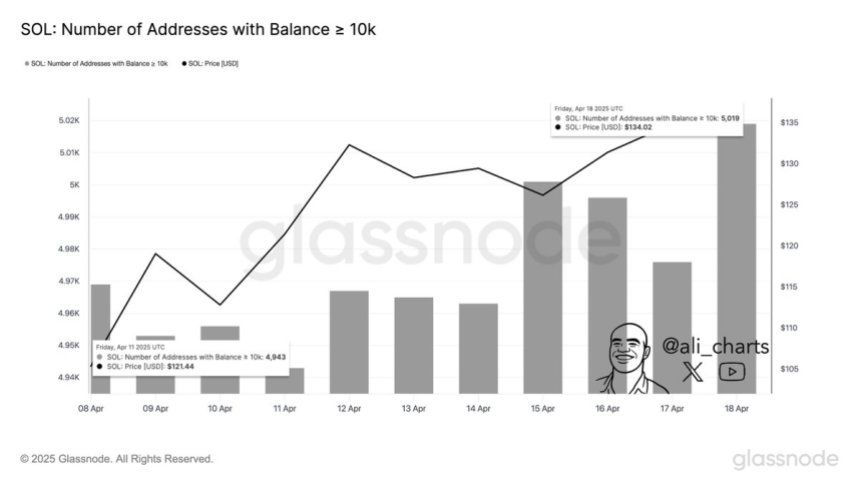

Adding weight to this view, Glassnod’s recent chain data reveal a subtle but notable change in whale activity. The number of portfolios holding more than 10,000 soil increased by 1.53% in last week, going from 4,943 to 5,019.

This increase suggests that the greatest holders can accumulate before a possible escape, interpreting current price levels as favorable entry points. Historically, such accumulation phases have preceded strong ascending movements, especially when combined with technical recovery signals and improving the feeling of the market.

The question of whether Solana can unravel the resistance and maintain recovery remains uncertain, but the interest of the growing whale painted an image cautiously optimistic for the days to come.

The accumulation of whales develops as the bulls take up the momentum

Solana was one of the hardest active ingredients during the recent slowdown in the market. Since the peak in January, Sol has lost more than 65% of its value, reflecting a deep uncertainty of investors and increased sales pressure. While macroeconomic tensions between the United States and China continue to grow, the world markets have moved to a feeling of risk, with high volatility as Solana which takes the weight of damage. However, there may now be signs of relief.

A possible resolution in the current commercial dispute and the improvement of liquidity conditions breathe a new life on the wider Altcoin market. In the case of Solana, the recovery story obtains support for chain measures. According to data shared by the upper analyst Ali Martinez on X, the number of portfolios holding more than 10,000 soil increased by 1.53% in last week, from 4,943 to 5,019. This subtle but notable increase in large accusation activities suggests institutional confidence or growing whales in the long -term potential of Solana.

10K | Source: Ali Martinez on X” width =”860″ Height =”484″ srcset =”https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=1200 1200W, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=750 750W, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=768 768W, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=860 860w, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=1140 1140W” sizes =”(max-width: 860px) 100VW, 860px” loading =”Lazy”/>

10K | Source: Ali Martinez on X” width =”860″ Height =”484″ srcset =”https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=1200 1200W, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=750 750W, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=768 768W, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=860 860w, https://www.newsbtc.com/wp-content/uploads/2025/04/btc_cb7bb7.jpeg?w=1140 1140W” sizes =”(max-width: 860px) 100VW, 860px” loading =”Lazy”/>This accumulation trend, associated with increasing momentum in bulls, could mark the start of a change of feeling after weeks of incessant pressure. If the appetite for global risk is improving and Solana can have key support areas, this whale behavior could lead to a supported price rebound.

Related reading

Solana tests key resistance because investors are targeting a recovery

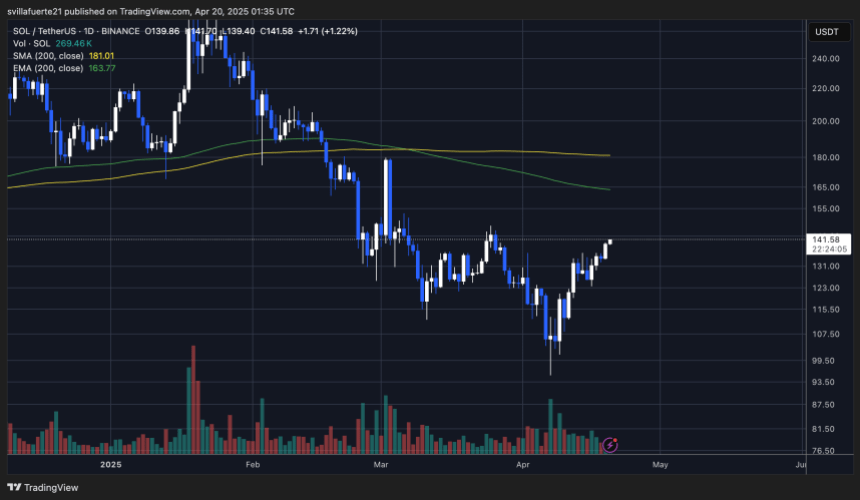

Solana (soil) is currently negotiated at $ 140, just below a critical resistance zone that has priced prices for weeks. After showing signs of strength during recent sessions, bulls are now trying to push soil above $ 150 – a key threshold that, if broken, could quickly propel the price to the $ 180 mark. The current momentum is closely monitored, because the recovery of this resistance would signal a trend reversal and provide the basics of stronger upward recovery.

To confirm an upward trend, Sol must break and keep above the $ 150 mark, then target the 200-day mobile average, currently acting as a dynamic resistance. A decisive decision above the 200-day Mame would indicate a change of feeling and strengthen Solana’s rupture potential in the short term.

Related reading

However, if the bulls did not recover and defend these levels, the bearish pressure could return. A rejection to the current prices would probably open the door to a retein of the lower demand zones. The loss of support around the level of $ 125 could bring soil to $ 100 – a level which previously served as a solid support during previous sales. The next few days will be essential to determine the short -term trajectory of Solana.

Dall-e star image, tradingview graphic